5 Things To Know In Investing This Week: The We Pivoted Bigly Issue

Years ago, President Trump talked about a change in tax rates that he described as “big league”. It was misinterpreted as “bigly” and a new word entered the lexicon. Last week, the Fed pivoted and cut the fed funds rate. This cut was more than two years after Fed doves and asset gatherers started begging for a return to zero interest rates. The Fed was too late for them and too early for my liking. They went for the 50bp cut, a bigly move. Those who disagree with me about the Fed will find their proof in weaker than expected results from shipper, FedEx (NYSE: FDX). Intel (NASDAQ: INTC) makes the smart move to separate their foundry business and gets a $3B government contract (and a potential buyout). Despite being a free market advocate, I think this was a good move for all involved. We discuss how Bitcoin (CRYPTO: BTC) is a short-term proxy for the NASDAQ and a long-term hedge against inflation. Finally, Learn Wall Street gives the smart advice to do substantial research before investing and we provide two examples of why that’s important.

This week, we’ll address the following topics:

-

The Federal Reserve pivots and cuts the fed funds rate by 50bp. More cuts on the way.

-

Lower rates mean more inflation which means reduced purchasing power for the dollar. Bitcoin rises on expectations for a weaker dollar.

-

Intel restructures and gets a big government contract. After weeks of criticizing Intel, DKI approves.

-

FedEx misses bigly supporting the decision of the Fed to cut.

-

If someone tells you there’s gold underground, how do you know there’s gold?

Alex Petrou and Andrew Brown come through bigly delivering an almost-completed version of this week’s 5 Things by Thursday night. Fantastic work as usual. Next week’s 5 Things will not include the word “bigly”. In order to remain non-partisan, will we include the term “unburdened by what has been”? Probably not, but check in with us just to be certain.

Ready for a new week of big rate cuts and more inflation? Let’s dive in:

The Federal Reserve completed its September meeting and decided to cut the fed funds rate by 50bp (.50%). The market knew the Fed would pivot and cut at this meeting. There was debate regarding the size of the cut. I had expected 25bp (.25%). The doves in the crowd calling for the larger 50bp cut were correct. The Fed will continue its monthly quantitative tightening and will continue to shrink the size of its balance sheet (for now). Given the weaker employment data and the public comments by Chairman Powell, I’m not surprised the Fed cut (no one is surprised at this point). I’m a bit surprised by the larger 50bp cut because the Fed tries to appear non-partisan and non-political in its actions. Today’s larger cut just 6 weeks before the November elections give the appearance that they’re trying to help Democratic candidates. Public cries for a 75bp cut from prominent Democratic politicians did not help this perception.

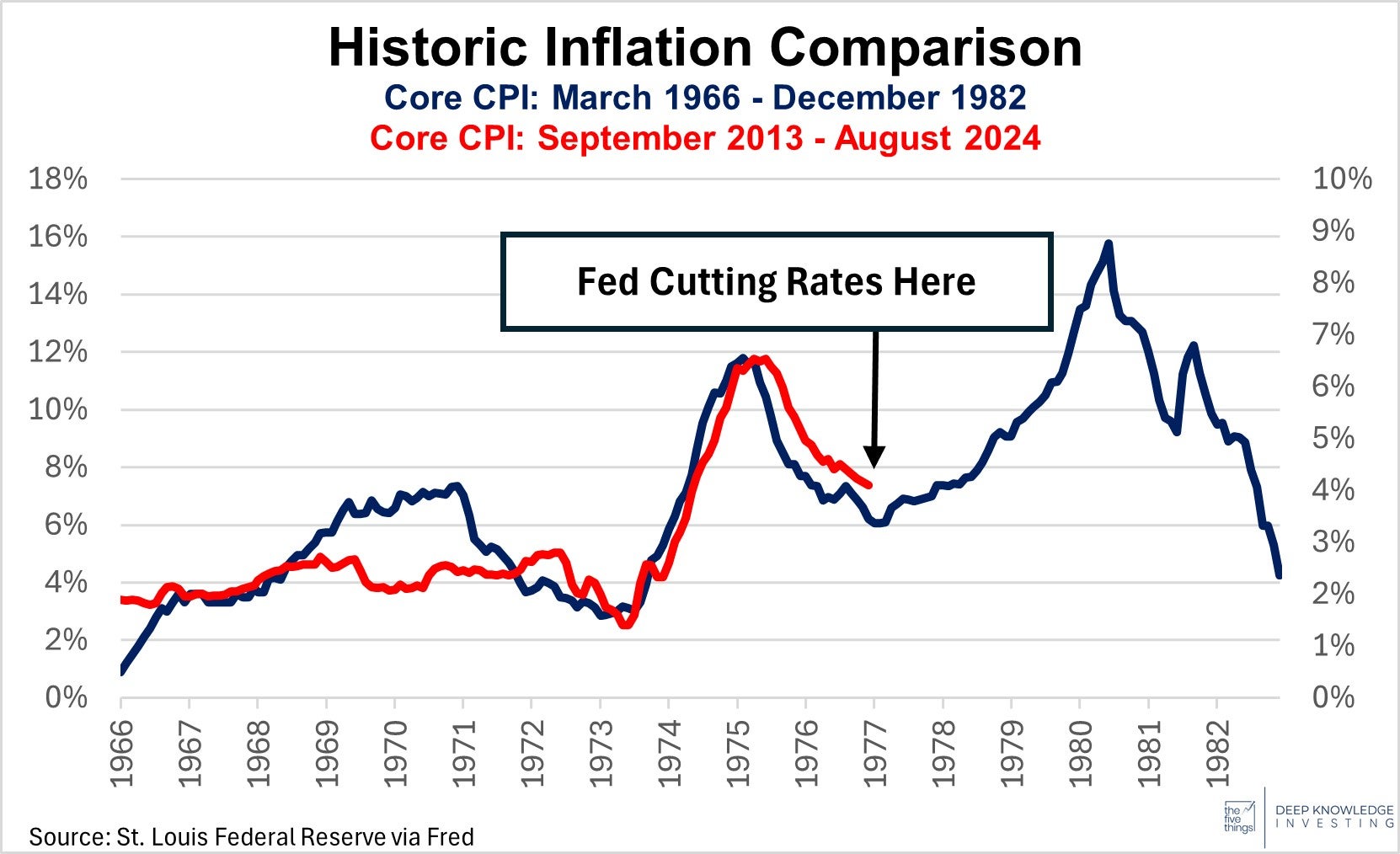

For those of you who were cheering for rate cuts, please look at this chart.

DKI Takeaway: I’m probably in the minority here, but think this cut is unwise. While many claim that the US economy is already in recession, I’m concerned that inflation is still above the 2% target and retail sales remain strong. There are still almost 8MM jobs available which is more than the number of people seeking jobs. Most importantly, Congress is still engaging in trillions of dollars of annual inflation-causing stimulus spending. (For those of you on team red or team blue, I’m sorry to report that overspending is a bipartisan problem.) Check out the graph for this Thing where we compare the inflation of the 1960s and 1970s with the more recent numbers. You can see where former Fed Chairman, Arthur Burns, eased rates prematurely leading to a resurgence of inflation. It looks …