Trump-Musk Rift, Bitcoin’s Price Swings, and ECB’s Latest Move: Your Weekly Crypto Recap

Although the week started in a sluggish manner, it quickly became an interesting one, especially when the soap opera at the highest levels in the United States took place. Yet, the drama that unfolded between the US President and one of his closest allies managed to impact the crypto markets as well.

But before we go into the details of the quickly escalating spectacle between the two, let’s rewind the clock slightly to the events that transpired since last Friday. Bitcoin’s price was quite calm at that point, as after the few rejections at around $110,000 in the previous week, it had found a solid spot close to $104,000.

It sat there for about 72 hours and started to gain traction as the new week began. However, it couldn’t go any higher than $106,500, where it was stopped on a few occasions. Even yesterday, after the European Central Bank announced an eighth interest rate cut, dropping the metric to a two-year low of 2%, BTC managed to climb only to $106,000.

It faced immediate selling pressure at that point and slumped to a multi-week low of $100,400. Of course, the blame for this substantial correction was put on the aforementioned drama between Musk and the POTUS. Both men used their respective social media platforms to fire shots at one another.

Some of the most notable include Musk saying Trump was in the Epstein files, while the President threatened to halt the former’s government contracts. More recently, Trump denied rumors that he plans to hash it out over a phone call, and other reports even emerged claiming that he plans to sell his Tesla EV.

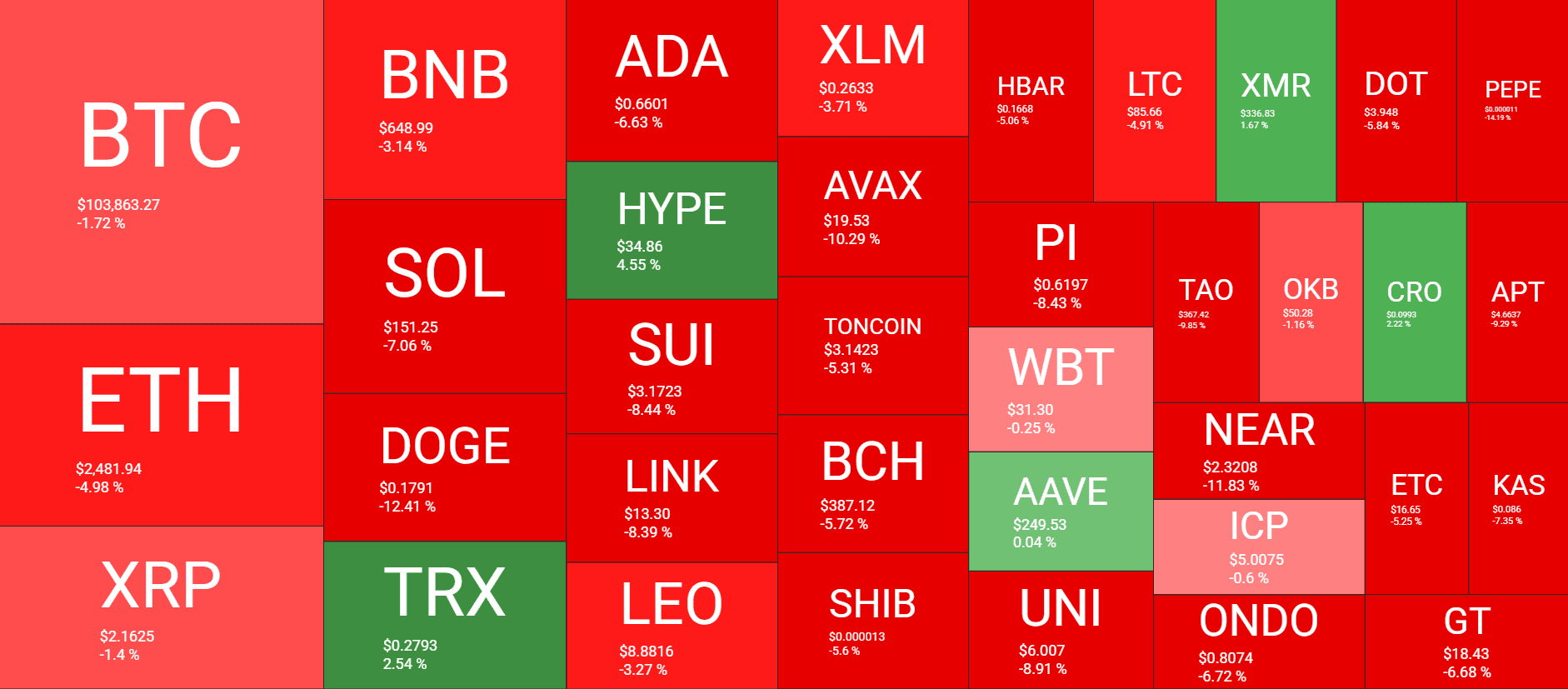

Despite this ongoing saga, BTC managed to recover some ground and now trades around $104,000. This represents a 1.7% decline on a weekly scale, but it’s minimal compared to the substantial losses experienced by DOGE (-12.5%), SIU (-8.5%), LINK (-8.5%), and AVAX (-10%).

Market Data

Market Cap: $3.365T | 24H Vol: $145B | BTC Dominance: 61.4%

BTC: $103,860 (-1.7%) | ETH: $2,471 (-4.7%) | XRP: $2.16 (-1.2%)

This Week’s Crypto Headlines You Can’t Miss

No Price Spike, But 22,500 BTC Quietly Left Exchanges in a Single Day. Although BTC’s price is yet to react, the amount of bitcoins heading out of exchanges and going into self-custodial devices continues to impress. In a single day alone, over 22,500 BTC were moved from trading platforms, which reduces the selling pressure.

On-Chain Data Signals ‘Buy the Dip’ as Bitcoin Hashrate Hits New Highs. Bitcoin’s price tumbled, as mentioned above, this week to a June low of under $100,500. However, an important on-chain metric, the Bitcoin Hash Ribbons Indicator, flashed a “buy the dip” signal.

ECB Cuts Interest Rates Again: How Did Bitcoin React? While the US Federal Reserve continues to leave the local interest rates unchanged in 2025, the European counterparty went in the opposite direction. The ECB lowered the rates in the Eurozone to 2% – the lowest in over two years, and BTC jumped initially before going down a notch.

Robinhood Cements Crypto Ambitions with $200M Bitstamp Takeover. Robinhood solidified its presence in the European crypto market by acquiring the world’s oldest still functioning digital asset exchange, Bitstamp. The deal, announced earlier this week, was for $200 million.

Bitcoin Sees Intense Surge in Realized Profits Following Ascent to $111K: Glassnode. With BTC falling further away from its latest all-time high registered a couple of weeks ago on Bitcoin Pizza Day, reports have emerged now claiming that the most probable reason behind this is that profit-taking has gone through the roof after the price surge.

Strategy Announces Proposed IPO of STRD Stock to Buy More Bitcoin. The world’s largest corporate holder of bitcoin, who made a relatively modest acquisition this week, announced IPO plans for 2.5 million shares ($100 per stock) to raise more capital for further BTC purchases. Later on, the company raised its target from $250 million to $1 billion.

The post Trump-Musk Rift, Bitcoin’s Price Swings, and ECB’s Latest Move: Your Weekly Crypto Recap appeared first on CryptoPotato.