BTC USD Price Braces For FOMC: Polymarket Says Cut, Will Powell Deliver?

In the next 48 hours or so, there will be two major market-moving events. The Federal Reserve and Jerome Powell will announce new interest rates tomorrow, and US President Donald Trump will meet with Premier Xi Jinping the day after. Regardless of the outcome, the BTC USD price will move.

So far, there are hints of strength. Even though Bitcoin bulls should build on the series of higher highs posted over the weekend, what’s crucial for structure traders is whether the digital gold will float above $110,000.

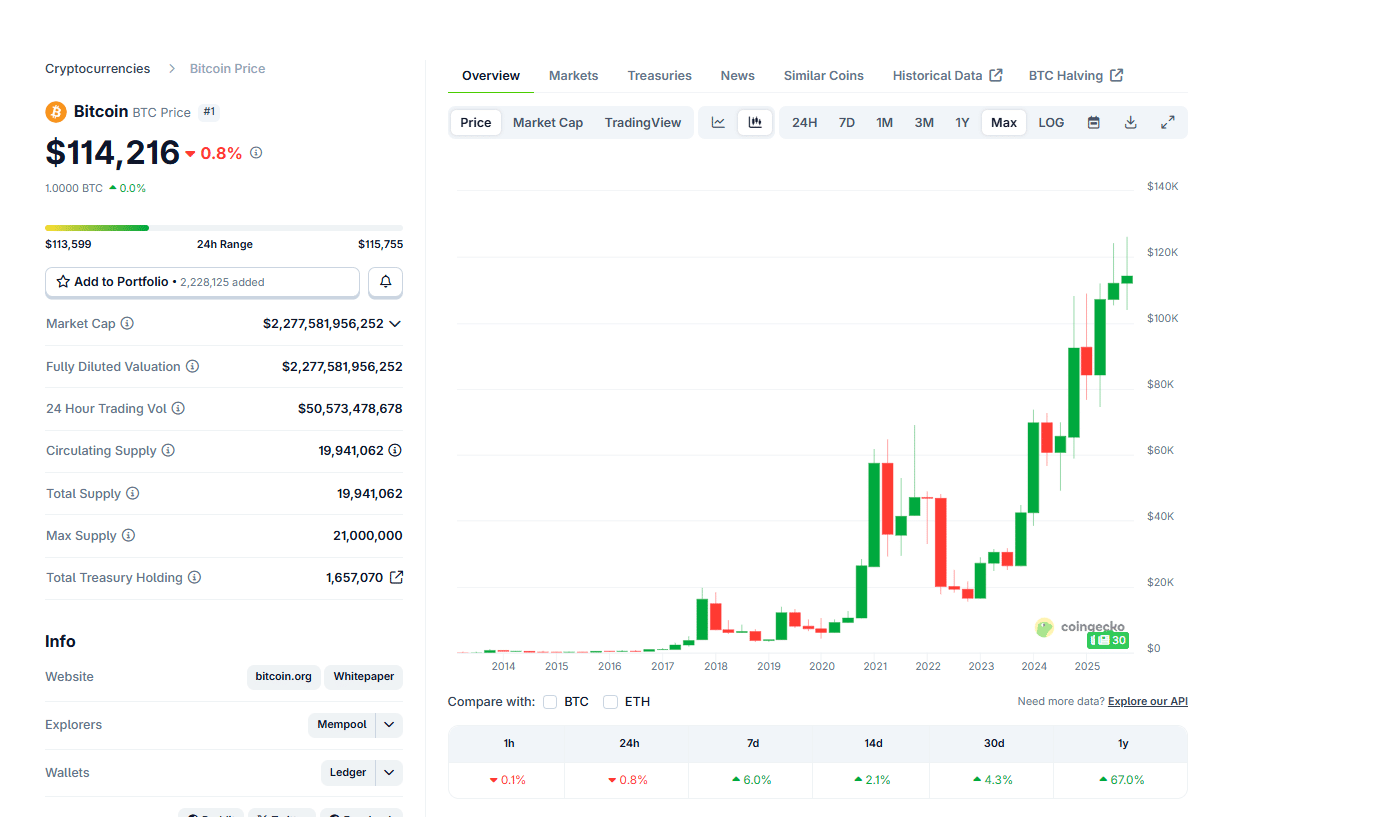

Presently, the BTC USD price is hovering around $114,000 and $115,000, up +6% in the past week. Although stable, the sharp recovery from October 23 could be the foundation for even more gains.

