Dust Settles Over HYPE Price After Hyperliquid Stablecoin Decision

The dust is settling over Hyperliquid’s stablecoin partner decision, and now 99Bitcoins analysts are dissecting what’s next for HYPE price.

HYPE price consolidation was rocked this week as the fast-growing derivatives exchange Hyperliquid concluded its highly anticipated stablecoin tender, with users voting to select Native Markets as issuer of the new USDH token.

The decision, finalized on September 15 after a week-long bidding process, marking one of the most significant developments yet in the $160Bn stablecoin sector.

A New Entrant Backed by Heavyweights: Will New Stablecoin Supercharge HYPE Price?

Native Markets has been awarded the USDH ticker on Hyperliquid.

Thank you to all HYPE stakers and network validators for their time and effort in reviewing the proposals put forward.

— max.hl (@fiege_max) September 14, 2025

Native Markets is a newly formed startup but arrives with heavyweight backing. It was co-founded by: Max Feige (himself an early Hyperliquid investor), Mary-Catherine Lader (another big hitter, the former president of Uniswap Labs and an ex-BlackRock executive), and finally Anish Agnihotri (former researcher at Paradigm).

The firm will issue USDH through Bridge, the stablecoin infrastructure acquired by Stripe earlier this year in a $1.1Bn deal, with BlackRock managing treasury reserves initially.

Over time, Fidelity and BNY Mellon are expected to join as custodians. On-chain asset management will be handled by Superstate, operating within Hyperliquid’s HyperEVM network.

Revenue-Sharing: Hyperliquid Make a Direct Strike On Circle

What sets the bid apart is Native Markets’ proposal to share 100% of stablecoin revenues with Hyperliquid traders and users.

By contrast, Circle currently captures an estimated $225M annually from USDC usage on Hyperliquid without distributing revenue back to the platform’s community.

This aggressive revenue-sharing model has raised expectations of a price war in stablecoins, one of crypto’s most lucrative markets.

Stablecoins earn yield primarily from short-term Treasuries backing their issuance, indeed,Tether, Circle, and Paxos together reap billions annually from this structure.

Since Hyperliquid users currently hold around $6Bn in USDC, representing roughly 8% of total USDC circulation. With USDH entering circulation, Circle risks a direct erosion of that share.

This decision sidelines a strong roster of competitors, including Paxos, Ethena, BitGo, Frax Finance, and Agora. Some industry voices questioned whether Native Markets’ win was predetermined.

Dragonfly Capital’s Haseeb Qureshi suggested the RFP “was a farce,” noting Native submitted its proposal almost immediately after the tender opened, while others required days to prepare. That speed raised speculation that the firm may have had advance knowledge of requirements.

EXPLORE: Best Meme Coin ICOs to Invest in September

HYPE Price Analysis: As Stablecoin Dust Settles, Will HYPE USDT Hit $60?

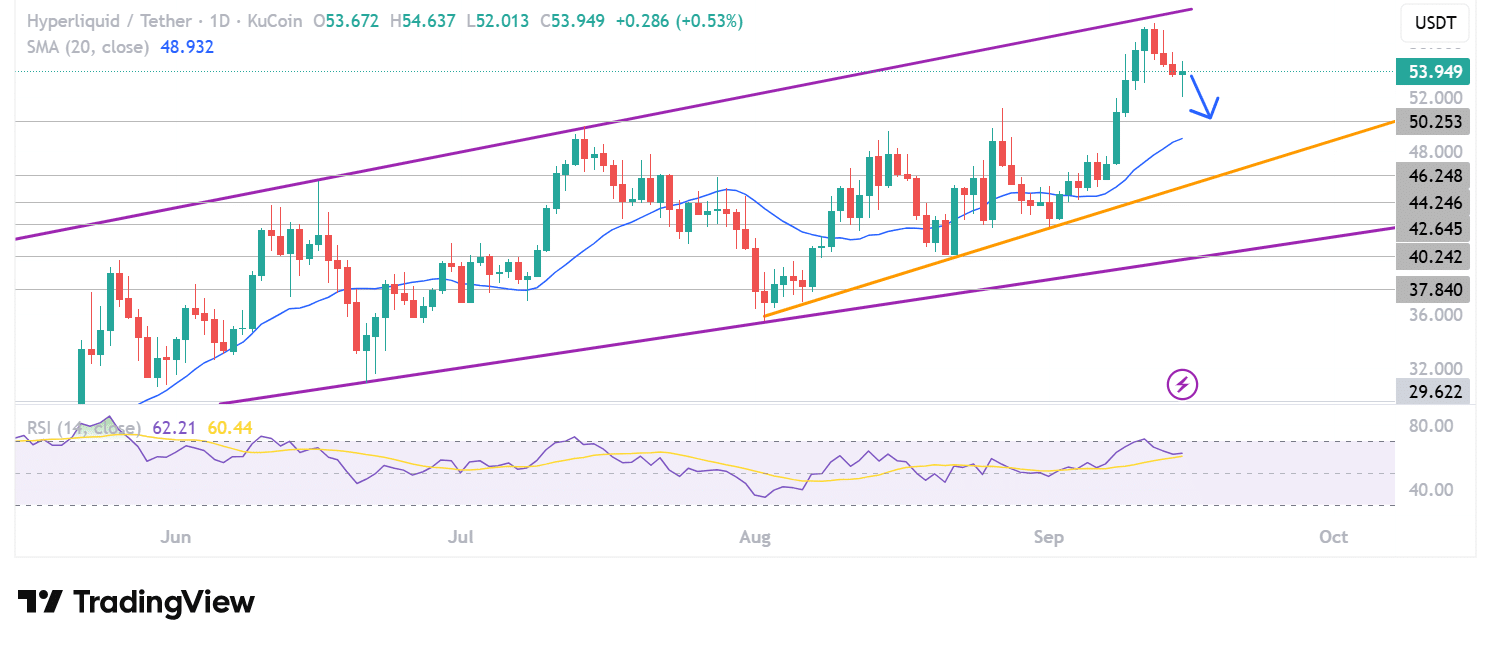

As the dust settles over the stablecoin announcement, HYPE is currently trading at a market price of $53 (representing a 24-hour change of +0.5%).

The modest upside move comes as HYPE price action stabilises in the aftermath of a short-lived sell-off following the announcement news – which saw HYPE drop -3% before recovering.

These local moves sit within a wider consolidation structure on the high-time frame, as HYPE continues to redevelop its strength following a correction from the recent all-time high at $57.

(Source – HYPEUSDT, TradingView)

Yet, this is dominated by the sustained pressure of the ascendant trading channel, which has supported HYPE’s climb since May – and now suggests downside action could dominate in the weeks ahead.

This is bolstered by the convergence of the 20DMA with lower support around the $49.5 price level, which would form a logical lower target for HYPE bulls.

Furthermore, a glance at the RSI indicator reveals that downside sentiment still prevails, with the reading still overheated at 62 also adding to the bearish thesis.

DISCOVER: Top Solana Meme Coins to Buy in 2025

The post Dust Settles Over HYPE Price After Hyperliquid Stablecoin Decision appeared first on 99Bitcoins.