Are The British About to Pump Ethereum? City Capital Could Fire Up ETH USD in November

Is it a case of a little bit too late for the United Kingdom? Well, British authorities now think this is the best time to unleash the “crypto beast,” roughly a year or so after the first spot Ethereum ETF went live in the United States, and more than 15 months after the United States SEC said yes to a spot Bitcoin ETF.

The news was supposed to immediately lift ETH USD and some of the best cryptos to buy. However, that has not been the case. Markets appear to drag on, even falling. Despite the welcomed recovery lifting the Ethereum price above $4,000, sellers are unyielding.

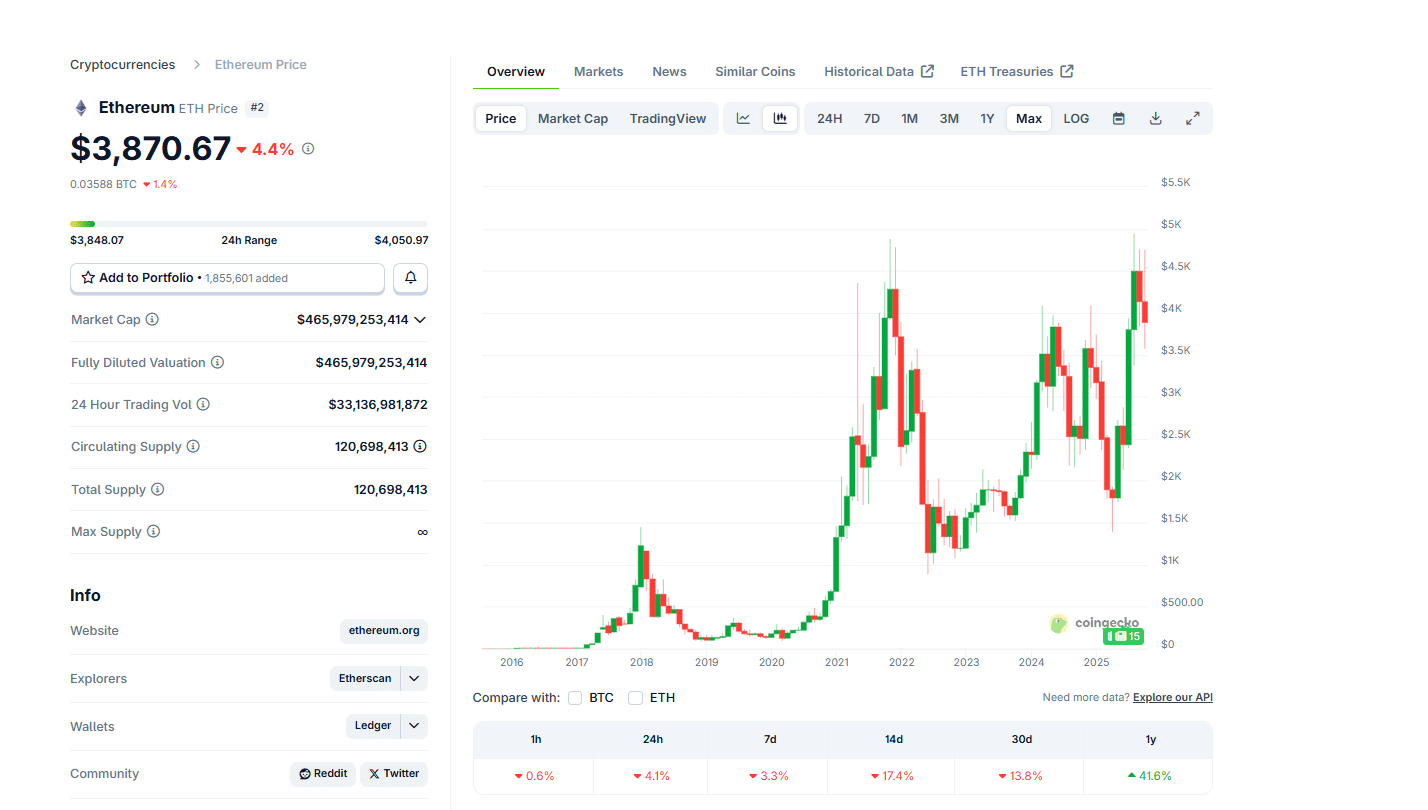

At spot rates, ETH USD has been down nearly 4% in the past week of trading. Changing hands below $3,900, the second most valuable coin is over $1,000 away from all-time highs. With every tick lower, there appears to be every reason to prepare for turbulence.

