Solana Foundation President: Expect Tether and Circle Profits to Tank

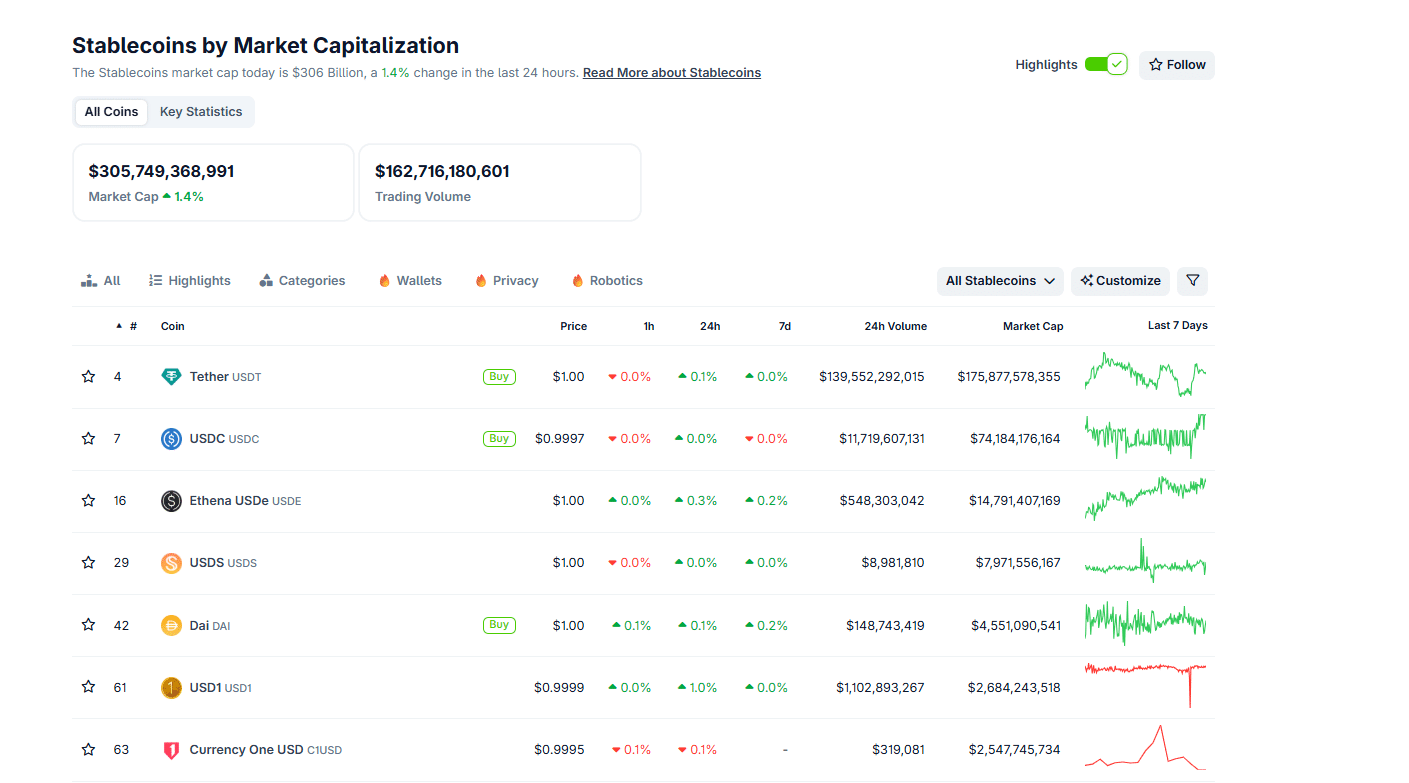

Forget meme coins. In 2025, crypto is being defined by stablecoins. USDT by Tether remains the undisputed leader, commanding over $175 billion as of early October 2025. USDC by Circle is in second place, while algorithmic alternatives like Ethena’s USDe and Sky’s USDS are making massive strides.

The explosion of stablecoins has pumped the broader crypto market, benefiting some of the best cryptos to buy. With Tether minting billions, capital has flowed to Ethereum and Bitcoin, pushing them to fresh all-time highs in 2025. While USDT, USDC, and other stablecoins blossom, their issuers swim in billions in profits. Every $1Bn increase in USDT or USDC circulation generates revenue for the issuer through interest on its treasury bill exposure, which largely underpins these tokens.

(Source: Coingecko)

To put it in numbers, in the first half of 2025, Tether reported a net profit of $5.7Bn, driven primarily by interest income on its reserves, mostly U.S. Treasuries and equivalents. Circle, meanwhile, posted net income of about $315.8M over the same period, with its reserves generating $1.23Bn.

