Bitcoin Short-Term Holders Back In Action As Demand Resumes, Price Spike Looming?

Amid the recent renewed upward price movement in Bitcoin, the demand for the largest cryptocurrency asset among short-term holders has witnessed a notable rise, suggesting strong optimism about BTC’s potential for growth in the near term.

Short-Term Holders Demand For Bitcoin Rebounds

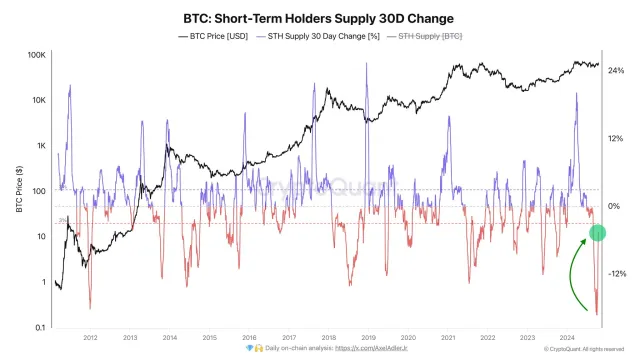

Axel Adler Jr., a macro researcher and author at leading on-chain firm CryptoQuant, recently reported that the average demand for Bitcoin from short-term holders has resumed after spotting positive advancements in the BTC’s Short-Term Holders Supply 30D Change metric following a period of decline.

According to market data, these investors, who are usually identified by their ownership of BTC for fewer than 155 days, are actively buying the cryptocurrency once more. This rebound reflects renewed interest from retail holders, which could be triggered by growing optimism about a possible price rally in the upcoming day.

After a thorough analysis of the Short-Term Holders Supply 30D Change metric, the expert highlighted that the indicator has witnessed a rebound over the past 18 days in spite of the supply change oscillator consistently staying in the negative territory. He further underlined that the supply saw about 15% growth or a daily increase of 0.95% during the period.

Thus far, investors and traders are closely watching the development since the resurgence could signal that a potential price increase is on the horizon, especially during uncertainty in the broader market.

Bitcoin’s short-term holders’ demand increases as volatility gradually returns to the market, as pointed out by Adler in another previous post. “As volatility has returned to the market, and it works both ways, be sure to assess risks when making trading decisions,” he stated.

Adler noted that the leveraged volume on the top of 3 crypto exchanges is currently at 32%. Meanwhile, a spike above 55% might lead to a “cascade of liquidations.”

A New All-Time High For BTC Coming Soon?

As anticipation for a major rally continues to grow, Michael Van De Poppe, a market expert and Chief Information Officer (CIO) of MN Consultancy has delved into the recent performance of BTC, predicting that the digital asset could reach a new peak soon. Van De Poppe highlighted that Bitcoin is in the consolidation period, which means the markets may “see some weakness.”

However, considering upcoming pivotal events like the United States Presidential election and a potential rate cut from the Federal Reserve (Fed), Van De Poppe is confident that the events could spark major price movements for Bitcoin in the upcoming weeks, noting that a new all-time high “is close.”

At the time of writing, BTC was trading at $67,899, demonstrating a 0.70% in the past day. While prices are slowly rising, BTC’s trading volume is displaying a negative outlook, falling by 2% in the last 24 hours.