Fed Rate Cut in September? What US Manufacturing PMI Data Really Signals

US manufacturing is saved! Or at least that’s what crypto investors are waiting to find out as markets brace for a pivotal Tuesday and fresh manufacturing PMI data, as new US economic data could shape the next leg of financial and crypto market sentiment. The spotlight will be on the Manufacturing PMI (forecast: 53.3, previous: 49.8) at 9:45 AM ET, followed by the ISM Manufacturing PMI (forecast: 48.9, previous: 48.0) at 10:00 AM ET.

Manufacturing is the only part of the economy that matters: wealth creation comes from value-added manufacturing. Services only exist to support manufacturing.

Wait, maybe that wasn’t the right Twitter post? Eh, no, it works.

Analysts expect the ISM number to remain in contraction but edge closer to the 50 threshold. “98–100k is the level to watch. We lose that and officially confirms the bull run being over,” one trader wrote on X, tying equity and crypto market direction to industrial strength. So what should you expect for crypto news today?

Key US Manufacturing PMI and ISM Data to Watch on September 2. Does the Manufacturing PMI Point to a September Fed Rate Cut?

Equity markets are often glued to PMI releases. Historically, better-than-expected prints have fed risk-on trades in stocks and digital assets; disappointments have had the opposite effect. The next reading matters, and if we’re above 49.5, the recovery story holds; below, the correction drags on.

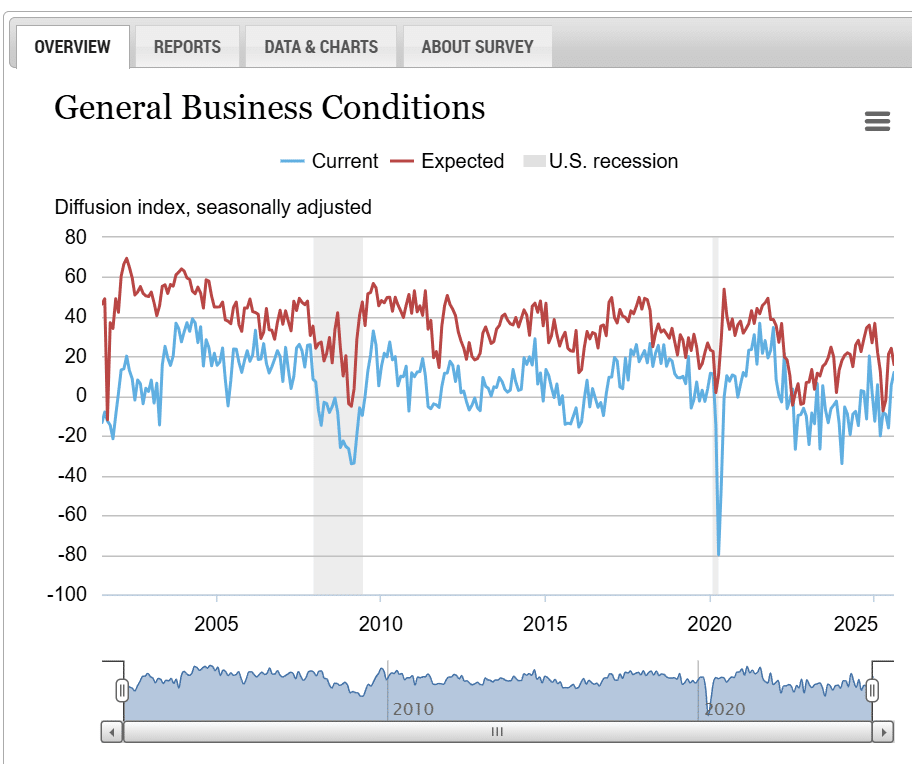

July’s economic signals gave no clear verdict on whether the US economy was recovering. Capital goods orders rose 1.1% and shipments 0.7%, showing equipment demand has not disappeared. Yet regional surveys were fractured, with the Empire index flashing growth while Dallas stayed weak. It’s a reminder that U.S. industry is still far from uniform.

DISCOVER: Top 20 Crypto to Buy in 2025

From Manufacturing to Tech: How the US Economy Shifted

The policies that built America’s industrial dominance, rising wages, labor protections, and safety regulations, also raised production costs.

