Is Bank of England Quietly Tapping HBAR Crypto For Stablecoin Push?

Hedera Hashgraph has been selected to join the Bank of England’s DLT (Distributed Ledger Technology) challenge, which is focused on testing how DLT can be used in finance. HBAR crypto is up +15% on the week following this announcement, alongside yesterday’s (October 28) Hedera ETF launch.

The Bank of England is officially committing to exploring DLT innovation, and the inclusion of Hedera is a big deal. It could play out really well for HBAR

5.01%

Hedera Hashgraph

HBAR

Price

$0.1986

5.01% /24h

Volume in 24h

$531.72M

Price 7d

crypto, with institutional interest in crypto heating up lately and the UK finally trying to emerge from its dark ages stance on crypto.

Hedera is proud to take part in the @bankofengland and @BIS_org DLT Innovation Challenge, exploring how central bank money could be transacted on external programmable ledgers.

Hedera looks forward to contributing insights on the role of DLT in the future of financial… pic.twitter.com/CJIUThF3WU

— Hedera (@hedera) October 24, 2025

Hedera One of the Big Players Involved in the Bank of England DLT Challenge

Hedera will participate in the DLT Innovation Challenge, an initiative launched by the Bank of England in collaboration with the Bank for International Settlements Innovation Hub (BISIH) London Centre.

This challenge aims to explore how wholesale central bank money could be transacted and settled on external programmable ledgers not operated by the Bank itself.

The Bank of England’s DLT Challenge will run throughout this autumn and serves as an invitation for firms to demonstrate how to securely transact and settle central bank money on an external ledger not controlled by the Bank of England.

Learning outcomes from the challenge will shed light on settlement finality and security, ensuring irreversible, tamper-proof transactions; scalability; handling high transaction volumes efficiently; network and asset control; balancing decentralisation with regulatory requirements; and interoperability.

Other decentralized firms taking part in the challenge include Ava Labs, Chainlink

1.97%

Chainlink

LINK

Price

$18.12

1.97% /24h

Volume in 24h

$937.24M

Price 7d

, Aave Labs, and USDC issuer Circle, among others. HSBC and KPMG are the most prominent participants from the TradFi space.

DISCOVER: Top Solana Meme Coins to Buy in October 2025

HBAR Crypto On The Up Following Hedera ETF Launch on October 28

The $HBR ETF offers exposure to HBAR, the native token of Hedera Hashgraph—used for network services, fees, security, & powering apps. Hedera stands out for its high throughput, low fees, enterprise governance, real-world usage, and energy efficiency

More: https://t.co/7wf857Bv0S pic.twitter.com/J7QRDA3GYj— Canary Capital (@CanaryFunds) October 28, 2025

Things are looking up for Hedera following its inclusion in the Bank of England’s DLT Challenge and, more importantly, yesterday’s launch of the HBAR ETF.

Canary Capital, an asset management firm specializing in digital assets, announced the launch of two new ETFs tracking Litecoin (LTC) and Hedera (HBAR) on the Nasdaq, marking the first-ever US-listed ETFs offering direct exposure to these tokens.

It is a huge deal because HBAR and LTC are just the (tied) third digital assets to receive spot ETF listing approvals, after Bitcoin in January 2024 and Ethereum in July 2024.

Hedera and Litecoin had a funny interaction on social media after Hedera posted celebrating being the third digital asset to have a spot ETF, and the Litecoin X account responded, “*Tied for 3rd*”.

According to an official statement from Canary Capital, both funds (the Canary Litecoin ETF and the Canary Hedera ETF) began trading on Monday (October 27), with management fees set at 0.95%, as detailed in the firm’s S-1 filing submitted in October.

Bloomberg ETF analyst Eric Balchunas posted on X to say that the HBAR crypto ETF saw $8m in inflows on its first day, while the LTC ETF saw only $1m.

ETFs and Bank of England Collaboration to Send HBAR Crypto to $0.34?

