SEC Crypto News: Will Key October Events Lead to Boom or Bust for Bitcoin?

SEC crypto news is leading the crypto dance this week, with several high-profile events led by the US Securities and Exchange Commission, which look set to impact both TradFi and crypto markets significantly. Regulatory clarity and macroeconomic factors are reaching a critical point for digital assets.

As always, Bitcoin is dictating the direction for the broader crypto market, and the leading digital asset has fallen 2.6% overnight, losing the key $110K level as it currently trades for around $108K.

Ethereum price has also dropped below $4,000, a significant price zone for ETH, as it has notoriously struggled to breach and hold above it on the few occasions it has traded above $4,000.

Tomorrow’s SEC ‘Payments Innovation Conference’ Hints at Bullish Announcement for Stablecoins in the US

The SEC Payments Innovation Conference is slated for tomorrow (October 22). Industry participants have been awaiting potential signals from the agency regarding its evolving stance on cryptocurrency regulation since President Trump took office in January.

This conference, which brings together leaders from the payments industry, fintech innovators, and regulatory officials, could provide crucial insights into how the SEC will approach digital asset oversight in the coming months.

Confirmed key speakers for tomorrow include Ethereum’s co-founder, Vitalik Buterin, Cathie Wood, CEO of Ark Investment Management, and Heath Tarbert, Chief Legal Officer for USDC issuer Circle.

There are rumors that a huge announcement will be made at the conference, with excitement building around the event as crypto traders eagerly await bullish news that can reverse the recent volatility across the market.

While the full agenda hasn’t been released yet, we can make a good guess about its direction: stablecoins, CBDCs, tokenized assets, and possibly how traditional payment systems could connect with private crypto networks.

BREAKING: The Federal Reserve will host its Payments Innovation Conference on Oct 21 in D.C.

Top speakers include Cathie Wood (ARK Invest), Rob Goldstein (BlackRock), Heath Tarbert (Circle) & Alesia Haas (Coinbase).

Main focus: Bitcoin, RWA, and crypto payments.

pic.twitter.com/kvLjHtbv7l

— Real World Asset Watchlist (@RWAwatchlist_) October 20, 2025

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Another 25 BPS Rate Cut from Powell Could Reignite Bitcoin as SEC Crypto News Dominates Headlines

