Bitcoin ‘Well-Positioned’ To Break $100,000 Barrier Despite Short-Term Volatility: Report

According to a recent report by Bitfinex, Bitcoin (BTC) breaking through the psychologically significant $100,000 barrier will largely depend on the actions of two key holder cohorts – long-term holders (LTH) engaging in profit-taking and short-term holders (STH) driving demand.

Short-Term Holder Demand Critical To Propel Bitcoin To $100,000

Bitcoin’s price surged an impressive 37.3% in November, closing the month at a record-breaking $96,506. However, for the flagship cryptocurrency to cross the $100,000 mark, demand from STHs must align with the supply provided by LTHs.

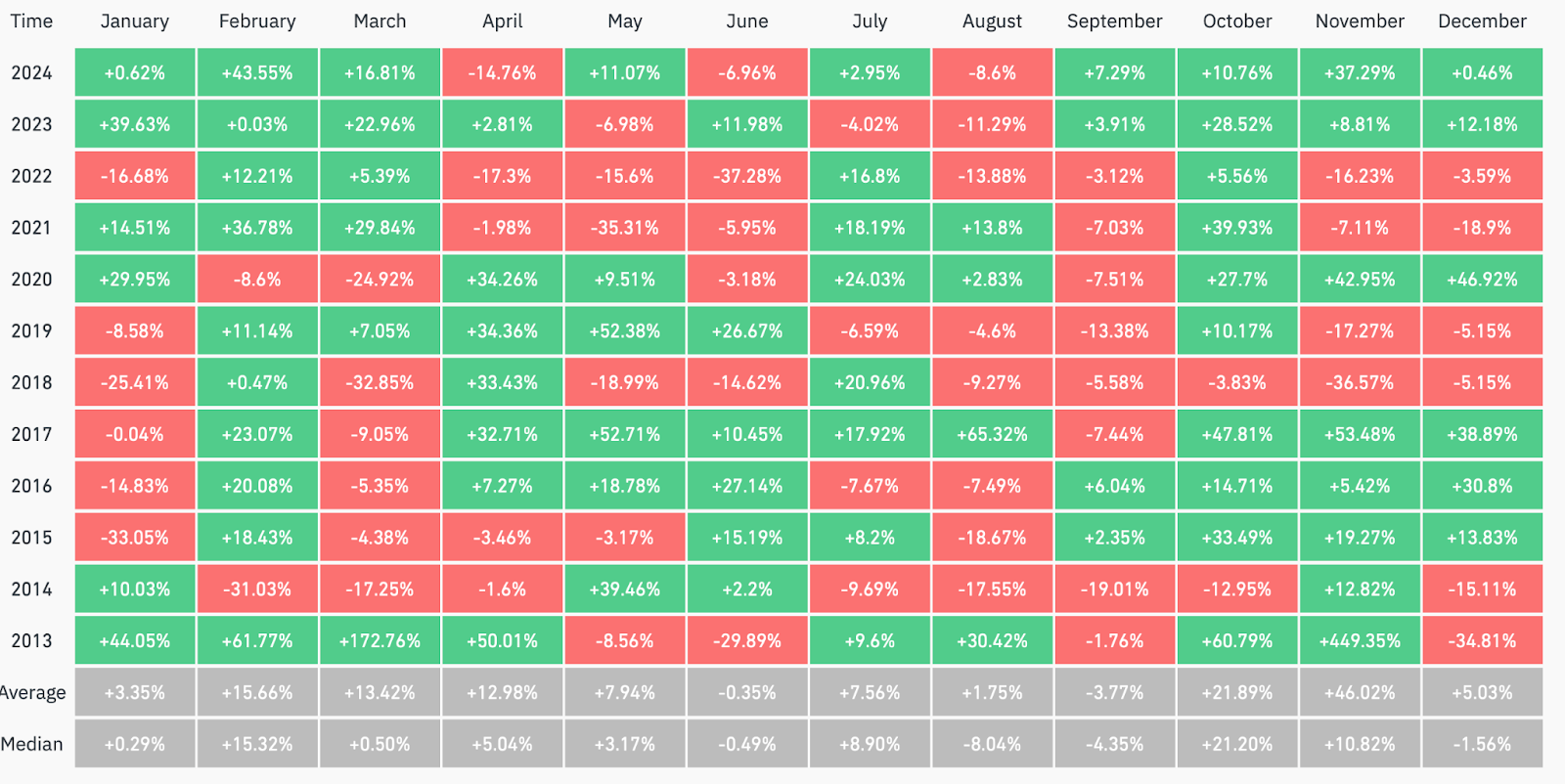

Historically, December has been one of the most volatile months for Bitcoin. However, during halving years, the month typically delivers strong performance, with average returns of 38.86%. Since the most recent halving occurred in April 2024, analysts anticipate that December could be favorable for BTC holders.

