Gold ETF Bleeds Money At Fastest Pace In 3 Years — Is The Safe-Haven Trade Over?

A major gold exchange-traded fund recorded its steepest capital exodus in nearly three years this May, casting doubts over investor appetite for traditional safe-haven assets—but some analysts suggest the bull cycle is far from over.

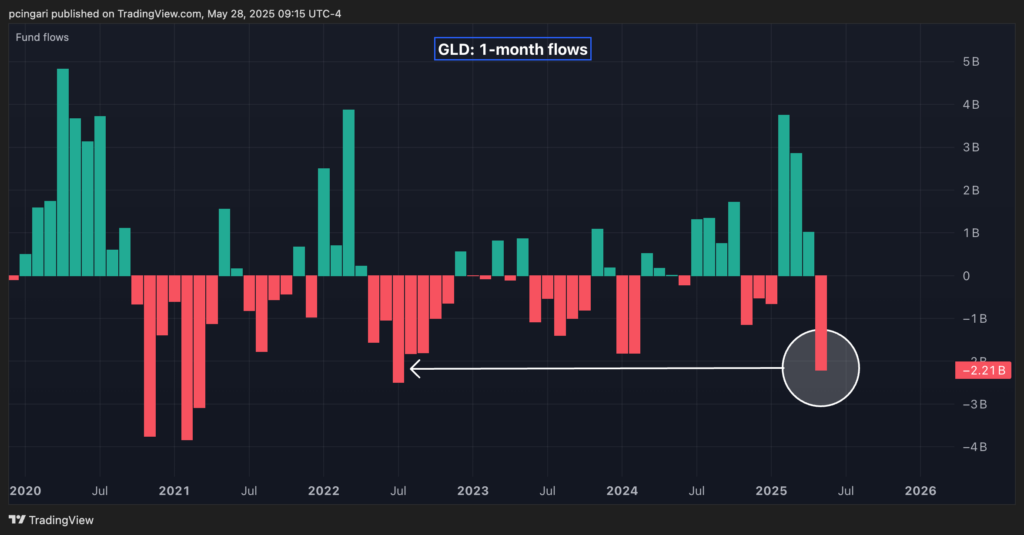

$2.1 Billion Outflows Rock SPDR Gold ETF

The SPDR Gold Trust ETF (NYSE:GLD) saw outflows totaling $2.1 billion in May, marking its worst monthly withdrawal since July 2022.

The sell-off follows three straight months of heavy inflows, during which the fund attracted approximately $7.5 billion, reflecting a major reversal in sentiment.

The outflows come as gold prices moved sideways in May, set to close the month broadly unchanged after a robust four-month rally that pushed prices to a record high of $3,500 an ounce in mid-April.

US-China Truce Dampens Demand For Gold

A key reason behind the fading appetite for gold appears to be the May 12 trade agreement between the U.S. and China, which saw both nations slash tariffs by 115 percentage points …