Spot Bitcoin ETFs Demand At 6-Month High, BTC Capped Below $70,000

Bitcoin prices are steady above the $66,000 support when writing on October 25. While confidence is high, the coin is still trending below the psychological round at $70,000. It has yet to shake off sellers in early October.

Demand For Spot Bitcoin ETFs Shoots To A 6-Month High

However, looking at emerging spot Bitcoin ETF trends, this is about to change. The latest analysis by Ki Young Ju of CryptoQuant on October 25 shows that the demand for these crypto derivative products has risen over the last 30 days.

The uptick has seen the demand for spot Bitcoin ETFs in the United States rise to a six-month high, attracting over 64,900 BTC in net flows.

Net flows, which consider total inflows and outflows over the test period, can be used to gauge institutional interest. Whenever it rises, coupled specifically with expanding inflows, it means more institutions are getting exposure to the digital gold. The more institutional interest increases, the more likely BTC will shoot higher.

Soso Value data shows that issuers in the United States collectively manage over $66 billion. On October 24, investors bought over $188 million of BTC through their issuers. So far, BlackRock, through its IBIT, is the largest issuer, controlling over $27 billion of BTC.

Over the past few months, Grayscale’s GBTC has seen massive outflows. On October 24, over $7 million of BTC were redeemed from GBTC.

Will Institutions Push BTC Above $70,000?

There are high hopes that the approval of spot Bitcoin ETFs in the United States paved the way for institutions to drive prices. Before then, most found exposure to BTC via approved Trusts, some offered by Grayscale.

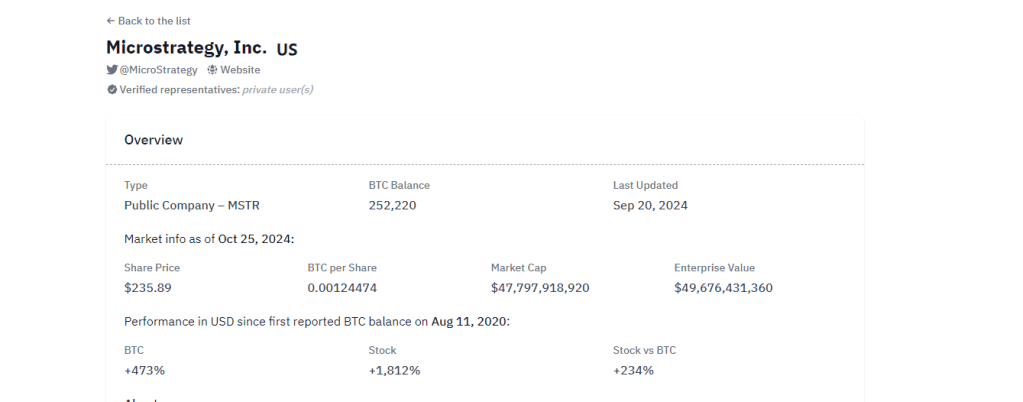

Meanwhile, some institutions bought MicroStrategy stocks as their performance reflected BTC, given the public company’s heavy investment in the digital asset.

According to Bitcoin Treasuries, MicroStrategy owns over 250,000 BTC, the biggest haul of any public company in the United States and worldwide. Over the years since their strategy of regularly stacking BTC, its stock, MSTR, has outperformed top stocks and indices in the United States.

Only time will tell whether BTC bulls have what it takes to break above $70,000. The round number marks September highs. If Bitcoin builds on the rejection of lower prices on October 24, it could find the momentum necessary to define the short-term trajectory.

A firm close above this psychological resistance line paves the way for a retest of $72,000 and all-time highs.