Bitcoin Poised For A Parabolic Bull Scenario During Price Discovery – Details

Bitcoin has broken all-time highs for the fourth consecutive day, surging to an impressive $99,500. This historic price action follows a wave of bullish momentum that began after President-elect Donald Trump’s victory in the US elections on November 5, further energizing both investors and analysts.

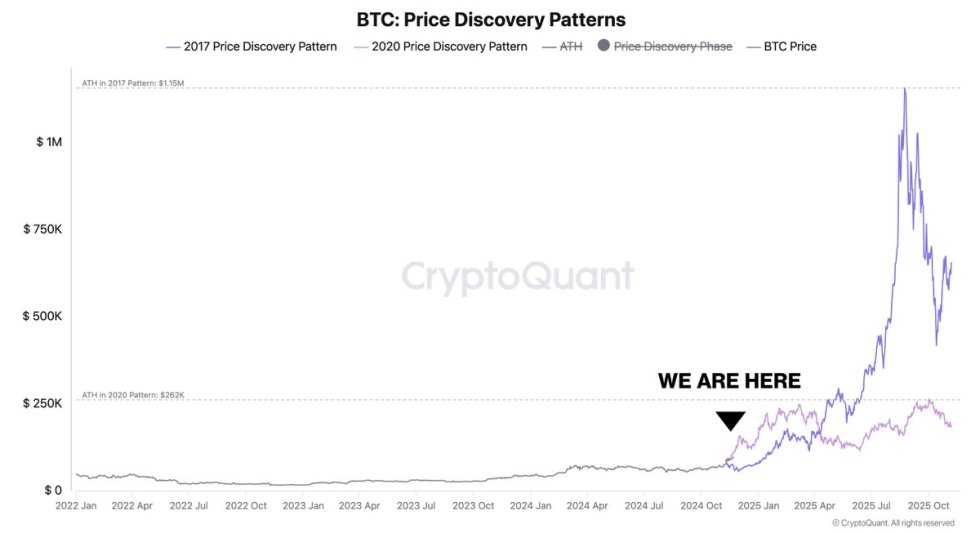

Market sentiment remains extremely optimistic, with Bitcoin’s recent rally reinforcing its position as a dominant asset in the financial landscape. CryptoQuant CEO Ki Young Ju provided key insights into this remarkable trend, sharing an X analysis highlighting BTC’s entry into a parabolic bull scenario.

According to Ju, this price discovery phase occurs only once every four years and signals a prolonged period of exponential growth for BTC.

Ju emphasized that Bitcoin’s parabolic run is still in its early stages, with historical patterns suggesting that this bullish period could extend for several months. Investors are watching closely as BTC continues its upward trajectory, with expectations mounting for the next psychological milestone of $100,000. As the market navigates this unprecedented rally, all eyes remain on BTC’s ability to sustain its momentum during this pivotal price discovery phase.

Bitcoin Enters Price Discovery

Bitcoin entered price discovery when it broke its March all-time high of around $73,800 just over sixteen days ago. Since then, BTC has surged more than 45%, pushing the price closer to the $100,000 mark, a psychological level many investors anticipate will soon be tested.

As the market enters this exciting phase, Bitcoin’s price action has been nothing short of impressive, with strong demand and consistent bullish momentum continuing to fuel the rally. CryptoQuant CEO Ki Young Ju recently shared an analysis on X, showcasing historical BTC parabolic bull scenarios during price discovery and drawing comparisons to the current one.

Ju’s analysis points to similarities in market structure and suggests that Bitcoin is still in the early stages of this parabolic rise. He highlighted a logarithmic chart that makes this trend even more evident, further solidifying the view that this rally has a long way to go.

As BTC continues to rise, analysts and investors remain optimistic that it could not only surpass the $100,000 mark but potentially continue to skyrocket beyond expectations. The ongoing surge has fueled excitement, with many seeing this as the beginning of an extended parabolic bull market similar to those in previous years.

With a clear path ahead and growing investor confidence, BTC’s price discovery phase is set to captivate the crypto world and potentially lead to even more massive gains in the coming months.

BTC Nears $100K: What To Expect?

After three weeks of highly bullish price action, Bitcoin is currently trading at $98,500. The price has consistently broken all-time highs, and now it’s on the verge of breaking the crucial $100,000 barrier. This marks a significant milestone in the ongoing rally, and many investors are closely watching for this key level to be breached. Once BTC surpasses $100,000, volatility is expected to increase, as this level is seen as a critical supply zone, which could trigger profit-taking and short-term pullbacks.

Despite the potential for increased volatility, strong demand continues to rise, and bullish sentiment remains high. Many investors believe that the current BTC bull market is just getting started, with significant upside potential ahead. If Bitcoin holds above the $93,500 mark in the coming days, a surge above the $100,000 level could be imminent, signaling the next phase of the rally.

However, there is also a high risk of a correction in the short term. Active profit-taking from long-term holders (LTH) is already underway, and a retrace to lower levels could be needed before the next leg up. Such a correction would provide healthy consolidation before Bitcoin continues its upward trajectory toward new highs.

Featured image from Dall-E, chart from TradingView