Is Bitcoin At Risk? What Google’s New Quantum Chip Means

On December 9, Google’s CEO Sundar Pichai revealed “Willow,” a quantum computing chip that he claims represents a pivotal milestone in the quest for scalable quantum systems —raising immediate questions about its implications for Bitcoin’s long-term cryptographic security. While quantum computing has long promised breakthroughs, Willow’s reported ability to dramatically reduce error rates and handle previously unmanageable computational tasks has re-ignited debate over its implications for cryptography, particularly Bitcoin’s foundational security layers.

In a statement posted on X, Pichai described Willow as a 105-qubit chip that can “reduce errors exponentially” at scale—something researchers have struggled to achieve for decades. He suggested that early benchmarks indicate Willow tackled a standard quantum problem in under five minutes, a task he said “would take a leading supercomputer over 10^25 years.”

Introducing Willow, our new state-of-the-art quantum computing chip with a breakthrough that can reduce errors exponentially as we scale up using more qubits, cracking a 30-year challenge in the field. In benchmark tests, Willow solved a standard computation in <5 mins that would…

— Sundar Pichai (@sundarpichai) December 9, 2024

Quantum computing’s potential to solve problems at unprecedented speed has long been discussed in the context of cryptography—both classical and elliptic-curve based systems. Bitcoin relies on two cryptographic pillars: ECDSA (Elliptic Curve Digital Signature Algorithm) for securing private keys and SHA-256 for hashing. Both are considered robust against current classical computers. However, the arrival of powerful, error-corrected quantum machines could upend that assumption by making classical cryptographic puzzles trivial to solve.

Is Google’s Willow A Threat For Bitcoin?

Shortly after Willow’s unveiling, Bitcoin Libre CEO Ben Sigman offered a measured response on X. While acknowledging Willow’s progress, he argues that Bitcoin’s encryption is still beyond the immediate reach of today’s quantum capabilities. He noted that exploiting Bitcoin’s elliptic-curve signatures using Shor’s algorithm would require “over 1,000,000 qubits”—orders of magnitude beyond Willow’s 105.

Turning to the second layer of Bitcoin’s security, SHA-256, Sigman points out that breaking it would demand “millions of physical qubits,” a threshold far higher than what Willow or any current quantum system can approach. He concluded, “Bitcoin’s cryptography remains SAFU … for now.”

Charles Edwards, founder and CEO of Capriole Investments, warns that ignoring quantum computing’s accelerating trajectory could be a grave oversight. Though he acknowledges the current gap between today’s quantum hardware and the massive scale needed to crack Bitcoin, Edwards cautions against complacency.

“The level of Quantum Computing skepticism today reminds me of the average person who spends 10 minutes researching Bitcoin and then dismissing it as valueless. Quantum Computing is real. It will change the world. MASSIVELY. QC will break Bitcoin if we do not upgrade it. The threat is real,” Edwards warns.

He points to research that suggests as few as 2,500 logical qubits—well below the often cited “millions of qubits”—might be enough to challenge SHA-256. The difference between physical and logical qubits is crucial. While physical qubits are the raw building blocks, logical qubits emerge only after substantial error correction and resource overhead. Building a system with thousands of logical qubits currently requires a far greater number of physical qubits—potentially millions.

Furthermore, Edwards references various studies and forward-looking timelines, suggesting that many quantum computing firms, some of them publicly listed and giving forward guidance, believe they may reach around 3,000 logical qubits in as little as five years.

He describes current skepticism about quantum’s pace as akin to early dismissals of Bitcoin’s value. Edwards stressed that while the exact timeline remains uncertain—whether it’s 3, 5, 10, or 15 years out—delaying action is ill-advised.

“Best case scenario, once we have agreed on a QC proof cryptography upgrade for Bitcoin, it will likely take 1 year just to move everyone (most) across to it. Further reducing the lead-time we have to act,” Edwards writes.

Adding to the debate, Matteo Pellegrini, CEO and founder of The New Orange Pill App, highlighted that while the number 2,500 logical qubits may appear small, achieving it is no trivial feat.

He remarked: “The referenced study indeed discusses the number of logical qubits potentially needed to break SHA-256. While it’s true that only ~2500 logical qubits might suffice for breaking Bitcoin’s encryption (e.g., private key derivation), achieving this in practice involves a massive leap in error correction, coherence time, and gate fidelity. Physical qubits required could number in the millions due to current inefficiencies.”

This discrepancy between physical and logical qubit counts underscores why some experts remain calm: scaling from a few hundred physical qubits (like Willow’s 105) to millions is a colossal engineering undertaking. However, Edwards warns: “Most firms are on track to achieve this in less than 5 years.”

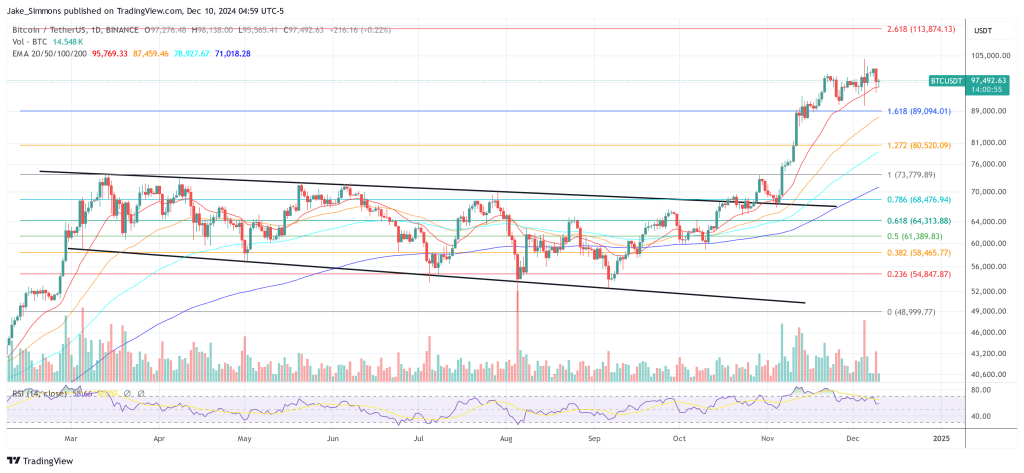

At press time, BTC traded at $97,492.