Cathie Woods Crypto Shopping Spree: Best Crypto to Buy Based on ARK Invest Bids

Cathie Wood is adding to her crypto-themed stock bets. This week, she put about $31 million into Jack Dorsey’s Block as demand for Bitcoin ETFs picked up again.

According to an official announcement on X, ARK Invest bought $30.9 million in Block shares on Monday. The position was spread across three of its funds: ARKK, ARKW, and ARKF.

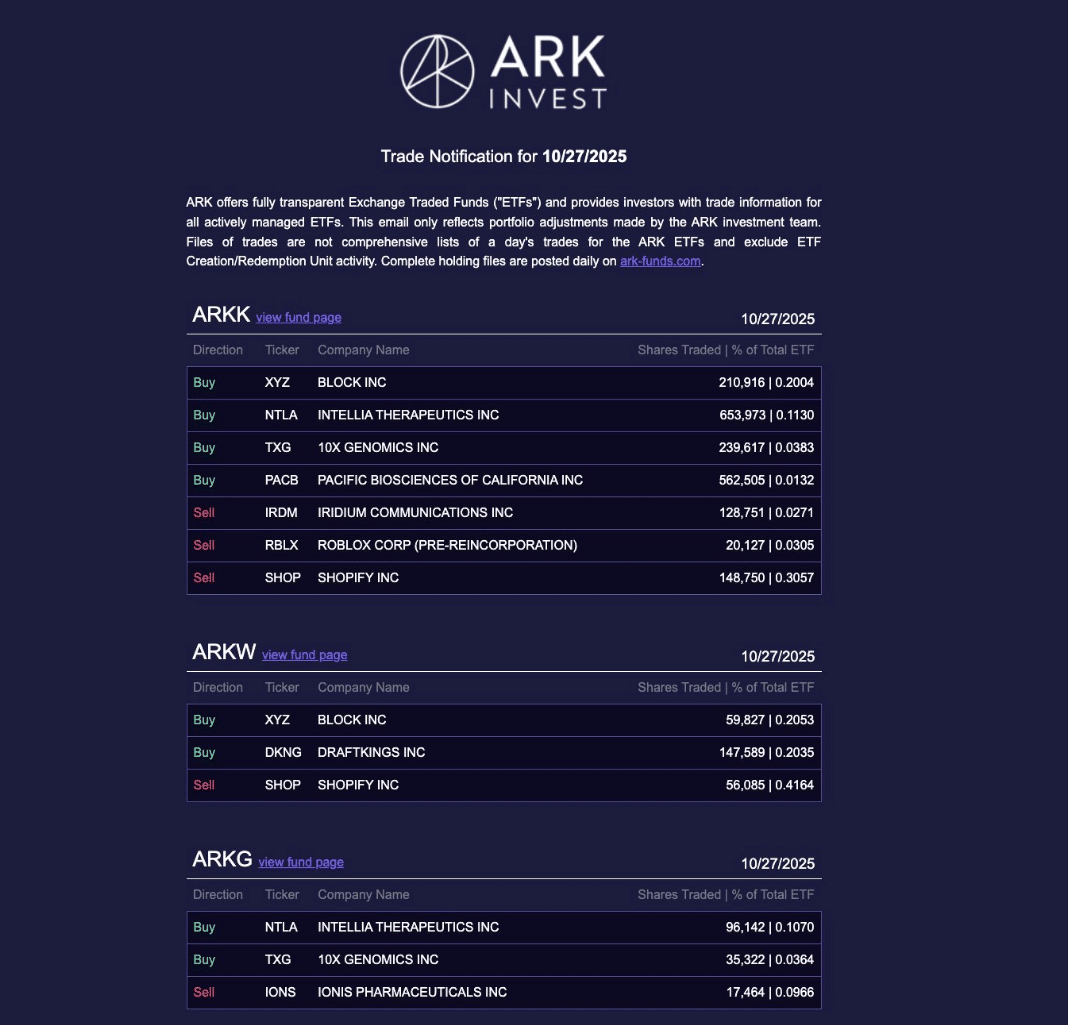

Here’s every move Cathie Wood and Ark Invest made in the stock market today 10/27 pic.twitter.com/4tKJozNK29

— Ark Invest Tracker (@ArkkDaily) October 28, 2025

The move fits ARK’s ongoing interest in companies linked to digital assets. It landed during a stretch of renewed inflows into US Bitcoin ETFs and the launch of new products focused on alternative tokens.

