Why is Bitcoin Dropping? Billionaire Crypto Whale Places Quarter-Billion Dollar Bitcoin Bet (Is The Top In For BTC USD?)

Why is Bitcoin dropping? The mysterious $11 Bn

1.52%

Bitcoin

BTC

Price

$108,309.05

1.52% /24h

Volume in 24h

$105.33B

Price 7d

whale is back and this time, he’s doubling down on another massive short.

Blockchain data indicate that the trader opened a $235M leveraged short position on BTC earlier this week, signaling that big money may be hedging for another leg lower amid tariff fears and the ongoing US government shutdown.

DISCOVER: 20+ Next Crypto to Explode in 2025

Why is Bitcoin Dropping? Whale Reenters With $235 Million Short Bet

According to Hypurrscan, the position was entered when Bitcoin was trading near $111,190, using 10x leverage, which would effectively print billions if BTC USD price continues to crash. The short is currently in the profit as BTC trades around $108,000.

“The whale who made $200M shorting the Bitcoin crash to $100K has now moved $30M to Hyperliquid and is shorting AGAIN,” wrote Arkham Intelligence in a post on X.

BREAKING: The insider Bitcoin whale who profited from last week’s crash, currently short $235M with 10x leverage. pic.twitter.com/xX8gADLB5j

— Jacob King (@JacobKinge) October 21, 2025

Just a week ago, the same wallet reportedly booked over $200 Mn in profit after accurately timing Bitcoin’s sharp drop to $100,000. It appears that he might be right again, with BTC stuck in what feels like a perpetual cycle of decline.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Whale Movements Signal Institutional-Level Strategy Underpinning BTC Mega Short

The investor, who first emerged in September, made headlines after rotating roughly $5Bn worth of BTC into Ethereum (ETH). This move briefly made the Whale one of the largest non-corporate ETH holders, surpassing even Sharplink’s treasury exposure.

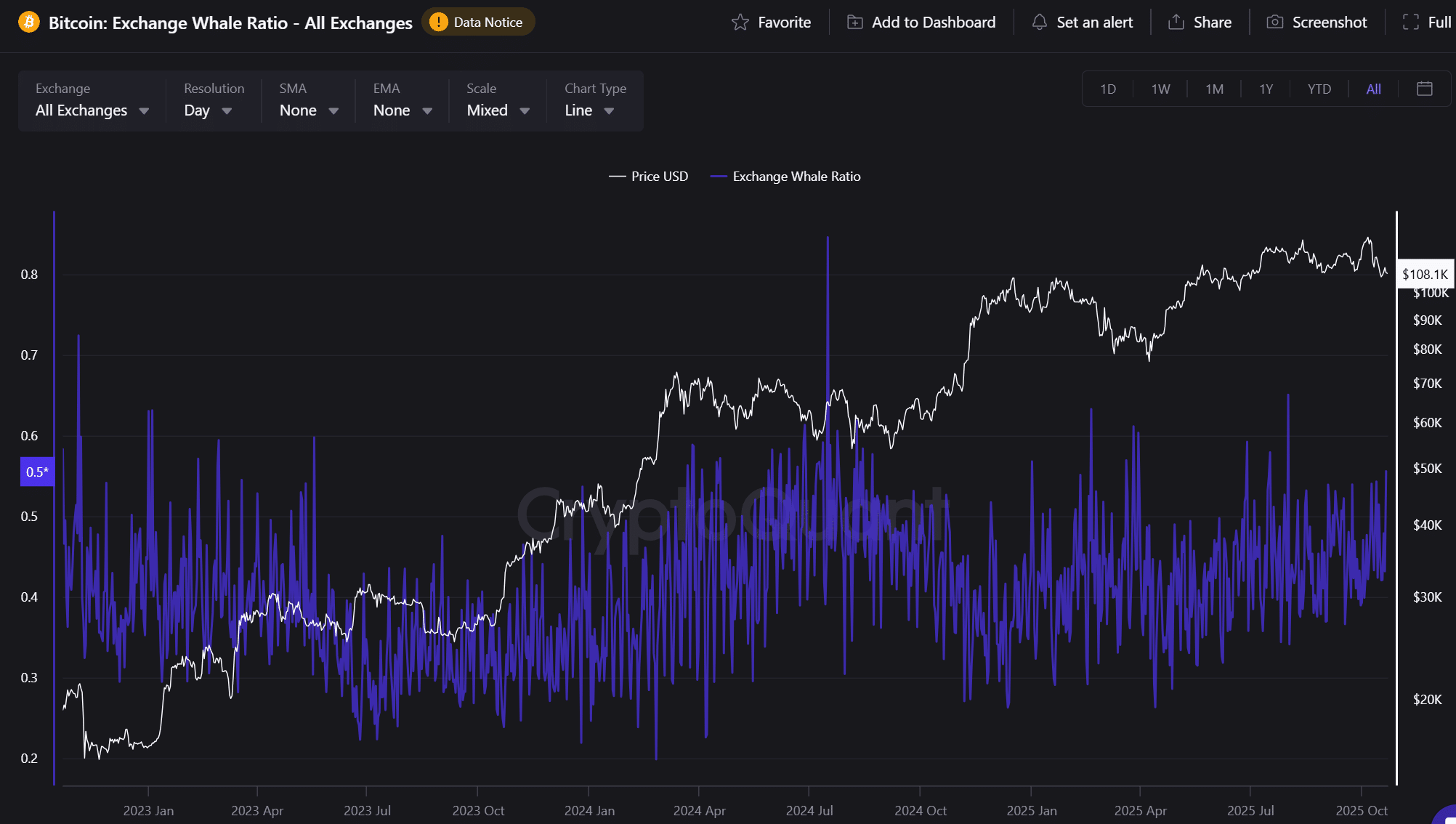

Meanwhile, newer Bitcoin whales aren’t faring as well. According to CryptoQuant, these large investors now face $6.95 Bn in unrealized losses after Bitcoin slipped below its average cost basis of $113,000.

“Bitcoin is trading below its average cost basis, leaving whales with the largest unrealized loss since October 2023,” CryptoQuant wrote on X.

Glassnode data reinforces that picture, showing that short-term holder supply, typically more speculative, has increased, indicating that traders are re-leveraging after a cleanup of overextended long positions.

Chart Check: Volatility or the Start of Something Bigger?

99Bitcoins analysts say the latest turbulence looks less like panic and more like a purge. We’re shaking off excess leverage but there’s also no gurantee we breakout of this mess. Bitcoin’s next test sits around $112,000, where liquidation clusters could spark violent intraday swings.

If the move fails, support lines up near $108,000 and $104,000, backed by the 200-day moving average, according to TradingView.

Whether this whale is early, lucky, or prescient, his trades have become a proxy for sentiment among high-cap investors.

EXPLORE: Now That the Bull Run is Dead, Will Powell Do Further Rate Cuts?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- Why is Bitcoin dropping? The mysterious $11 Bn Bitcoin whale is back and this time, he’s doubling down on another massive short.

- If the move fails, support lines up near $108,000 and $104,000, backed by the 200-day moving average, according to TradingView.

The post Why is Bitcoin Dropping? Billionaire Crypto Whale Places Quarter-Billion Dollar Bitcoin Bet (Is The Top In For BTC USD?) appeared first on 99Bitcoins.