(Source: Coingecko)

DISCOVER: 9+ Best Memecoin to Buy in 2025

BTC USD Price Firm: Will Jerome Powell Deliver?

On Coinglass, most traders are bullish. The long/short ratio across tracked perpetual exchanges, that is, Binance and OKX, stands above 1.

This positive ratio signals that most traders are opening more leveraged buy positions than shorts.

The larger the number expands ahead of tomorrow’s FOMC meeting, the higher the probability of the BTC USD price ticking higher, closing above $118,000 and ideally $120,000 by the end of the week.

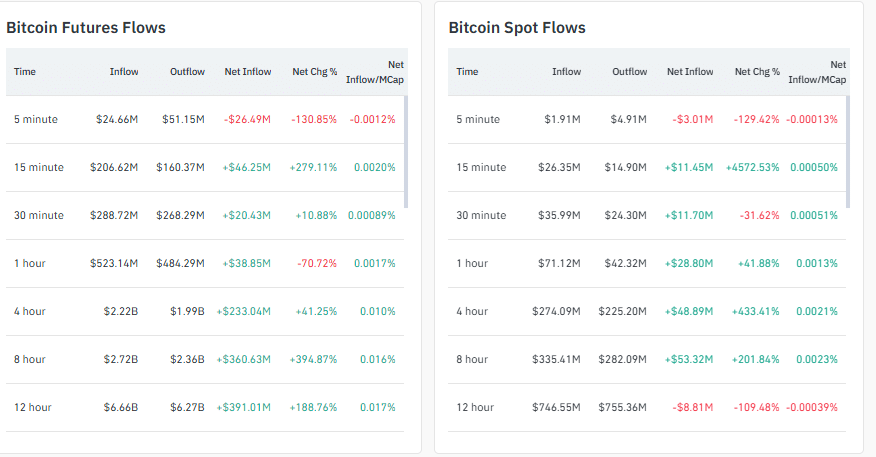

As the long/short ratio expands, there is decent inflow to spot Bitcoin exchanges. Over $120M of Bitcoin crypto has been bought in the last eight hours. Meanwhile, money continues to pour into Bitcoin futures exchanges.

(Source: Coinglass)