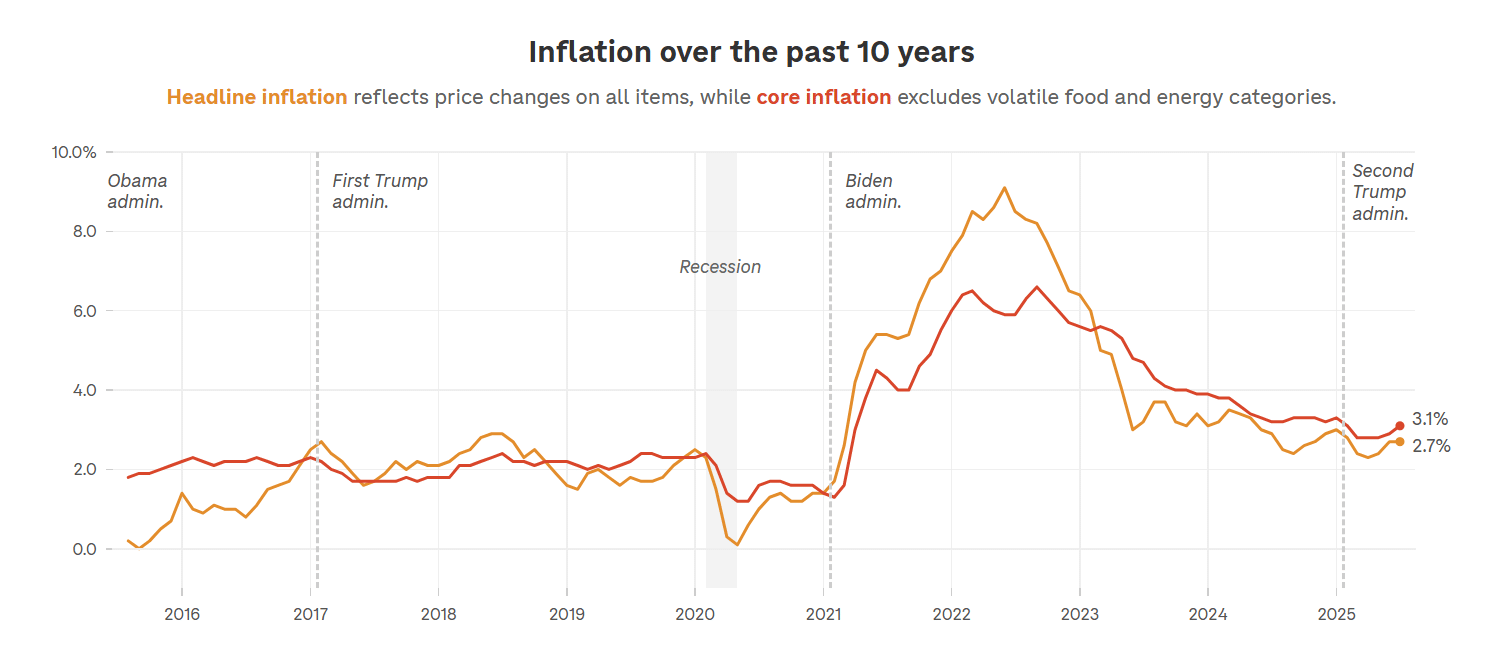

By the 1980s, US factories were undercut by cheaper overseas competition. Fast-forward to 2025, and President Donald Trump’s solution of tariffs and subsidies has had the opposite of the intended effect, so far at least, stoking inflation and driving consumer prices higher.

The structural shift that followed is an ancient prophecy at this point. Manufacturing gave way to technology and services, sectors built to scale with far fewer costs. Apple outsourced production abroad, while design and research stayed at home, signaling where American value creation had moved.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in July 2025

Will the US Manufacturing PMI Point to a September Fed Rate Cut?

Despite its long-term decline, manufacturing continues to shape market mood because it mirrors the state of the wider economy. A move by PMIs toward neutral would fit the soft‑landing narrative.

Polymarket investors expect two 25-basis-point rate cuts in 2025, likely in September and December, according to CME FedWatch and recent surveys. However, projections may shift as analysts from Goldman Sachs and others forecast up to three cuts, contingent on future inflation and labor data.

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- US manufacturing is saved! Or at least that’s what crypto investors hope as markets brace for a pivotal day and fresh manufacturing PMI data

- According to Polymarket, markets expect two 25-basis-point rate cuts in 2025, likely in September and December

The post Fed Rate Cut in September? What US Manufacturing PMI Data Really Signals appeared first on 99Bitcoins.