Stock Market Today: Dow Jones, S&P 500 Rally After Trump Hints At De-Escalation With China— Tesla, Meta And Other Mag 7 Stocks In Focus (UPDATED)

Editor’s Note: The future prices of benchmark tracking ETFs were updated in the story.

U.S. stock futures rose on Monday following Friday’s sell-off. Futures of major benchmark indices were higher.

Magnificent 7 stocks surged in premarket following President Donald Trump‘s de-escalation on Sunday, saying, “Don’t worry about China, it will all be fine,” adding that the “Highly respected President Xi just had a bad moment.”

Asian markets tumbled in trade on Monday, with major Chinese technology and auto stocks falling sharply in trade in Hong Kong.

The 10-year Treasury bond yielded 4.03% and the two-year bond was at 3.50%. The CME Group’s FedWatch tool‘s projections show markets pricing a 96.2% likelihood of the Federal Reserve cutting the current interest rates in its October meeting.

| Futures | Change (+/-) |

| Dow Jones | 0.96% |

| S&P 500 | 1.33% |

| Nasdaq 100 | 1.84% |

| Russell 2000 | 1.61% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose in premarket on Monday. The SPY was up 1.14% at $660.47, while the QQQ advanced 1.71% to $599.59, according to Benzinga Pro data.

Stocks In Focus

Magnificent 7 Stocks

- Nvidia Corp. (NASDAQ:NVDA) advanced 3.57%, Tesla Inc. (NASDAQ:TSLA) was up 2.70%, Microsoft Corp. (NASDAQ:MSFT) gained 1.51%, Apple Inc. (NASDAQ:AAPL) was higher by 1.75%, whereas Amazon.com Inc. (NASDAQ:AMZN) rose by 2.09% and Alphabet Inc. (NASDAQ:GOOG) and Meta Platforms Inc. (NASDAQ:META) gained 1.52% and 1.56%, respectively.

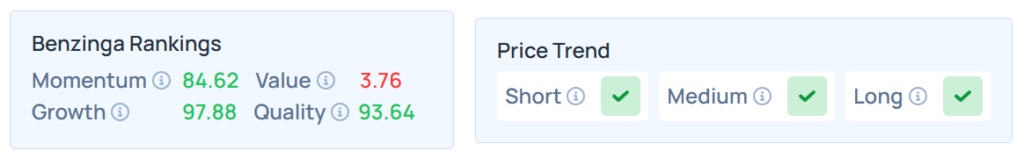

- NVDA maintained a stronger price trend over the short, medium, and long terms, with a poor value ranking, as per Benzinga’s Edge Stock Rankings. Additional performance details are available here.

Fastenal

- Fastenal Co. (NASDAQ:FAST) jumped 2.57% ahead of its earnings before the opening bell. Analysts estimate earnings of 30 cents per share on revenue of $2.13 billion.

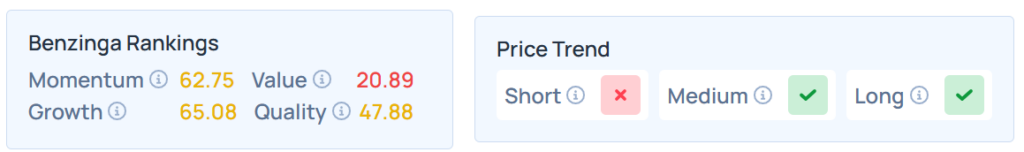

- Benzinga’s Edge Stock Rankings indicate that FAST had a weaker price trend in the short term but a strong trend in the medium and long terms, with a moderate quality ranking. Additional performance details are available here.