Federal Reserve To Own Bitcoin? Senator Lummis Proposes Legislative Update

In an interview with Yahoo Finance, US Senator Cynthia Lummis of Wyoming outlined a proposal to grant the Federal Reserve the authority to hold Bitcoin as part of the United States’ official reserves. She argues that this approach could improve the country’s long-term financial stability, strengthen the global role of the US dollar, and provide a valuable hedge against the nation’s ballooning national debt, which now surpasses 36 trillion dollars.

Authority To Own Bitcoin

“My proposal would have the US purchase, through other assets it already owns, 200,000 BTC a year for five years, for a total of a million,” Lummis reiterated her plans. “We would hold it for at least 20 years, and at the numbers that we project that would accrue a fund that’s worth about 16 trillion dollars. We want our federal government to have a Strategic Bitcoin Reserve (SBR) that can help back the US dollar, the world reserve currency, and then serve as a long-term savings account, thereby offsetting our national debt.”

The senator’s remarks directly confront the current stance of Federal Reserve Chair Jerome Powell. At the latest Federal Open Market Committee press conference, Powell reiterated that the Federal Reserve Act restricts the institution from owning it. “We’re not allowed to own Bitcoin. The Federal Reserve Act says what we can’t own [it], and we’re not looking for a law change. That’s the kind of thing for Congress to consider, but we are not looking for a law change at the Fed,” Powell remarked on Wednesday.

Lummis acknowledged this legal roadblock but remained determined to shift the conversation in Congress. She believes lawmakers need to give the central bank the authority to hold Bitcoin. “I understand the Federal Reserve believes it doesn’t have the legal authority to own Bitcoin,” Lummis said. “We need to give that to them. The Bitcoin the US already owns, roughly 200,000 Bitcoin, are within the asset forfeiture fund, and it’s important I think that we take that fund, scoop it over into a strategic Bitcoin reserve, and then add to it.”

Her proposal aligns with principles set forth in the Bitcoin Act of 2024, introduced earlier this year. It seeks to establish a SBR in the US to enhance the national financial strategy. The Act involves setting up secure BTC storage facilities, purchasing 1 million BTC over five years, and funding these purchases through existing financial reserves without increasing taxpayer burden.

“It absolutely is the right asset,” she said, describing BTC’s properties. “It is digital gold. It is a finite source—only 21 million BTC will ever be mined. Even though it’s slightly volatile, it’s always volatile in an upward leaning direction, and so the goal here of holding it for 20 years is in recognition that on the short term, there is short-term volatility. In the long term, there is long-term growth that far exceeds the ability of the US dollar to keep up.”

Lummis cited historical growth trends to bolster her argument. Although Bitcoin has existed for only 15 years, she views its long-term trajectory as overwhelmingly positive. While she acknowledges that growth may slow from the early years—declining from 55% annual growth to figures like 45% or 35%—it would still, in her estimation, “continue to grow, where the US dollar will continue to decline in value.” She sees in these figures a bulwark against the inexorable erosion of purchasing power that comes with a currency deliberately managed to produce steady inflation.

Senator Lummis says she wants to give the Federal Reserve the authority to own Bitcoin.

“I want our federal government to have a Strategic Bitcoin Reserve – buying 200,000 $BTC a year for 5 years, and holding it for 20 years.” pic.twitter.com/g0nVZWKtK7

— Bitcoin Archive (@BTC_Archive) December 19, 2024

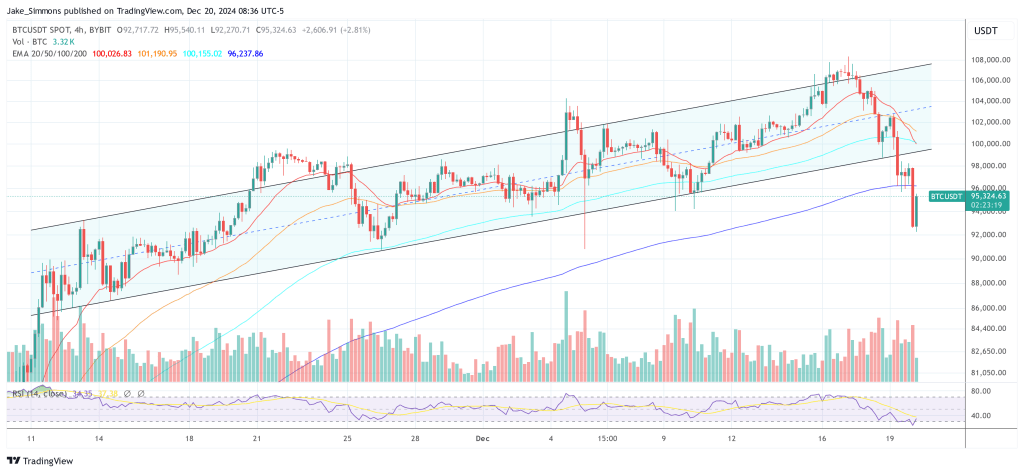

At press time, BTC traded at $95,324.