Is New Mexico the Next State to Hold a Bitcoin Reserve? VanEck Analysts See a $23 Billion Opportunity

New Mexico joins other US states in proposing the creation of a Bitcoin reserve, VanEck expects at least $23 billion to flow into State BTC.

At this time last year, the crypto world was uncertain. The United States Securities and Exchange Commission (SEC) had just approved the first spot Bitcoin ETF in the country, permitting institutions to gain exposure through a regulated vehicle.

The problem was that although the agency appeared supportive, it was at war with the industry. Specifically, Gary Gensler and his team relentlessly pressed charges and de-banked crypto firms. It was tough for crypto and Bitcoin, though prices were elevated, trading above $40,000.

New Mexico Senator Forwards A Bitcoin Reserve Bill

A year later, it’s a different story. Not only is Donald Trump pro-crypto, but many states are also considering investing in and holding BTC. Yesterday, New Mexico took a bold step after introducing the “Strategic Bitcoin Reserve Act”, SB 175, which seeks to establish a Bitcoin reserve.

The bill, forwarded by Senator Anthony Thornton, wants the state to allocate 5% of its public funds to Bitcoin.

Funds will be sourced from the grant permanent fund, the severance tax permanent fund, and even the tobacco settlement permanent fund.

The state now joins around 20 other states, including Texas, Florida, Pennsylvania, and Ohio, all of which are exploring such reserves. It’s a trend that increasingly sees states desirous of integrating BTC into their treasuries.

VanEck Expects $23 Billion To Flow Into BTC Should Bills Pass

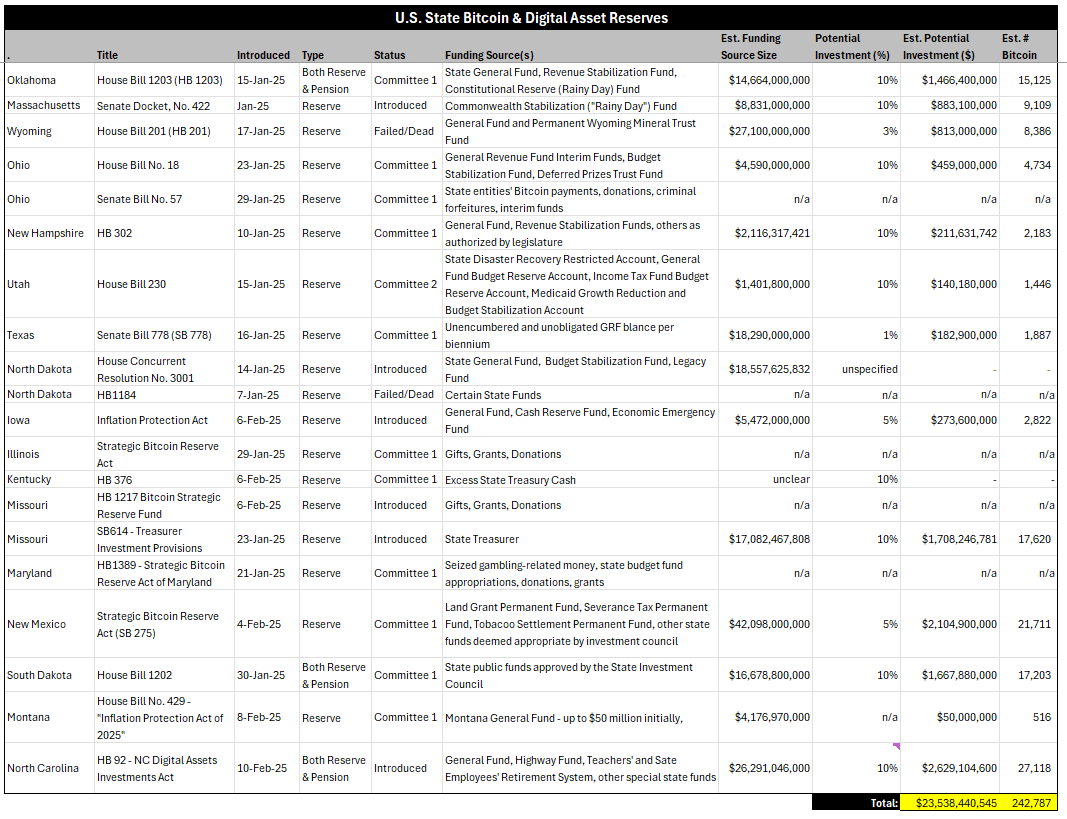

According to a VanEck executive, Matthew Sigel, if all these states approved the formation of a Bitcoin reserve, over $23 billion could end up being funneled into BTC.

This means that the United States states will scoop over 242,000 BTC at spot rates. However, the number will shrink as the market reprices, reflecting the new state of affairs.

(Source)

The domino effect is that pension funds will also seek to double down on BTC and crypto. For holders, this might see BTC skyrocket, even breaking $150,000 and $200,000, as news of those approvals permeates the market.

Sigel notes that Bitcoin is increasingly being viewed as a suitable hedge against inflation. With inflation back in the green, rising against economists’ forecasts, it is likely that more states will push for the creation of their own BTC reserves.

Yesterday North Carolina, Today New Mexico: Will The United States Lead The Way?

The idea of a strategic national Bitcoin reserve is being considered at the federal level. However, as David Sacks, the crypto czar, said, the priority is creating clear laws, especially on stablecoins.

The decision to create a Bitcoin reserve, which will run parallel with the American Sovereign Wealth Fund (SWF), will be determined by a crypto working group led by Sacks.

They will examine its feasibility before approving or dismissing the idea. Meanwhile, Howard Lutnick and Scott Bessent, both pro-crypto, will manage the SWF.

So far, Senator Cynthia Lummis has introduced the BITCOIN Act of 2024. If approved, the United States Treasury will buy 1 million BTC over five years.

Bitcoin Reserve Bills Key Takeaways

- New Mexico proposes the creation of a Bitcoin reserve, joins Florida, Ohio, and nearly 20 other states

- Bitcoin viewed as a hedge against inflation.

- United States could lead the world in creating a strategic national Bitcoin reserve

EXPLORE: Dave Portnoy’s New Meme Coin Went 100,000% But What Is The Best Meme Coin to Buy?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Is New Mexico the Next State to Hold a Bitcoin Reserve? VanEck Analysts See a $23 Billion Opportunity appeared first on 99Bitcoins.