Controversial Take: Is It Time to Sell ETH After 130% Surge in 2 Months?

TL;DR

- It happened with BTC and with XRP – is it time for investors to look into the possibility of securing some profits after ETH also charted a new all-time high?

- In this article, we will also show you which entities are selling ETH and who is buying. Hint: the US President is involved.

Has the Time Come?

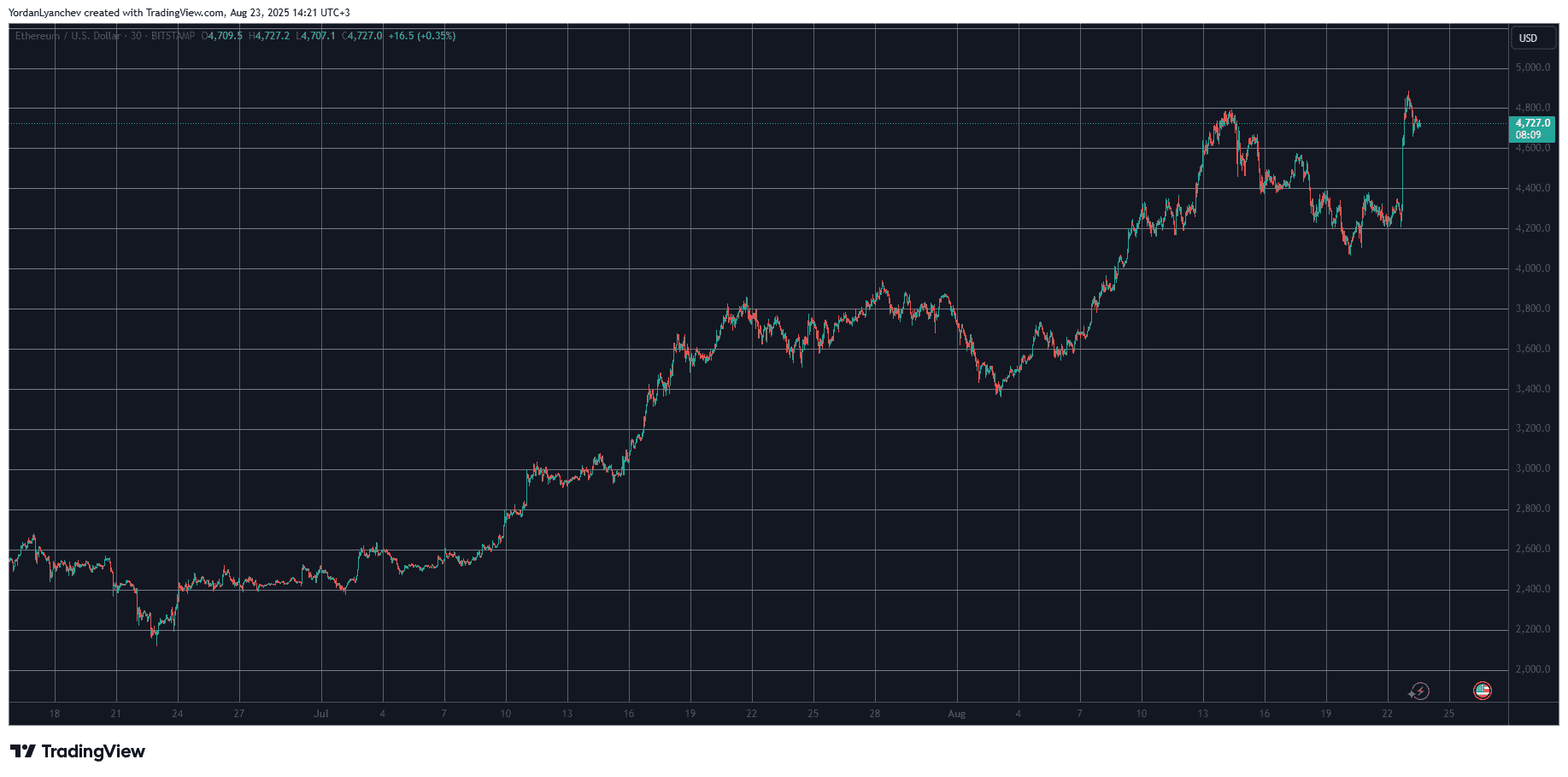

The chart above paints a picture worth a million dollars. It shows how ETH, which was once among the poorest performers in 2025, turned the tables and skyrocketed from under $2,200 marked on June 23 to an all-time high of $4,900 two months later, on August 22. From a percentage perspective, this mindblowing rally represents a 130% surge in roughly 60 days.

A lot changed for Ethereum along the way. Investors went wild for its underlying asset, which is evident from the massive inflows in the ETH ETFs as well as the growing number of tokens purchased by many Ethereum treasury companies.

But, still, the essential question for ETH investors has popped up – has the time come to sell (at least some portions)?

#ETH is up over 100% after one month

Now is a good time – Realise BIG profits!

Gave you ETH to buy low, and now sell high

Many will regret in the next weeks.. https://t.co/f87L1Ov4bi pic.twitter.com/QiXSS9dT1c

— Doctor Profit (@DrProfitCrypto) August 23, 2025

Doctor Profit seems to think so. The self-described “elite trader, master of x100” believes ETH investors should realize “BIG” profits. This wouldn’t be a surprise in the crypto market. Recall that profit-taking went through the roof for both XRP and BTC in July and August as the assets charted new all-time highs of their own.

Matrixport has apparently adopted Doctor Profit’s approach, as several of the company’s wallets have made substantial deposits into Binance and OKX, with the most likely intention of selling $450 million worth of ETH.

Multiple wallets linked to #Matrixport deposited 95,873 $ETH($452M) into #Binance and #OKX over the past 3 hours.https://t.co/NKiO55cVOyhttps://t.co/U8AXgsVjSW pic.twitter.com/DFEJatM4LA

— Lookonchain (@lookonchain) August 23, 2025

But They Are Buying

In contrast to the above is the approach undertaken by this Bitcoin OG, who sold large BTC portions only to buy ETH spot and open long Ethereum positions. The mysterious wallet has only doubled down on their ETH position since yesterday.

This Bitcoin OG deposited another 300 $BTC($34.86M) into Hyperliquid to sell for $ETH an hour ago.

He’s up $100M+ in unrealized profits:

Holding a 135,265 $ETH($581M) long at $4,295 avg entry, up $58M.

Bought 122,226 $ETH($535M) spot at $4,377 avg, up $42M.… pic.twitter.com/oSQcHLNfap

— Lookonchain (@lookonchain) August 23, 2025

Let’s also not forget that the Trump family’s World Liberty has continued to accumulate ETH, even as the asset’s price skyrocketed yesterday. According to Lookonchain, the team spent $5 million USDC to acquire an additional 1,076 ETH.

Obviously, the question of whether it’s time to sell is a very personal one and it depends on the investor’s current financial situation and risk appetite. But, if you want to read more about when it’s actually a good time to sell any asset, including ETH, you can check this guide.

The post Controversial Take: Is It Time to Sell ETH After 130% Surge in 2 Months? appeared first on CryptoPotato.