Disgraced FTX Boss SBF Heads For Appeal: Will Sam Find Wiggle Room Or Pray For Trump Crypto Pardon?

FTX’s fall from grace is nearly complete. On Tuesday, former FTX CEO Sam Bankman-Fried (SBF) will stand before the Second Circuit Court, fighting to erase a conviction that made him the face of crypto’s collapse.

Do you still keep all your tokens stored on a centralized exchange like FTX perchance? Well, you must be crazy! That or maybe you consult your KOL first before being able to formulate an answer?

Anyway, SBF’s lawyers are arguing that Judge Lewis Kaplan tainted the jury and that the trial was rigged from the outset.

It’s a claim built on thin ice. The man who once promised to fix finance now has one goal left: to outlive his own disaster.

“The way the court conducted the trial was in itself essentially unfair,” said Howard Fischer, partner at Moses Singer, speaking to CoinDesk TV.

DISCOVER: 20+ Next Crypto to Explode in 2025

Will FTX Traders Get a Bigger Bailout? The Numbers Don’t Add Up for FTX Creditors

While SBF’s appeal unfolds, FTX creditors are still counting losses, and the math isn’t pretty. According to a TradingView report, the FTX bankruptcy estate controls roughly $16 billion in assets, but only a fraction is being distributed in crypto terms.

Meanwhile, prominent creditor Sunil estimated that “real recovery rates” range from 9% to 46%, depending on the token. His data shows that even the touted 143% fiat repayment translates to just 22% in Bitcoin, 46% in Ethereum, and 12% in Solana, given the massive rally in crypto since 2022.

The upshot is that most of those traders lost out on potential gains.

“FTX creditors are not whole,” Sunil wrote on X. “The fiat payout doesn’t reflect the lost crypto value.”

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Is Sam Bankman-Fried Trump’s Next Pardon? SBF’s Last Stand as FTX Creditors Face Harsh Reality

Donald Trump’s foray into not only crypto but crypto politics, pardoning both Ross Ulbricht of Silk Road and CZ of Binance, set off a chain reaction that shook markets from X to Polymarket. Speaking at a campaign event, he defended former Binance CEO Changpeng Zhao:

“They said what he did wasn’t even a crime… I granted him a pardon at the request of many respectable people.”

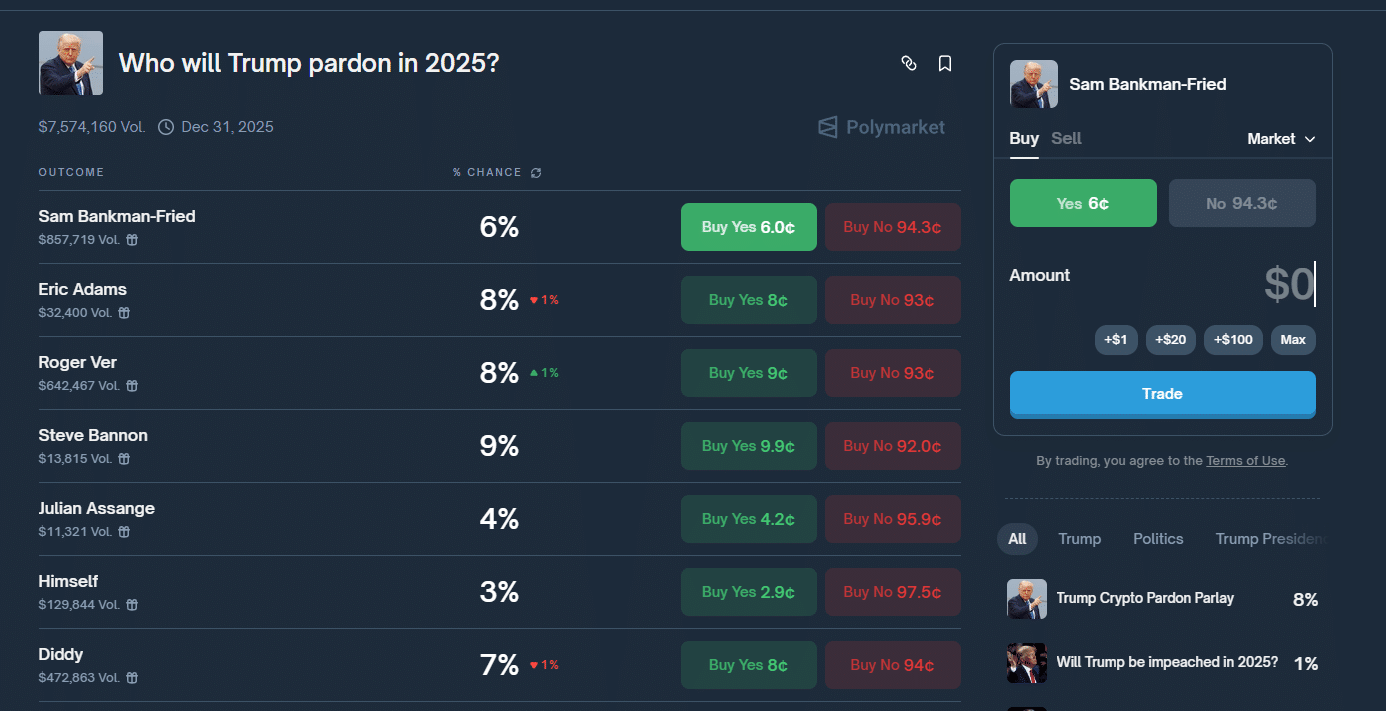

Within hours, traders began factoring in the possibility of a presidential pardon for SBF. On Polymarket, odds of SBF walking free spiked from 5.6% to nearly 19% before settling near 6%.

— CZ

BNB (@cz_binance) October 24, 2025

CZ, now keeping a lower profile, posted a brief acknowledgment on X. His boasting, paired with Trump’s statement, sent speculation into overdrive.

FTX Creditors Discover “Phantom” Repayments

CoinGecko and Glassnode data show crypto’s market value has quadrupled since FTX collapsed, leaving bankruptcy reimbursements a fraction of what assets are worth today.

It’s why pretty much no one is cheering for an SBF pardon. His appeal has become a symbol of both legal desperation and the uneasy truth that, even in a trillion-dollar market, you can still get rugpulled.

EXPLORE: Is It All Over For the Bull Run? Rates Cuts Sink Crypto Markets

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- FTX’s fall from grace is nearly complete. On Tuesday, former FTX CEO Sam Bankman-Fried (SBF) will stand before the Second Circuit Court.

- His appeal has become a symbol of both legal desperation and the uneasy truth that, even in a trillion-dollar market, you can still get rugpulled.

The post Disgraced FTX Boss SBF Heads For Appeal: Will Sam Find Wiggle Room Or Pray For Trump Crypto Pardon? appeared first on 99Bitcoins.