Ex-Kraken CLO Says Solana Delivers on Promises Ethereum ‘Made Almost a Decade Ago’

New comments from Solmate’s Marco Santori and two widely followed analysts put the focus on SOL’s $238 pivot and what would confirm higher prices.

Marco Santori’s comments

In an X thread, Santori, a former Kraken CLO, introduced Solmate, calling it “brand new Solana infrastructure” for the UAE and saying he will be CEO. He said it is aligned with the Solana Foundation, backed by UAE investors with support from Ark Invest, and plans bare-metal validators in Abu Dhabi in partnership with RockawayX. He framed digital asset treasuries as “capital accumulation machines” and closed, “I’m all in on it.”

Comments from analysts on SOL’s price action

Analyst Rekt Capital said SOL has broken a long-term downtrend and is now retesting about $238 —f ormerly major monthly resistance —a s support on the weekly chart. He sees a successful retest as confirmation that the old ceiling has flipped to a floor, which would keep the path open for attempts at new all-time highs.

Trader KALEO said “$1,000+ sol isn’t a meme,” presenting four-figure prices as plausible; he did not specify timing in the post.

CoinDesk Research’s technical analysis

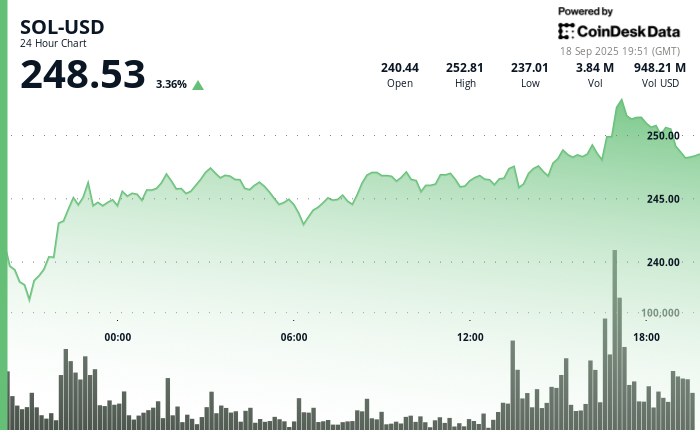

Time window. The analysis covers Sept. 17, 2025, 19:00 UTC to Sept. 18, 2025, 18:00 UTC.

What happened. During that window, SOL moved from $233.78 to $250.59 (about +7.2%), swinging about $19.72 in total. That tells us buyers were generally in control during this period.

Where buyers showed up. Around 22:00 UTC on Sept. 17, 2025, price pushed above ~$245 on much heavier trading (~2.32M units). “Heavier trading” means more coins changed hands than usual.

When price climbs on bigger-than-normal activity, it’s a sign demand is strong enough to overcome sellers. After that push, ~$245 started acting like a floor (support) — traders were willing to buy dips there.

Where sellers pushed back. At 17:00 UTC on Sept. 18, 2025, price stalled near ~$253.44 on very high trading (~2.88M units). That shows ~$253 is a ceiling (resistance) — many traders chose to sell or take profit there, absorbing buy orders.

How the window ended. Between 17:56 UTC and 18:55 UTC on Sept. 18, 2025, price eased from $251.55 to $250.40. That small, orderly fade after a strong run is typical cool-off or consolidation — the market catching its breath rather than reversing trend.

Levels to watch:

- Floors (support): ~$245 first, ~$238 if ~$245 breaks. Support = areas where buyers have recently stepped in.

- Ceilings (resistance): ~$252–$253 first, then ~$255–$260 if price gets through ~$253. Resistance = areas where sellers have recently pushed back.

Bottom line. Buyers defended ~$245; sellers capped ~$253. A daily/4-hour close above ~$253 (UTC) would likely invite a push toward ~$255–$260. A drop below ~$245 would likely bring a check of $242–$243, then ~$238.

Analysis of Latest SOL-USD CoinDesk Data Charts

24-hour chart (ending Sept. 18, 19:51 UTC): Range $237.01–$252.81; coiling above ~$245 with a ceiling ~$252–$253. Hold ~$245 and a push through ~$253 would likely target ~$255–$260; lose ~$245 and the path is $242–$243, then ~$238.

One-month chart (ending Sept. 18, 19:52 UTC): Uptrend of higher highs/lows (roughly $179.71 → $250.50). $238 is the pivot: above it keeps the breakout case clean; below it suggests a pause toward the low $230s before another try higher.