Bitcoin Hashrate Shows Rapid Climb To New Highs: Bull Run Here?

Data shows the Bitcoin Hashrate has been experiencing a rapid uptrend recently, a hint that miners expect the asset’s latest rally to continue.

7-Day Average Bitcoin Hashrate Has Been Exploring New Highs Recently

According to data from Blockchain.com, the BTC network has seen its Hashrate shoot up recently. The “Hashrate” here refers to an indicator that keeps track of the total computing power the miners have currently connected to the Bitcoin blockchain.

When the value of this metric observes a rise, it means new miners are joining the network, and old ones are expanding their farms. Such a trend implies that the chain is looking like a profitable venture to these chain validators.

On the other hand, the indicator going down suggests some miners have decided to disconnect their rigs from the network, potentially because they are no longer finding BTC mining attractive.

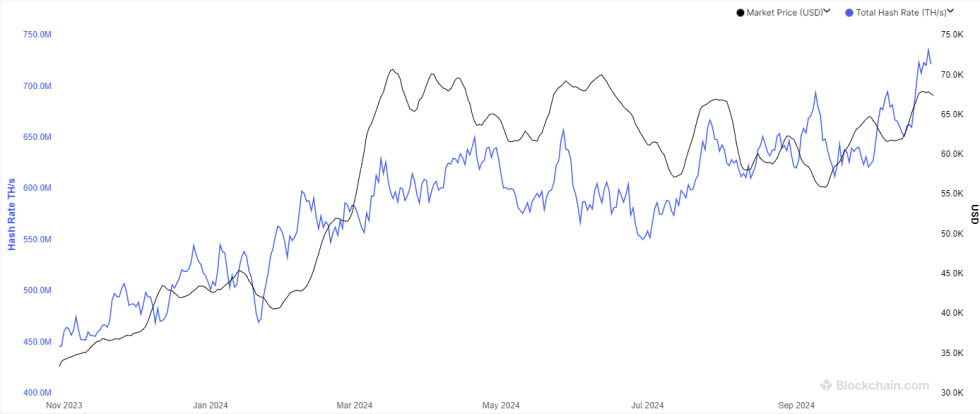

Now, here is a chart that shows the trend in the 7-day average of the Bitcoin Hashrate over the past year:

As displayed in the above graph, the 7-day average Bitcoin Hashrate has witnessed a sharp surge during the last few weeks and has set a new all-time high (ATH).

The metric is traditionally measured in terms of hashes per second (H/s), but at this point, the BTC network has grown so much that a much larger terahashes per second (TH/s) is used instead. The latest ATH of the indicator has been around 735 TH/s, almost 6% higher than the 694 TH/s record set earlier in the month.

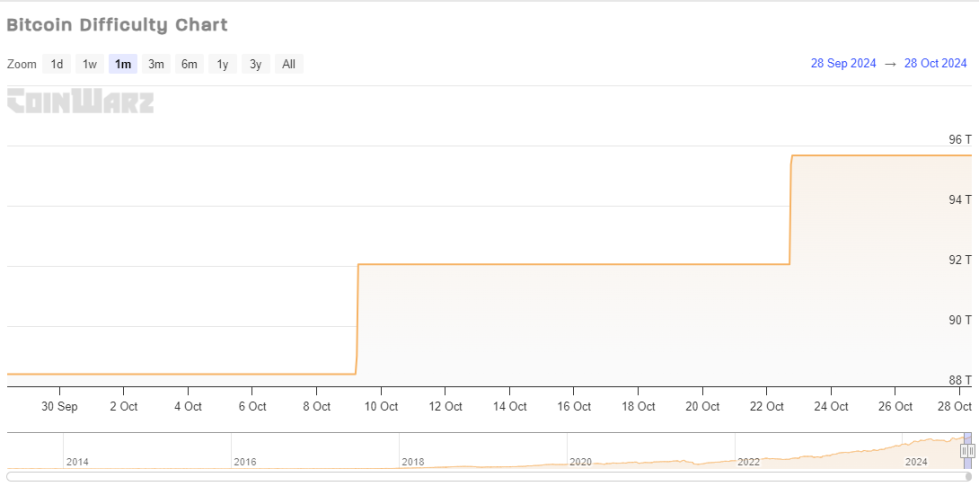

The rapid growth that the Hashrate has seen recently naturally suggests that the miners have been confident about the cryptocurrency. Interestingly, these chain validators have made these expansions even though the network Difficulty has seen a rise in the latest adjustment.

As data from CoinWarz shows, this Difficulty increase has been the second consecutive that the chain has gone through.

The “Difficulty” refers to a feature on the Bitcoin blockchain that controls how hard the miners would find the task of BTC mining. The Difficulty exists in limiting the rate at which miners receive block subsidy, which serves as the only means of producing new BTC, so the asset’s inflation can be controlled by restricting it.

Whenever miners increase the Hashrate, they temporarily become faster at their task and receive block subsidy at a faster rate. To counteract this, the network raises its Difficulty in the next biweekly adjustment, bringing miners back to the desired speed.

This means that no matter how much investment the miners make, they can never earn more than they did before. The only way the expansions pay off is if the BTC price goes up since the value of their BTC rewards would also naturally increase.

Given the aggressive increase in the Hashrate recently, despite the Difficulty setting new records, it would appear that the miners believe the current rally will continue.

BTC Price

Bitcoin had breached beyond the $69,000 level earlier today, but the asset appears to have seen a pullback as its price is now down to $68,700.