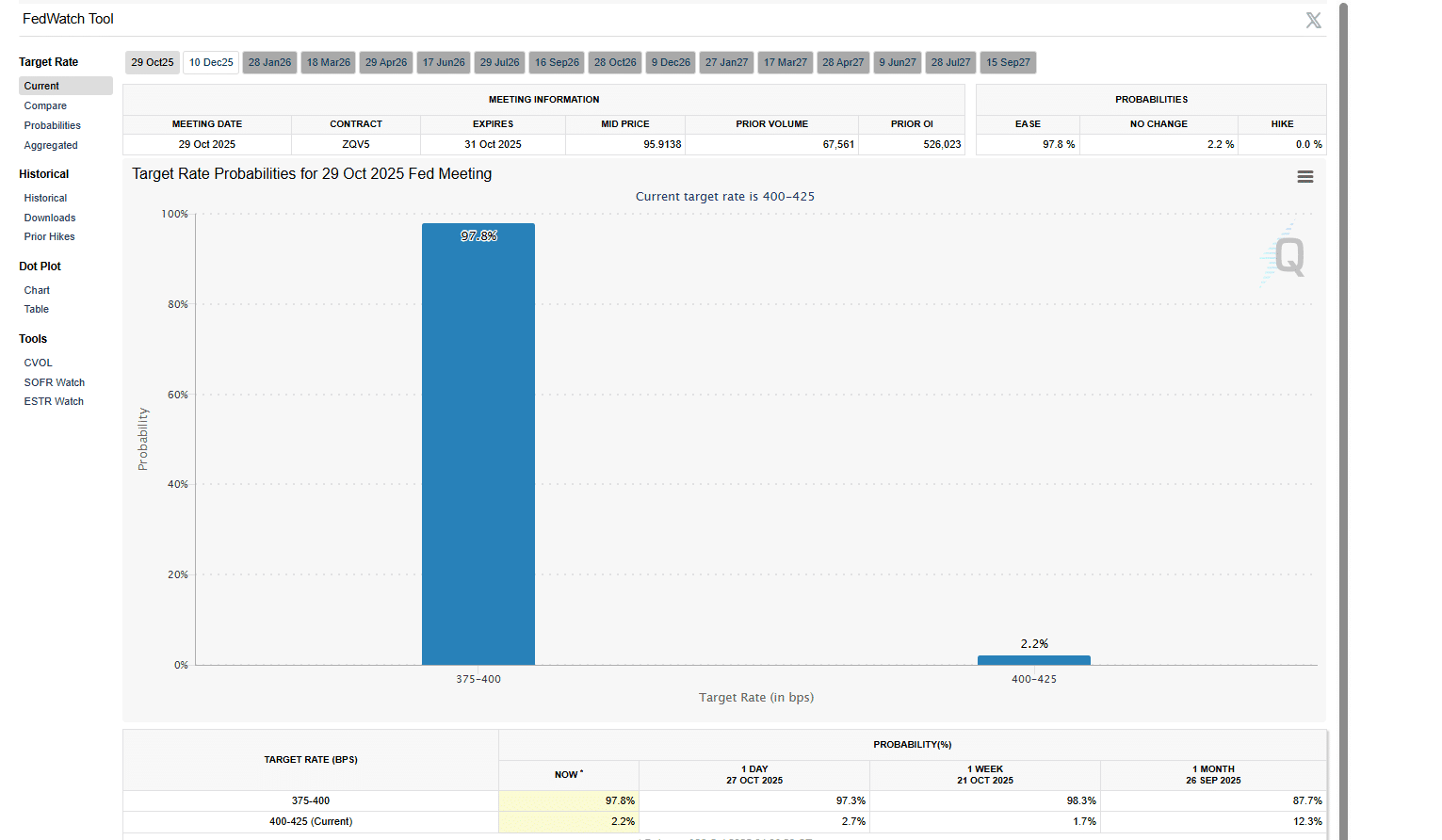

The CME FedWatch tool places the probability of a rate cut to the +3.75% to +4% range at over +97%. Still, though economists are confident that the central bank will slash rates for the second time this year, everything depends on the FOMC and Jerome Powell.

(Source: CME)

The Federal Reserve is data-driven and monitors several economic data points, mostly inflation and the labor market. In August, job growth slowed to just 22,000, the weakest since 2010. Labor data are expected to soften further in September despite the government shutdown delaying official reports.

Meanwhile, inflation eased slightly in August with core PCE at +2.7%, which is above the +2% benchmark. Tariffs and reduced immigration continue to add upward pressure on inflation, but lower demand for goods, on the other hand, is helping create balance.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

Punters On Polymarket Expect A Rate Cut

In the previous meeting, Powell said their outlook for employment and inflation has not changed much since September, which opens the door for more easing.

Some governors, on the other hand, want the central bank to aggressively slash rates. Specifically, Governor Stephen Miran favors a +0.50% rate cut.

The consensus is for a rate cut, and if Jerome announces a +0.25% rate cut, the BTC USD price, including some of the top Solana meme coins, could tick higher.

However, gains will be amplified should the central bank decide to implement a +0.50% rate cut. In that event, not only will the Bitcoin price breach $120,000, but it could soar above $126,000 in the next few days.