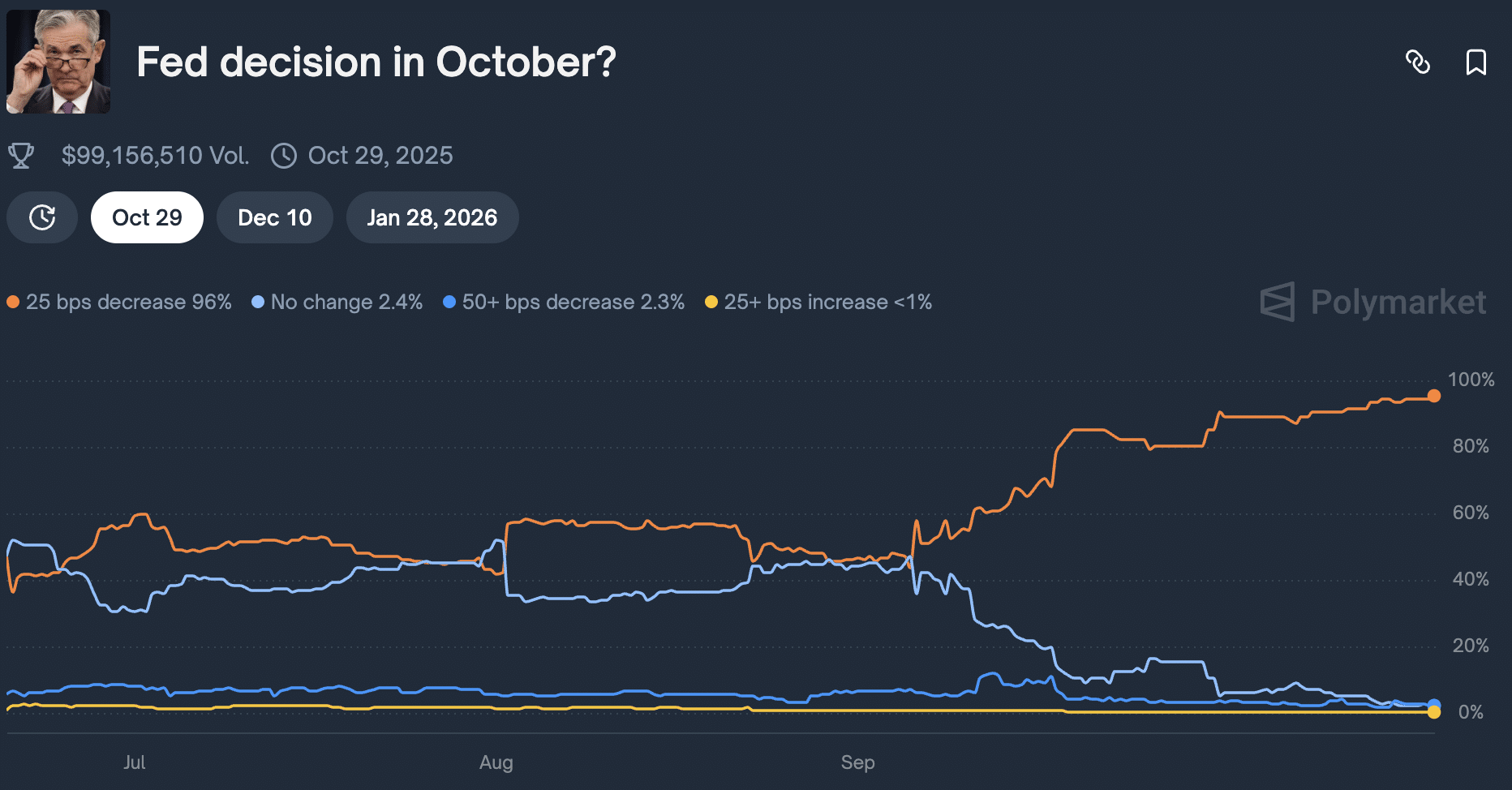

In addition to the SEC Payments conference, significant attention from crypto investors is focused on the Fed’s FOMC meetings, scheduled for October 28-29. Markets are anticipating a 25-basis-point interest rate cut, which would represent another step in the Fed’s monetary easing cycle.

Right now, prediction market platform Polymarket has a further 25bps cut at 96% chance of happening. Polymarket has been an excellent indicator for events like FOMC meetings in recent times, and with it being so close to 100%, it seems that another interest rate cut is a foregone conclusion.

Historically, cryptocurrency prices have been sensitive to interest rate decisions, with lower rates generally supporting risk-on assets by reducing the opportunity cost of holding assets like Bitcoin and Ethereum

4.50%

Ethereum

ETH

Price

$3,884.32

4.50% /24h

Volume in 24h

$31.04B

Price 7d

.

A rate cut could provide new momentum for digital asset markets, potentially reversing recent consolidation patterns and drawing renewed interest from institutional investors. In recent years, the correlation between Federal Reserve policy and cryptocurrency valuations has strengthened as digital assets have become more integrated into traditional financial portfolios.

Trump and Xi Linkup in South Korea Could Put an End to Trade Tensions

JUST IN:

President Trump has accepted an invitation from Xi Jinping and will visit China in early 2026. pic.twitter.com/KqpuVv09XK

— Conor Kenny (@conorfkenny) October 20, 2025

President Trump confirmed on Sunday (October 19) that he will be meeting with China’s President Xi Jinping at the Asia-Pacific Economic Cooperation (APEC) summit in Seoul, South Korea, slated to begin on October 31.

“We’re going to meet in a couple of weeks. We’re going to meet in South Korea, with President Xi and other people, too,” Trump told Fox News.

“Xi Jinping is a very strong leader, a very amazing man. You can look at what he’s done, where he is in his life. It is an amazing story. It’s a story for a great movie. I think we’re gonna be fine with China, but we have to have a fair deal. It’s going to be fair.”

However, Trump has since created more fear across the markets as he warned on Monday that his administration could impose 155% tariffs on China from November 1 if trade talks fail to produce a desirable outcome.

During a White House address yesterday, following discussions with Australian Prime Minister Anthony Albanese, Trump noted that China had demonstrated respect towards Washington, despite ongoing trade tensions, and was already incurring significant tariffs on its exports to the US.

With the US President seemingly unable to make up his mind regarding his nation’s stance on China, it will all come down to the meeting between Trump and Xi in South Korea at the end of the month. A positive outcome is likely to see a flight back to risk-on assets, such as crypto.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post SEC Crypto News: Will Key October Events Lead to Boom or Bust for Bitcoin? appeared first on 99Bitcoins.