China’s New Investment Playbook: VCs Chase Crypto As A Travel Upstart Eyes New York

Two recent shifts by smaller venture capital firms and a major IPO plan from a Hong Kong travel upstart signal telling trends for the future. China Renaissance (1911.HK) is making a significant foray into cryptocurrency, while Tian Tu Capital (1973.HK) is pivoting from its consumer goods comfort zone into technology, funded by an unusual bond issue. Simultaneously, online travel agent Klook is preparing a major U.S. listing. These moves, while distinct, paint a broader picture of adaptation and strategic recalibration in a rapidly changing landscape.

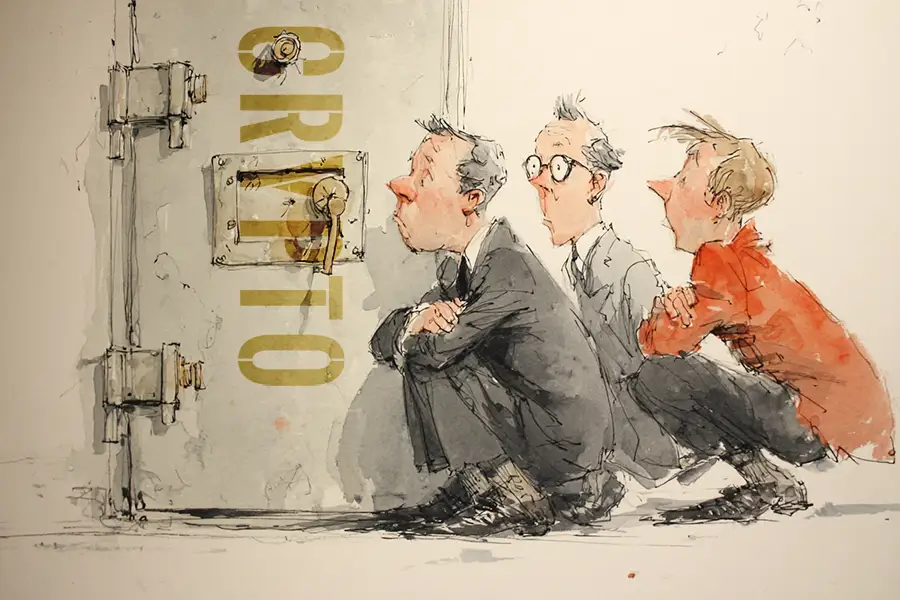

We believe the move by firms like China Renaissance into crypto is, in a word, inevitable. Crypto is no longer a back-alley affair; it has moved to center stage. While crypto trading is technically illegal on the Chinese Mainland, this has not deterred Chinese venture capital. We’ve seen this before, with firms like IDG investing in companies like Circle. The strategy is clear: use Hong Kong as the major platform to access crypto assets and launch related products. It’s a path already being tested by giants like JD.com, which is participating in a stablecoin sandbox scheme in the city. This isn’t an unorthodox maneuver but a prudent one, allowing onshore companies to tap into the trend legally through their offshore entities. We expect to see increasing crypto exposure for venture capital firms going forward, even if not every firm launches a dedicated fund.

Tian Tu Capital’s pivot away from its traditional focus on the consumer sector is equally noteworthy. The consumer story in China has grown complicated. The boom of 2021, which saw a wave of new brands in cosmetics, food, and retail attract huge VC investment, came to an …