Bitcoin Exchange Exodus: Investors Withdrew $24 Billion In BTC Over Last 8 Months

On-chain data shows Bitcoin has continued to leave the exchanges’ wallets recently, a sign that the asset’s price could be bullish.

Bitcoin Exchange Reserve Has Registered A Significant Decline Recently

As explained by analyst Ali Martinez in a new post on X, exchanges have seen a massive amount of Bitcoin leave over the last few months. The on-chain relevance metric here is the “Exchange Reserve,” which keeps track of the total number of tokens currently sitting in the wallets of all centralized exchanges.

When the value of this metric rises, investors will make net deposits into these platforms right now. As one of the main reasons holders might transfer their coins to exchanges is for selling-related purposes, this trend can be bearish for the asset’s price.

On the other hand, the indicator registering a decline implies the users are transferring a net amount of BTC out of the wallets associated with exchanges. This could be a potential sign that investors want to hold their coins in the long term, which can naturally be bullish for the cryptocurrency.

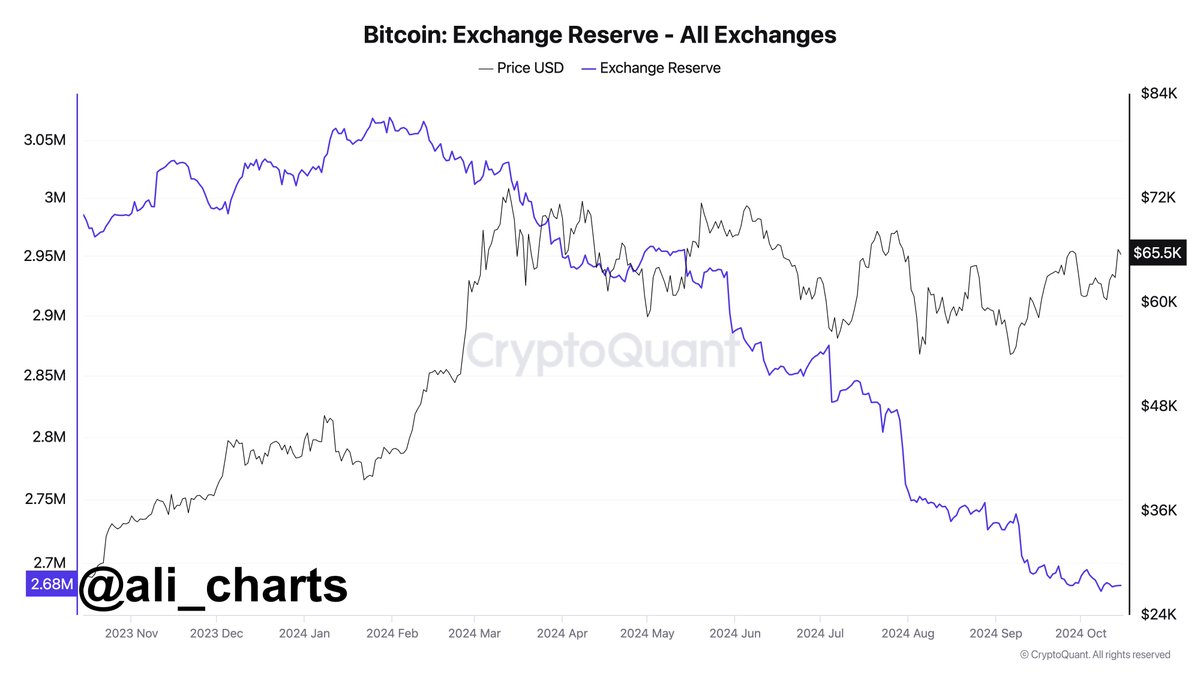

Now, here is a chart that shows the trend in the Bitcoin Exchange Reserve over the past year:

As the above graph shows, the Bitcoin Exchange Reserve has been riding a consistent downtrend since early in the year, suggesting that investors have continuously been draining the supply on these platforms.

More specifically, the indicator’s value has reduced by 400,000 BTC over the last eight months, equivalent to more than $27 billion at the current exchange rate of the cryptocurrency.

The relentless withdrawals from these platforms can be a positive sign for the asset if the investors have made them for accumulation. There could be, however, another reason behind this trend.

The chart shows that the outflows from the exchanges started roughly around the time the spot exchange-traded funds (ETFs) got approval from the US Securities and Exchange Commission (SEC).

The spot ETFs provide an alternate means of getting exposure to Bitcoin’s price movements in a mode familiar to traditional investors. Traders who don’t want to dabble with cryptocurrency wallets and exchanges may prefer to invest in the asset through these financial instruments.

As such, the long-term decline that the Exchange Reserve has been going through could represent the market shift that the emergence of the spot ETFs has induced.

BTC Price

At the time of writing, Bitcoin is trading at around $68,000, up more than 9% over the last seven days.