Conversely, a no-cut or an unexpected rate hike could force some of the best cryptos to buy lower. Bitcoin could plunge to $110,000, forcing other top coins lower.

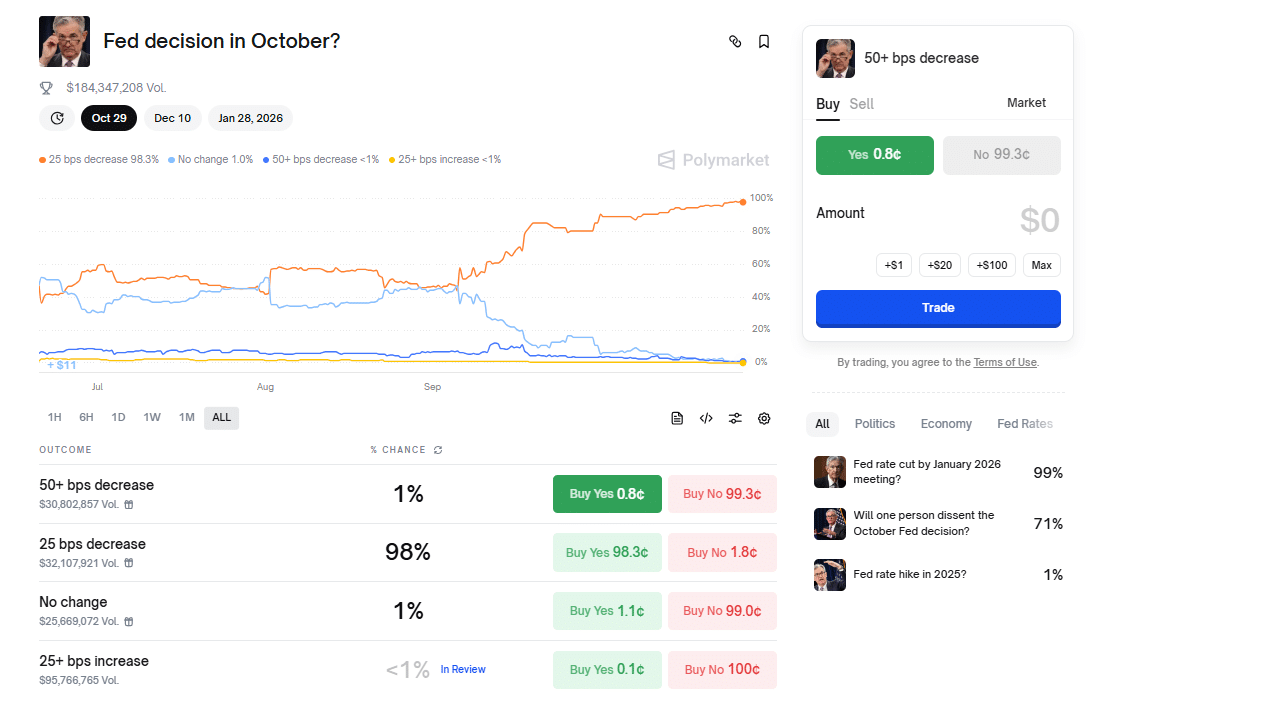

The good news is that on Polymarket, the world’s largest predictions market, punters expect the FOMC to slash rates by +0.25%, placing the probability at +98%.

(Source: Polymarket)

This high confidence in a rate cut mirrors what most economists expect.

DISCOVER: 10+ Next Crypto to 100X In 2025

BTC USD Price Braces For FOMC: Polymarket Says Cut

- BTC USD price stable above $114,000

- FOMC and Jerome Powell will announce new rates on October 29

- Economists and punters expect a 0.25% rate cut

- Will BTC USDT pump above $120,000?

The post BTC USD Price Braces For FOMC: Polymarket Says Cut, Will Powell Deliver? appeared first on 99Bitcoins.