Block remains a major public name in Bitcoin-related payments.

Its Square business recently rolled out tools that allow US merchants to accept Bitcoin with no fees and automatically convert daily card sales into BTC.

Bitcoin traded near $114,000 on Tuesday afternoon in the US market, while Ether stayed around $4,060.

ARK Invest continued to build its crypto exposure, adding 385,585 shares of Block.

The firm has been leaning not only on crypto-linked ETFs but also on companies involved in digital payments and on-chain services.

Its buying streak has stretched into consumer platforms as well.

Late last week, ARK purchased about $21.3 million worth of Robinhood shares across its funds.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Here’s every move Cathie Wood and Ark Invest made in the stock market today 10/22 pic.twitter.com/vk3O3vh5iD

— Ark Invest Tracker (@ArkkDaily) October 23, 2025

The disclosure followed soon after and helped lift the stock during the session.

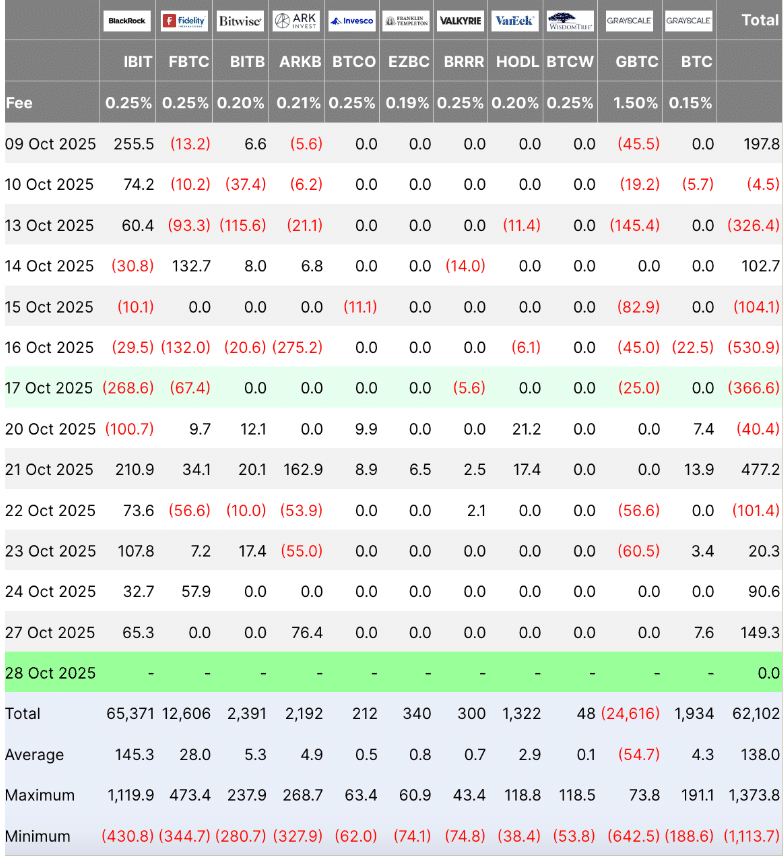

The ARK 21Shares Bitcoin ETF (ARKB) recorded roughly $76.4 million in net inflows on Monday, the strongest single-day haul among BTC funds. US spot bitcoin ETFs have now posted gains for three straight days.

The market also saw new ETF options land on Tuesday.

Spot products tied to Solana (SOL), Hedera (HBAR), and Litecoin (LTC) began trading, giving investors more regulated ways to access crypto beyond Bitcoin and Ether.

DISCOVER: 20+ Next Crypto to Explode in 2025

What ARK’s bids imply about “best crypto to buy”?

ARK is putting more money into Block. The move comes soon after its Square unit rolled out new Bitcoin payment and treasury tools for merchants. It shows ARK is still betting on Bitcoin’s real-world use.

With steady inflows into ARKB, the message is clear: BTC remains the main focus.

The recent Robinhood purchase highlights the importance of retail trading. Activity on the platform generally rises when altcoins get more liquidity.

With expected ETFs tied to SOL, HBAR, and LTC, Solana now sits beside Bitcoin and Ethereum as one of the key assets to watch.

ARK has moved in and out of Coinbase several times in 2025. This week, it leaned toward Block and Robinhood. The shift suggests ARK is focusing on payment networks and easier retail access, not only traditional exchange exposure.

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Cathie Woods Crypto Shopping Spree: Best Crypto to Buy Based on ARK Invest Bids appeared first on 99Bitcoins.