Bitcoin Slumps To ~$112K Despite Record ETF Inflows – Is Institutional Liquidity Fading?

The recent drop in the price of Bitcoin (CRYPTO: BTC) toward the $112,000 level, despite a period of record-breaking inflows into U.S. spot ETFs, presents a challenging paradox for investors. While many view ETF adoption as a guaranteed upward price catalyst, the market behavior suggests institutional liquidity is being offset by powerful counterforces, questioning the immediate impact of institutional demand.

This slump should not be immediately interpreted as institutional liquidity “fading.” Rather, it’s a reflection of the crypto markets enduring vulnerability to macroeconomic headwinds and internal profit-taking dynamics.

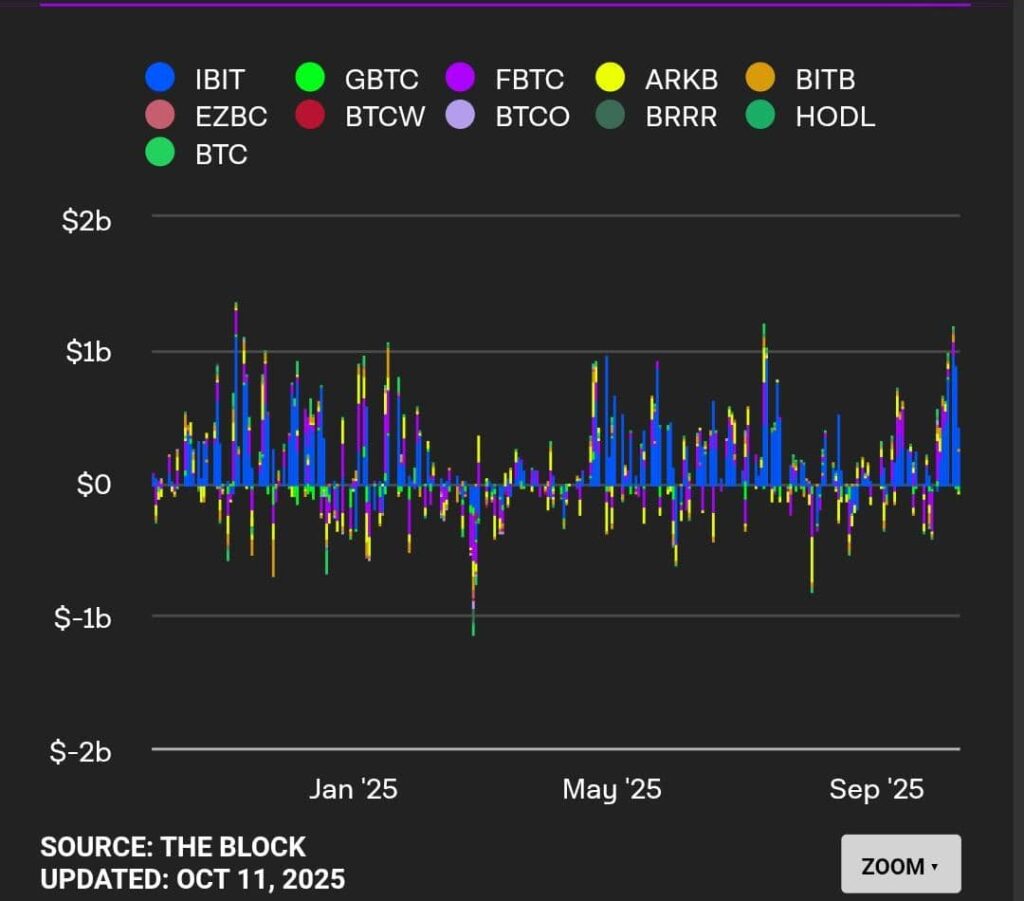

ETF Demand Remains Robust, But Pace Is Cooling

Recent data from CoinShares shows that global crypto ETFs attracted $5.95 billion in inflows during the first week of October 9, U.S. Bitcoin ETFs posted only about $197 million in net inflows – the weakest since last run began.

That moderation suggests that while institutions are still accumulating, they are turning more selective amid broader risk-off sentiment across equities and digital assets.