(Source: Coingecko)

DISCOVER: Best Meme Coin ICOs to Invest in 2025

ETH USD Stagnant, Will Ethereum Bulls Push Higher To Over $4,500?

If the listing of Ethereum and Bitcoin ETPs on the London Stock Exchange is supposedly massive, then ETH USD should reject all sellers’ attempts to push prices below $3,700.

On the daily chart, $3,700 is a critical support level marking October lows. A bear flag is forming now, though ETH USD prices raced higher after the dip on October 10, buyers didn’t step in, fully reversing losses.

Instead, ETH USD has been wavering lower, with $4,250 acting as local resistance that must be broken for the uptrend to continue.

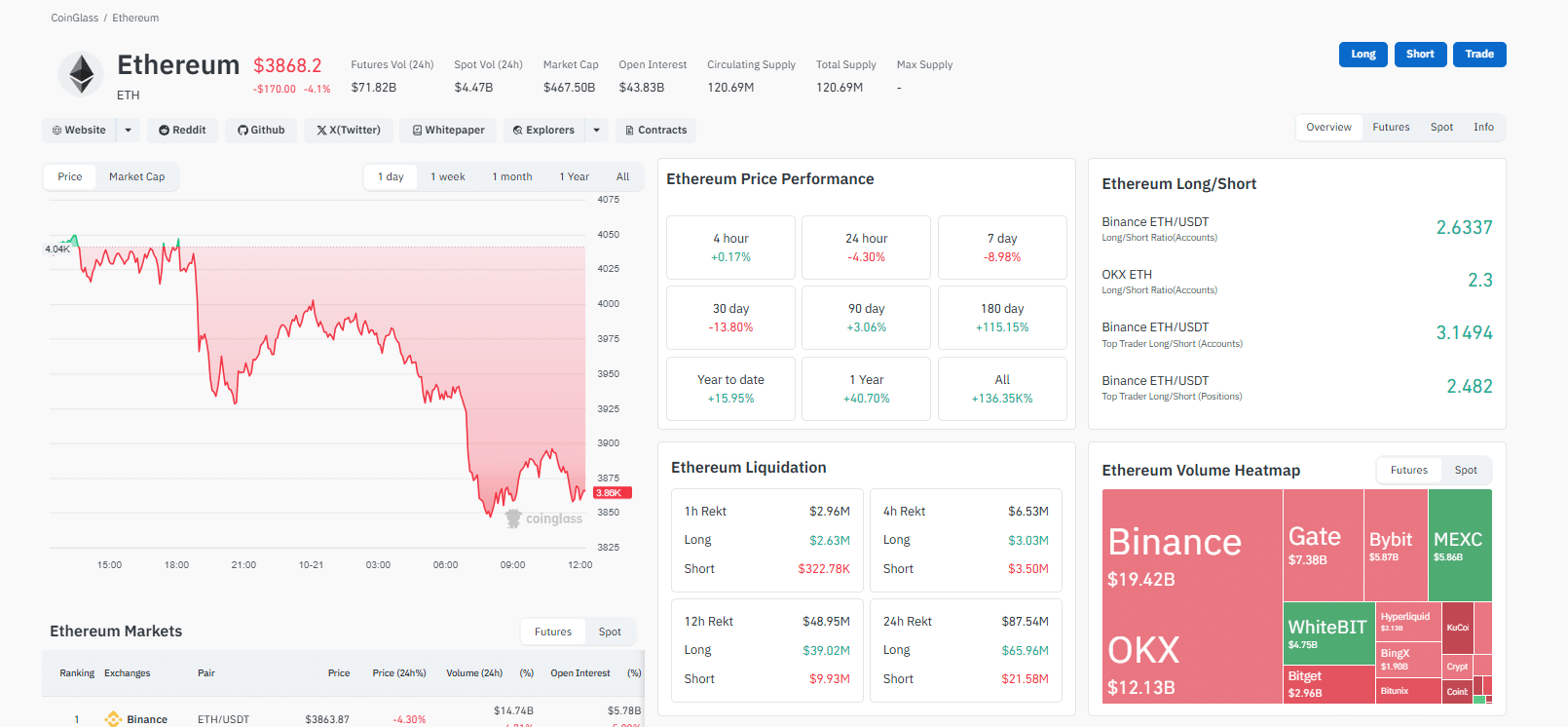

On Coinglass, traders are bullish. The long-short ratio on Binance averages over 2.5, suggesting that more leveraged longs are open; a net positive for optimistic buyers.