DISCOVER: 10+ Next Crypto to 100X In 2025

Solana Foundation President Sounds the Alarm: Expect Tether, Circle Profits To Fall

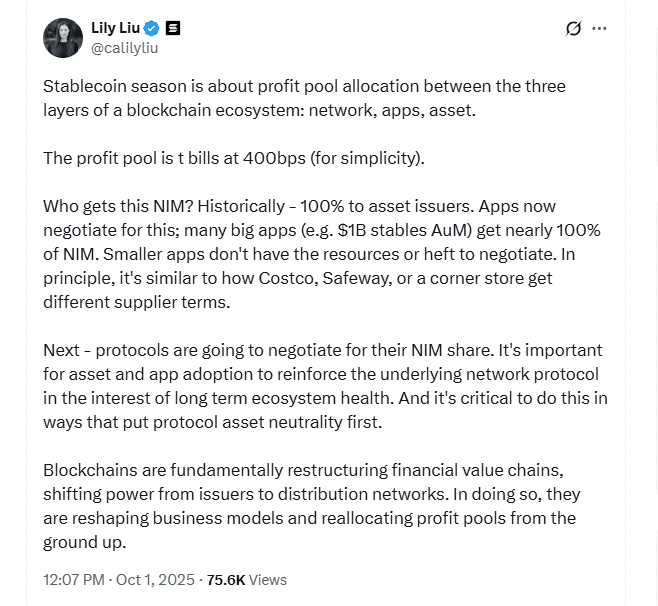

Despite these eye-popping figures and the dominance of Tether and Circle in the stablecoin space, Solana Foundation President Lily Liu is raising a red flag.

In a recent post on X, she warned that Tether and Circle are on the cusp of a seismic shift. Much of their revenue is set to be redistributed, not just to their platforms but also to the underlying networks and popular dApps managing billions in value.

(Source: calilyliu, X)

She pointed out that, unlike now, when most stablecoin issuers pocket every penny, the landscape is fast changing. The anticipated reconfiguration of the $305Bn stablecoin market will finally start sharing those profits with users.

Liu explained that the “profit pool” created by the assets backing stablecoins is at the heart of this transformation. Right now, after the recent interest rate cut to the 4–4.25% range, issuers typically earn about a 4% yield on Treasuries. This yield, essentially the net interest margin (NIM), is what allowed Tether to rake in billions in net profit. In 2024 alone, Tether captured 100% of the NIM, netting $13.7Bn.

But as stablecoins achieve mainstream adoption and more players enter the fray to issue their own, this power dynamic is flipping. Major players on popular blockchains, where these stablecoins are minted and traded, are now vying for a slice of the pie. To secure instant adoption, issuers may have to surrender big portions of their margins in return.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Time for Protocol dApps and Tech Firms to Lead the Change?

A prime example is USDC. While Circle is the public face of the stablecoin, the issuer shares revenue with Coinbase, the exchange boasting over 100 million users worldwide.

As a result, even as Circle generates billions from its Treasury reserves, Coinbase claims half of it, capitalizing on the volume and network effects that Circle depends on for growth.

Circle earned ~$1.7b revenue in 2024 and paid out $900M+ to @coinbase as a distribution partner

That ~$1B going to Coinbase likely comes with little to no cost/opex to serve. At 10x earnings = $10 B mkt cap and likely contributes ~25% of $COIN valuation

For perspective -… pic.twitter.com/2Et3yaSgas

— James Ho (@jamesjho_) April 1, 2025

This partnership illustrates how massive platforms, managing billions in assets, leverage their influence to negotiate aggressively for their share.

PayPal’s PYUSD stablecoin, issued by Paxos and currently managing over $1.1 billion, follows a similar playbook. By leveraging PayPal and Venmo’s vast user base, Paxos achieved rapid adoption while enabling the payment giant to generate income from the token. The more PYUSD is issued, the more revenue flows to PayPal, enhancing its profitability.

1/

Breaking News: @PayPal USD (PYUSD) is live on Solana!

PayPal USD stablecoin issued by @Paxos will leverage Solana and token extensions to serve over 30m+ merchants, empowering users with fast and secure stablecoin transactions. pic.twitter.com/h66iejTv50

— Solana (@solana) May 29, 2024

The trend is accelerating on popular protocols, too. Hyperliquid recently launched its native stablecoin, USDH, issued by Native Markets. Under the terms, a substantial portion of revenue must be redistributed to protocol users and used to buy back and burn HYPE tokens from the market.

Native Markets securing the USDH ticker sets up two big shifts:

+ A brand-new token airdrop farm

+ A vampire attack on USDC/USDTHere’s why: NM’s proposal splits yield 50/50.

Half goes to HYPE buybacks

Half fuels ecosystem growth

That “growth” side is essentially a fresh… pic.twitter.com/9BOdZi07FI

— Cypher (@NxtCypher) September 19, 2025

Specifically, +50% of USDH revenue will fund the Hyperliquid Assistance Fund for HYPE buybacks and burns, with the rest reinvested into the USDH ecosystem.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Solana Foundation President: Expect Tether and Circle Profits to Tank

- Tether and Circle are dominating the stablecoin scene

- USDT, USDC adoption have helped rake in billions in profits to issuers

- Solana Foundation president expects profits to be redistributed rapidly

- Native Markets on Hyperliquid is leading the way

The post Solana Foundation President: Expect Tether and Circle Profits to Tank appeared first on 99Bitcoins.