LikeFolio’s Top 7 Stock Picks (And One Crypto) For This Market Pullback

Investor fear is brewing.

The market is pulling back, headlines are flashing warnings, and uncertainty is creeping in. Stocks are sliding, Bitcoin just dipped below $80,000, and Wall Street is scrambling to make sense of the latest economic signals.

On Monday, the Dow tumbled nearly 800 points, the Nasdaq shed almost 4%, and fear-driven selling hit high-growth names the hardest.

President Trump’s latest comments on a possible recession only added fuel to the fire, while concerns over tariffs and inflation have investors bracing for more volatility.

This is the kind of pullback that shakes out weak hands. It’s also the kind of moment where opportunity shows itself for those paying attention.

Market cycles are nothing new—investor emotions swing from euphoria to panic, creating moments where high-quality assets get caught in the crossfire.

We are in the downturn cycle on the chart above — so it’s prime time to prepare for the next wave higher.

Right now, Bitcoin isn’t the only asset flashing an accumulation window. Some of the most compelling growth companies—names with undeniable tailwinds—are trading at prices that won’t last forever.

Approaching a Market Pullback

At LikeFolio, we specialize in spotting major consumer macro trends and understanding what makes people tick – likes, dislikes, pain-points, and products/services they can’t get enough of.

We do this by leveraging powerful data in real-time, including digital traffic patterns, app usage, comments on X, posts on Reddit, and even commentary from executives during earnings calls.

This approach helps us to anticipate future demand, and thus, growth prospects for publicly traded companies.

Our client base spans from major hedge funds and institutions to individual traders, like you (and like us!).

We’ve identified eight under-the-radar plays that could deliver outsized returns as the cycle turns.

The full report breaks down the names highest on our Watch List for a rebound.

Let’s get started.

8. Bitcoin

Bitcoin has pulled back significantly from recent highs, even dropping below $90,000, as macro fears and short-term profit-taking weigh on sentiment.

The selloff comes after Bitcoin ETFs saw their first major outflows, combined with concerns over potential tariffs and inflation.

Meanwhile, President Trump’s pro-Bitcoin stance is fueling speculation that the U.S. may build a strategic Bitcoin reserve, a move that would further entrench Bitcoin’s role as a macroeconomic asset.

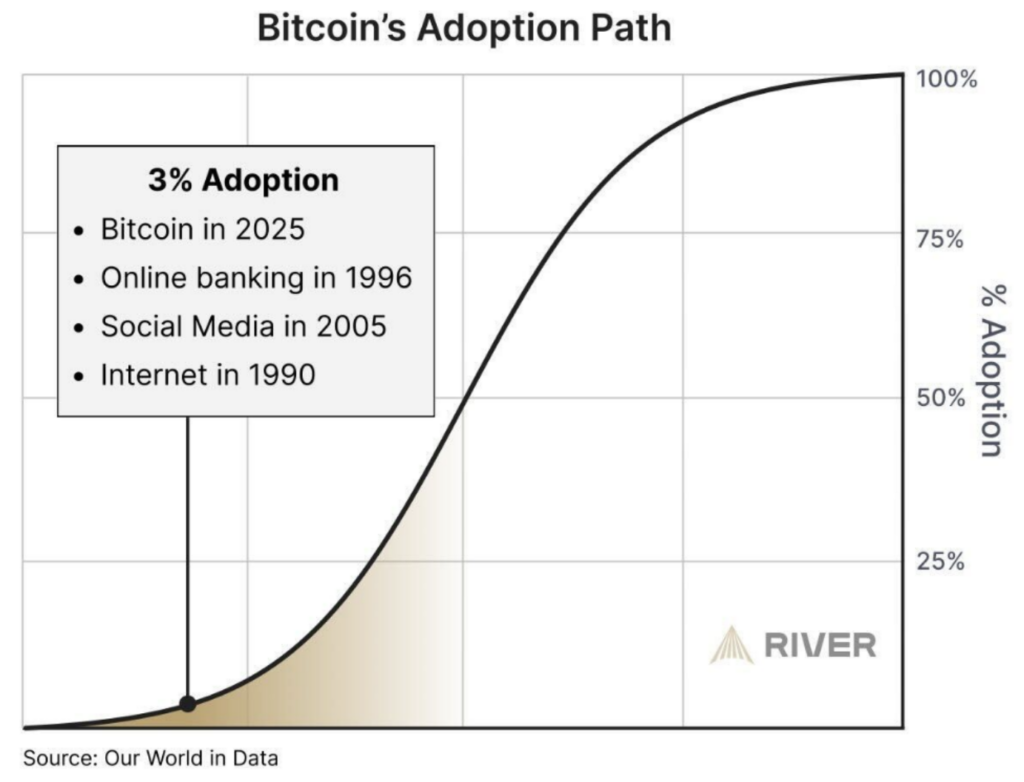

At LikeFolio, we believe we are in the very early stages of Bitcoin adoption, and the bet is more asymmetric than ever before.

Bitcoin Tailwinds

- Pro-Bitcoin Administration in the U.S.: Trump’s public support for Bitcoin mining, ETFs, and a national reserve is creating a more favorable policy backdrop—a stark contrast to the previous administration’s approach. The idea of Bitcoin being added to U.S. national reserves is gaining traction, positioning BTC as a geopolitical asset, not just a speculative one.

- Institutional Capital is Deeply Embedded: While recent ETF outflows have contributed to Bitcoin’s pullback, major firms continue to accumulate and expand exposure.

- Money Supply Expansion: Milton Friedman once noted that “inflation is always and everywhere a monetary phenomenon.” In other words, when the supply of money increases faster than economic output, inflation follows—and asset prices, particularly those with fixed supply like Bitcoin, tend to react accordingly… …