Crypto Adoption Update: South Asia Drives Crypto Growth, US Remains Volume Leader, TRM Labs

Crypto adoption is no longer fringe. It has become a global movement as digital assets have gone mainstream, with retail traders, institutions and governments embracing them.

A new report titled, 2025 Crypto Adoption and Stablecoin Usage Report, published by the research firm TRM Labs, found that the biggest growth this cycle has come from South Asia. This region as we all know from previous Chainalysis reports is now the fastest growing hub for crypto adoption.

Meanwhile, the US is leading in terms of total transaction volume, meaning it still handles the most crypto activity overall.

According to the report, India and Pakistan saw a massive jump in their crypto adoption numbers from January to July 2025. Compared to the same time frame a year ago, the jump equates to about 80%.

(Source: TRM Labs)

India stands as the global leader in crypto adoption for the third year in a row, followed by the US, Pakistan, the Philippines and Brazil. The diverse set of countries in this list highlights that interest in crypto is spreading across both developed and developing markets.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

US Crypto Hits $1T: Regulators Finally Playing Nice?

The US crypto market saw major growth in early 2025, with trading and transaction volume jumping 50% in the first seven months to breach $ 1 trillion. In its report, TRM Labs credited this surge to clearer regulations, especially the GENIUS Act.

It also mentioned the White House 180-Day Digital Asset Report, which helped institutional investors feel more confident about dipping their toes in the crypto landscape.

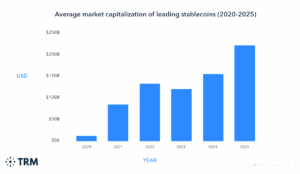

Per TRM Labs, one of the biggest reason for this surge in adoption is the way stablecoins have come up and become a cornerstone of the crypto landscape.

TRM Labs Study Flags Rising Criminal Use of Stablecoins Despite 99% Licit Activityhttps://t.co/fpmHvFlVkV

— John Morgan (@johnmorganFL) October 22, 2025

Stablecoins now make up about 30% of all crypto transactions. By August this year, stablecoin transaction volume hit a record $4 trillion, an 83% increase compared to the previous year.

0.01%

Tether

USDT

Price

$1.00

0.01% /24h

Volume in 24h

$170.08B

Price 7d

and

0.01%

USDC

USDC

Price

$0.9999

0.01% /24h

Volume in 24h

$22.88B

Price 7d

are the dominant players and have been for quite some time. Together, they account for roughly 93% of the total stablecoin capitalization.

(Source: TRM Labs)

Meanwhile, retail interest has shot up. Compared to last year, the number of smaller, everyday crypto transactions rose by 125% between January and September this year. According to TRM, this underscores that the use cases for crypto are growing, including payments, remittances and protecting value during economic uncertainty.

“In some jurisdictions, adoption has accelerated in response to regulatory clarity and institutional access; in others, it has expanded despite formal restrictions or outright bans,” the report said.

“These contrasting dynamics point to a consistent trajectory: crypto is moving further into the financial mainstream. A key trend underscoring this shift is the rise of stablecoins,” it further added.

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

Crypto Adoption Gets A Boost As Wealthy Asian Families Expand Exposure

Wealthy families across Asia are expanding their crypto investments, driven by strong market returns, clearer regulations and a growing consensus that digital assets now belong in a diversified portfolio.

Jason Huang, founder of NextGen Digital Venture, a Singapore-based investment firm, shared that his firm raised over $100 million in just a few months for its new crypto-focused investment product, the Next Generation Fund II.

He said, “Our investors, mainly family offices and internet or fintech entrepreneurs, recognize the growing role of digital assets in diversified portfolios.”

His previous fund, which closed last year, delivered a 375% return in under two years.

Major banks are also noticing this shift, with UBS reporting that overseas Chinese family offices plan to allocate about 5% of their portfolios to crypto.

EXPLORE: Top 20 Crypto to Buy in 2025

Key Takeaways

- South Asia leads global crypto adoption, with India and Pakistan seeing 80% growth

- US crypto market tops $1 trillion, driven by regulation and stablecoin momentum

- Wealthy Asian families boost crypto exposure, viewing digital assets as core portfolio components

The post Crypto Adoption Update: South Asia Drives Crypto Growth, US Remains Volume Leader, TRM Labs appeared first on 99Bitcoins.