SEC Takes Aim At IMX: Immutable Faces Potential Lawsuit Over Token Sales

The US Securities and Exchange Commission (SEC) has filed a Wells Notice to Immutable over its sales of IMX tokens. The SEC’s contention is related to a 2021 blog post on the pre-launch investment made in the IMX tokens priced at $0.10 or a $10 pre-100:1 split.

Immutable has questioned the SEC’s judgment, saying that the price was inaccurate; thus, the charge is “incorrect” since no exchange happened between parties.

Immutable (IMX) was one of the popular gaming-focused projects in 2021, a time of the growing popularity of play-to-earn (P2E) blockchain projects. The blockchain project featured an NFT marketplace and an L2 scaling solution, primarily serving third-party game developers.

Immutable has received a Wells notice from the SEC, the latest in their de facto policy of regulation by enforcement. We received this within hours of our first ever conversation, on a timeline clearly accelerated to land before an election.

Sadly, stories like this are becoming…

— Immutable (@Immutable) October 31, 2024

Wells Notice Targets ‘Sale Of IMX Tokens’

Immutable is a leading Australian blockchain that launched a $320 million pre-sale. Around 14% of the IMX tokens went to the public. SEC believes that the same IMX tokens during its launch violated some laws, hence the decision to file the notice.

In the US, companies and individuals may receive a Wells Notice from the agency if they are investigated for possible violations. Immutable immediately responded to the notice, saying that the agency was deliberately harsh on start-ups despite little evidence of wrongdoing.

Upon issuance of the notice, the agency contacted the company for a conversation. With a Wells notice filed, Immutable may face a lawsuit soon.

Token Price Dips To One-Month Low

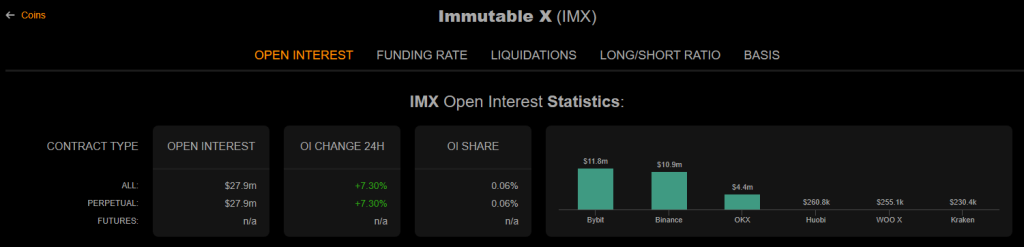

The recent news on Immutable and the potential investigation spooked many traders, pushing the token’s price to $1.22 from $1.37, a one-month low. However, the SEC issuance was also helpful for the company as the volume of its open interest increased. For Immutable, the open interest covers coin-margined and stablecoin-margined contracts in USD.

Recently, IMX’s open interest went from a low of $22 million to a high of $27 million in just a few hours. While many consider IMX risky, analysts see a possible and quick recovery from its lows. Top exchanges, including Coinbase and Binance, carry IMX.

Immutable Slams SEC For Its Aggressive Enforcement

Australia’s Immutable shared its frustrations over Twitter/X, saying that these notices and investigations are becoming less surprising. The company used the experiences of other blockchain companies like Coinbase, OpenSea, and Uniswap as examples. Immutable added that the agency’s recent aggressive moves now extend to gaming.

In the same post, the company reiterated its commitment to the industry and said it would continue building to support gaming. If necessary, the company will also fight and defend gamers’ rights. So far, the SEC’s Wells notices have not led to company or project delistings, except for XRP, which was removed from Binance for one year.

Featured image from TechCrunch, chart from TradingView