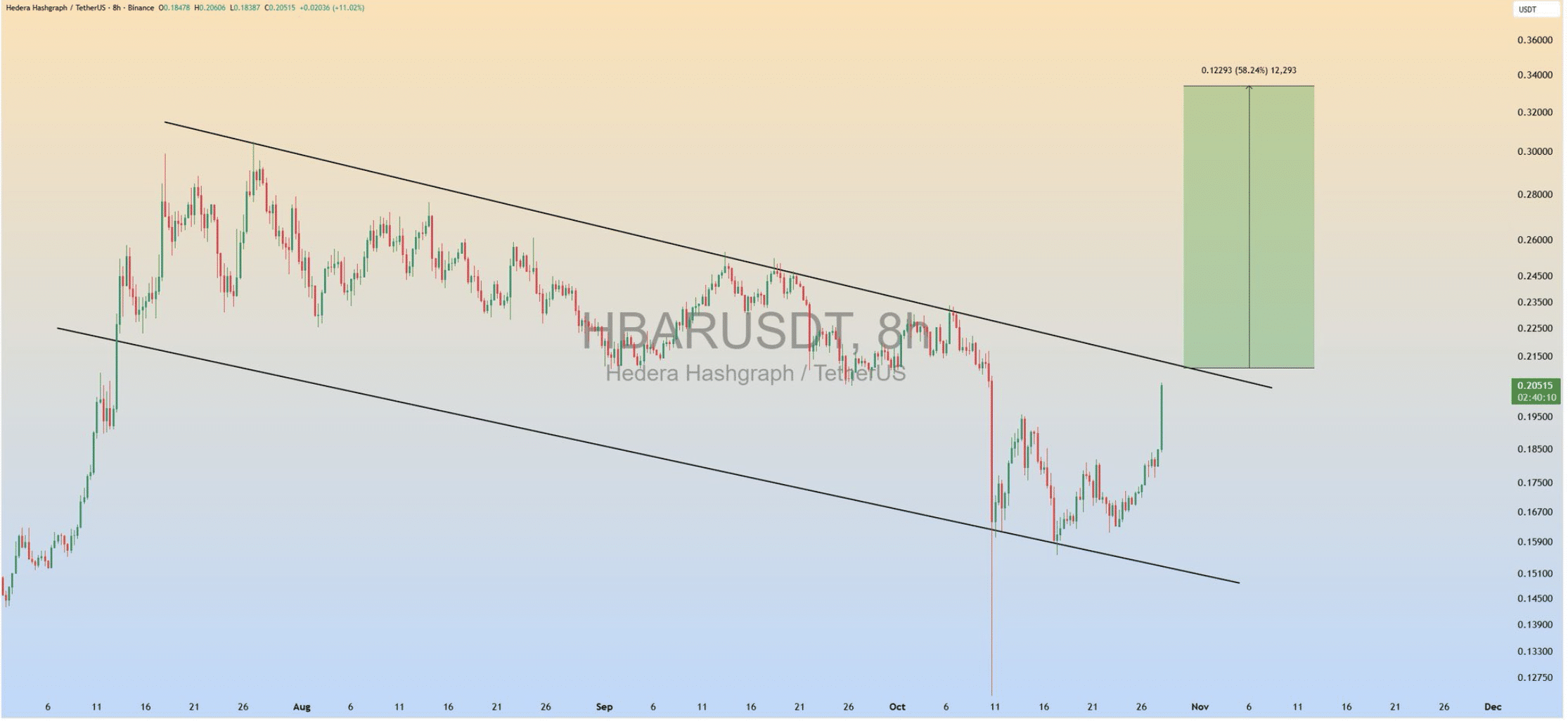

On a 4-hour timeframe, HBAR crypto is in a clear bullish channel and is currently testing the upper range at around $0.205. If it breaches this level and closes a 4-hour candle above $0.205, it will have a clear run toward $0.34, where the next resistance zone lies.

Hedera is currently trading at $0.195, having pumped by 15% over the past week, amid all the bullish catalysts announced for HBAR in recent days.

However, it is still down -65% from its all-time high of $0.5692 from September 2021 and has a long way to go before it can reach new highs, although the launch of a spot ETF and partnerships with the Bank of England represent a good starting point.

HBAR crypto is currently valued at $8.3Bn, making it the 28th largest digital asset by market cap, per CoinGecko data. There is a growing belief that the institutional demand for Hedera, coupled with a live ETF product, could see it become a top-10 digital asset during this bull run.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Is Bank of England Quietly Tapping HBAR Crypto For Stablecoin Push? appeared first on 99Bitcoins.