Bitcoin Surpasses $1.79 Trillion Oil Giant Saudi Aramco – Can BTC Climb Up And Pass Gold?

Bitcoin has entered an explosive bullish rally, breaking all-time highs seven times over the past eight days. This sustained surge has set new price records and pushed its market cap above $1.809 trillion, placing it ahead of Saudi Aramco, the oil giant valued at $1.79 trillion.

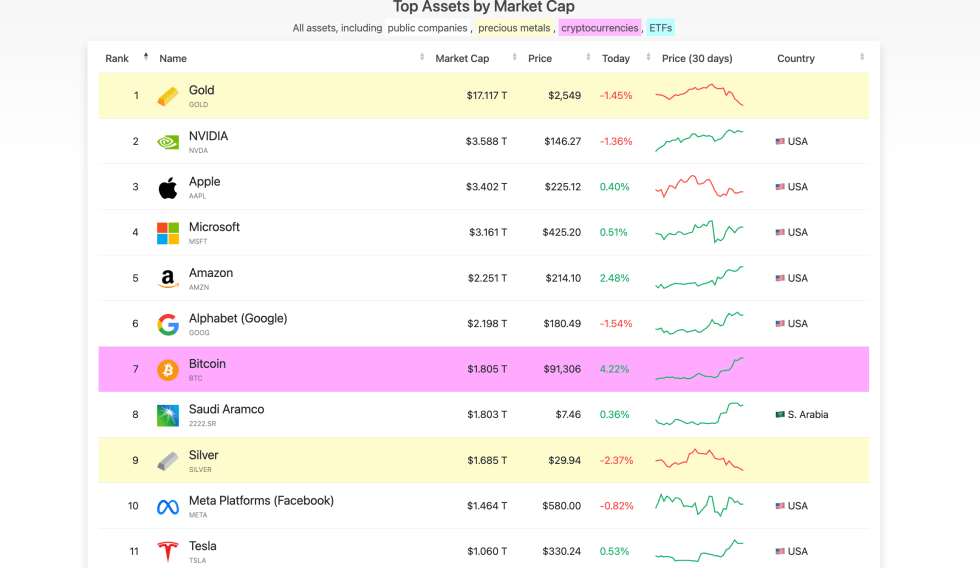

Now positioned as the world’s 7th largest asset by market cap, BTC’s climb is capturing attention as it challenges traditional giants of global finance and commodities.

This milestone fuels speculation: could BTC one day overtake gold, which holds the top asset position with an estimated $17 trillion market cap? While BTC’s rise has been driven by institutional adoption, supply scarcity, and growing acceptance as “digital gold,” it must multiply several times to match gold’s market dominance.

The path is uncertain, but Bitcoin’s trajectory suggests a future where it continues to rise as an alternative store of value. This rally could begin an unprecedented shift in how global wealth is stored, transferring capital from traditional assets to digital alternatives. In this unfolding scenario, BTC is proving that it’s more than just a cryptocurrency—it’s becoming a powerful asset class with global impact.

Bitcoin Becoming A Global Asset

Bitcoin is rapidly evolving into a global asset, increasingly recognized as a store of value and a tradable asset by institutions and individuals alike. As more organizations adopt BTC, its appeal is no longer limited to the cryptocurrency community but expands across traditional finance and beyond.

Key data from Companies Market Cap highlights this evolution, revealing that Bitcoin’s market cap now stands at $1.809 trillion, making it the 7th largest asset globally. This milestone surpasses well-established companies like Saudi Aramco, Meta, and Tesla and commodities like silver, underscoring Bitcoin’s growing stature in the financial world.

With 106 million users worldwide, BTC is still in the early stages of its adoption curve, suggesting significant growth potential in the coming years. If BTC continues gaining traction as a reserve asset and global trade tool, it could move up the asset rankings further.

While overtaking gold seems like a distant challenge—Bitcoin’s market cap is currently more than 10 times smaller than gold’s estimated $13 trillion—there is potential for a shift. A rise in global adoption, especially if cryptocurrencies become a mainstream mode of trade, could push Bitcoin’s market cap to $17 trillion, a feasible target given its rapid growth.

The pace at which BTC is expanding solidifies its status as one of the fastest-growing assets in history, setting the stage for further leaps in the next decade.

Bitcoin Price Rising Fast

Bitcoin is trading at $90,700 after reaching a new all-time high of $93,483 yesterday. The cryptocurrency has surged more than 15% since the US election, and its momentum shows no immediate signs of slowing down. Aggressive buying pressure has fueled this strong rally, marking over eight consecutive days of price increases.

However, given the rapid ascent, there is a growing risk of a correction or consolidation below the $93,000 level. Some analysts expect a pullback to find support around $85,000, allowing the market to establish a new equilibrium before continuing higher.

Despite this possibility, Bitcoin’s price action remains extremely bullish, with no signs of weakness on the chart. The general sentiment is that the current surge is only the beginning of a larger upward trend.

As BTC trades near its record highs, the next few days will be crucial to determine whether a brief consolidation occurs or if the bullish momentum continues unabated. While short-term pullbacks are possible, Bitcoin’s overall trajectory remains strong, and its long-term outlook favors further price appreciation.

Featured image from Dall-E, chart from TradingView