CZ Doubles-Down on Aster: Will $2M CZ Crypto Bid Fuel $2 ASTER Price in November?

Binance founder Changpeng ‘CZ’ Zhao created a stir in the market over the weekend after revealing he had made a personal investment in the ASTER crypto token, which led to a sharp market rally for the struggling asset.

CZ took to X to publicly disclose that he had purchased 2,090,598.14 ASTER tokens, worth approximately $2 million, at an average price of $0.91 per token. He stated, “I bought some ASTER on Binance today with my own money. I’m not a trader; I bought it and I’ll hold it.”

The ASTER price surged following CZ’s announcement, rising from around $0.90 to $1.25, representing an increase of approximately 35%. It has since cooled down and is currently trading for roughly $1.07.

CZ Puts Social Media in a Frenzy With Personal ASTER Purchase Declaration

The X post from CZ on Sunday (November 2) took social media by storm. Within an hour, the ASTER token had surged over 35%, briefly hitting $1.25, after starting the day around $0.91. The post also sparked a surge in buying across Binance and other platforms, as the trading volume spiked to $2.5Bn.

A user replied to CZ’s post, showing a screenshot of the green candle on the ASTER chart following the Binance founders’ public purchase, with the caption “CZ Candle” and a laughing emoji.

Zhao responded, saying, “damn, I was hoping to buy some more at low prices…”, hinting that CZ hasn’t finished his ASTER buying spree. This is one of the rare instances where the Binance founder has publicly disclosed a crypto purchase.

This sentiment was echoed by the man himself, who has previously talked about buying and holding Bitcoin over the years. CZ got the ASTER community excited when comparing this purchase to his early BNB buys. He said, “I bought some #BNB in the first month of its TGE 8 years ago, and held all of it (except spendings).”

Full disclosure. I just bought some Aster today, using my own money, on @Binance.

I am not a trader. I buy and hold. pic.twitter.com/wvmBwaXbKD

— CZ

BNB (@cz_binance) November 2, 2025

DISCOVER: Top Solana Meme Coins to Buy in November 2025

ASTER Resurgence Also Boosted by Updated Tokenomics and Buybacks

Aster’s recent rally was supported by updates to its tokenomics that were announced just days earlier. On October 31, the Aster team revealed changes to its S3 buyback and airdrop model. The new plan includes the following:

50% of all buybacks from both S2 and S3 will be burned, reducing the overall token supply. The remaining 50% will be allocated to a locked airdrop address, limiting the circulating tokens and rewarding long-term holders.

These changes aim to enhance long-term price stability, although the timing of CZ’s announcement somewhat overshadowed this development.

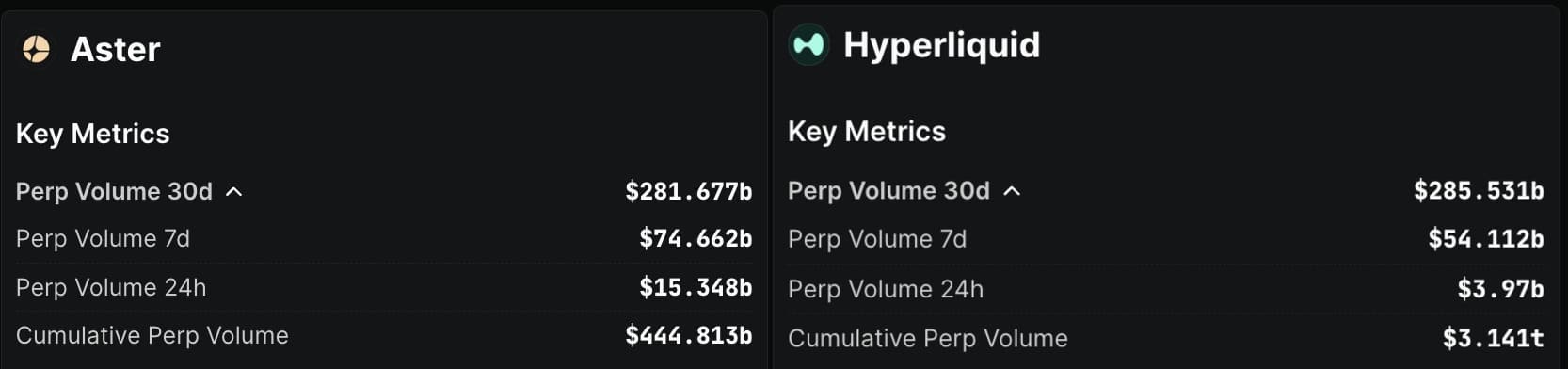

Additionally, Aster recently surpassed Hyperliquid in trading volume, reporting over $70Bn in trades over the past week. However, these figures have been subject to scrutiny. The DefiLlama team temporarily removed Aster’s self-reported perpetual volume due to verification concerns, but the data was later reinstated.

DefiLlama now shows nearly $282Bn in 30-day perpetual trading volume, compared to $285Bn on Hyperliquid, highlighting just how closely matched the two platforms are against each other.

Is ASTER Crypto Heading for $2 in November?

After crashing 60% from its all-time high of $2.48, the ASTER price finally began to show signs of life, having hovered under the $1 level for the past few weeks. The last few days of bullish price action ended its nearly 40-day downward trend.

The ASTER price went parabolic in the days after its debut, hitting a high of $2.48 on September 24, but has since struggled against relentless selling pressure and FUD regarding accusations of insider trading and fudged numbers.

During its decline, ASTER confirmed the $1.50 horizontal area as resistance and fell to a low of $0.85 on October 30. However, things are looking better for the perp DEX token as it ended its downtrend with a 50% price increase, breaking out from the diagonal resistance.

Currently, the ASTER price is attempting to validate the trend line as support, a bullish sign that could cause the asset to retest the $1.50 resistance once again.

Momentum indicators legitimize the breakout. During the movement, the Relative Strength Index (RSI) moved above 50, and the Moving Average Convergence/Divergence (MACD) turned positive.

Thanks to these bullish signals and CZ’s seven-figure spending spree, ASTER could now confirm the trend line as support and make another attempt to reach the $1.50 resistance level. However, for ASTER to regain above $2, it will need to close above $1.50 on a daily basis.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post CZ Doubles-Down on Aster: Will $2M CZ Crypto Bid Fuel $2 ASTER Price in November? appeared first on 99Bitcoins.