Is Bitcoin Still ‘Digital Gold’? The October Crash Tells A Different Story

Last Friday delivered a hard lesson for cryptocurrency investors.

The crypto market wiped out $19.3 billion in a single day, marking the largest liquidation event in crypto history. And for anyone who’s been treating Bitcoin as a safe haven or modern alternative to gold, this crash should be a serious wake-up call.

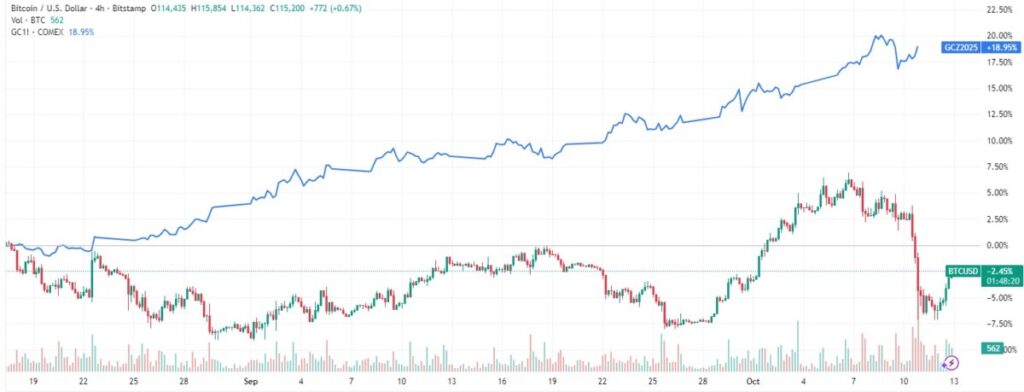

When President Trump announced sweeping tariffs on Chinese imports, we saw something fascinating play out in real-time. Bitcoin crashed 15% from its recent high near $126,000. Meanwhile, gold (which had just broken through $4,000 per ounce) held steady and actually attracted safe-haven flows.

That split-screen moment tells you everything you need to know about how these assets really behave when markets get choppy.

The “Digital Gold” Story Doesn’t Hold Up Anymore

For years, Bitcoin supporters positioned it as “digital gold”, as a modern safe haven that could protect your wealth during times of uncertainty.

But the reality has become impossible to ignore.

Bitcoin’s correlation with the NASDAQ 100 reached 0.87 in 2024. That means Bitcoin now moves almost in lockstep with tech stocks. When the market rallies, Bitcoin rallies. When tech names pull back, Bitcoin gets hit even harder.

This wasn’t always the case. Before 2021, Bitcoin actually showed very little correlation with traditional markets, which supported its reputation as an alternative asset. But as institutions piled in through ETFs and corporate treasury purchases, Bitcoin’s behavior fundamentally changed.

Today, institutional investors hold over 40% of the global Bitcoin supply. And that concentration has tied Bitcoin’s fate directly to broader market sentiment.

So when the Fed adjusts interest rates or economic data disappoints, Bitcoin increasingly reacts like a high-growth tech stock rather than a defensive asset. That’s a problem if you’re counting on it to protect your portfolio during a downturn.

Chart showing BTC and Gold (blue line) performance during the last 30 days

What Gold Still Does Right

Gold’s performance during last Friday’s chaos …