The latest edition of the ‘Bitfinex Alpha’ report highlights several factors likely to propel Bitcoin beyond $100,000. The report notes that while short-term volatility may persist, the current bullish momentum in the cryptocurrency market suggests further gains are probable.

The report also points out that short-term price pullbacks – like the one witnessed last week when BTC briefly dropped to $90,911 – are often driven by ETF outflows and LTH profit-taking. Specifically, the report states:

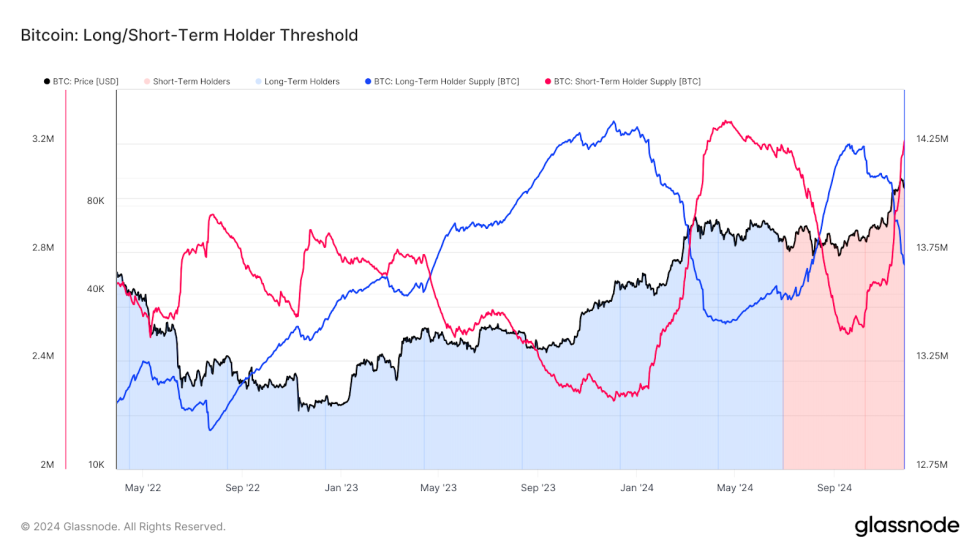

Last week, ETFs registered net outflows of $135.1 million, with the bulk of these taking place during the first two trading days. LTHs have distributed a significant 508,990 BTC since September, increasing the supply entering the market.

While the 508,990 BTC distributed by LTHs since September is notable, it remains lower than the 934,000 BTC distributed before the March 2024 highs. Nonetheless, consistent demand from ETFs and retail buyers will prevent further price pullbacks.

As can be seen in the above chart, the STH supply is close to its cycle high of 3,282,000 BTC. Based on past data, the last phase of a bull run commences when STH supply surges past pre-halving cycle highs. The report reads:

This shift indicates increasing retail participation but also highlights the market’s reliance on incoming demand to absorb LTH profit-taking.

For the uninitiated, STH supply typically means the total amount of BTC currently held by wallets or entities that have acquired it within a relatively short time, typically less than 155 days. On the contrary, LTH supply refers to the BTC currently held that was acquired more than 155 days ago.

Analysts Confident $100,000 BTC Is Within Reach

While BTC price continues to see-saw in the mid-$90,000 range, several prominent analysts believe that $100,000 is just a minor hurdle in BTC’s upward price trajectory. For instance, Cryptoquant predicts that BTC’s top for this cycle might be at $146,000.

Similarly, investment management firm VanEck foresees BTC hitting as high as $180,000 during the current cycle. At press time, BTC trades at $95,238, down 1.2% in the past 24 hours.