(Source: Coinglass)

Even so, considering the series of discouraging lower lows, trading volume on Binance and OKX is down, on average, by over -8% to $19.42Bn and $12.13Bn, respectively.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Will Ethereum ETPs on The London Stock Exchange Lift Prices?

Whether ETH USD will recover depends on BlackRock, 21Shares, Bitwise, and WisdomTree’s reception of Ethereum ETPs on the London Stock Exchange today.

After public consultation that began earlier this year, the primary regulator, the Financial Conduct Authority, lifted its four-year ban on retail access to crypto ETNs. Earlier, the regulator claimed these products were volatile and no strong consumer protections existed.

(Source: London Stock Exchange)

With these product listings, retail investors will now have the freedom to buy via familiar brokerage accounts like pension funds and ISAs. Here, crypto gains will be tax-free, a possible catalyst for more investors to position themselves in ETH USD. This may lift the Ethereum price above $4,000 and even $5,000 in the medium term.

Alexis Marinof, the CEO of WisdomTree Europe, said crypto ETPs on the London Stock Exchange signal how far the market has evolved and the increasing interest stock investors have in crypto.

“The availability of crypto ETPs on the Main Market of the LSE demonstrates how far the market has evolved, giving investors confidence that they can access digital assets through trusted, regulated channels. Access and transparency are essential to building trust in this asset class, and today’s milestone reinforces that belief.”

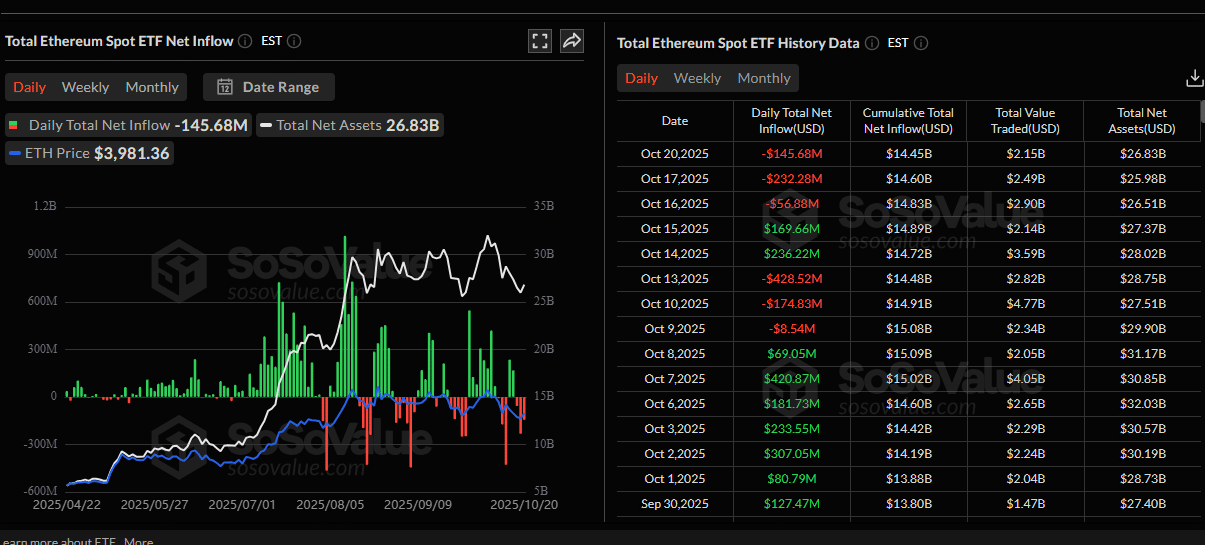

Meanwhile, in the United States, institutions appear to be exiting their ETH USD long positions. There have been outflows from spot Ethereum ETF issuers for three straight days. Over $145M of spot Ethereum ETFs were redeemed on October 20.

(Source: SosoValue)

DISCOVER: 10+ Next Crypto to 100X In 2025

ETH USD To Surge After Ethereum ETP Listing On The LSE?

- United Kingdom FCA lifts ban on retail investment in crypto ETPs

- ETH USD pinned below $4,000

- Will the Ethereum price fly above $4,250 in November?

- Institutions redeeming spot Ethereum ETFs in the United States

The post Are The British About to Pump Ethereum? City Capital Could Fire Up ETH USD in November appeared first on 99Bitcoins.