[LIVE] Crypto News Today, November 5: The Market Sees Red, BTC Barely Manages To Hold Above $100k And ETH Slides Down Further To $3.1k

Crypto news today paints a grim picture. The market is red and is becoming redder by the second as major digital assets such as Bitcoin (BTC) and Ethereum (ETH) fail to hold their positions and keep sliding down. In the last 24 hours alone,

5.38%

Bitcoin

BTC

Price

$101,957.00

5.38% /24h

Volume in 24h

$111.94B

Price 7d

has slipped by more than 2.89%, continuing the week-long trend of shedding its value. Weekly, BTC is down by 9.88%.

(Source: CoinMarketCap)

Investors are fleeing riskier assets like crypto, and the sell-off has triggered a wave of withdrawals from spot BTC ETFs after US President Donald Trump issued fresh warnings.

He warned that if the US does not dominate crypto, China will. According to a Forbes article, he said, “I don’t want to have somebody else have crypto and have China be number one in the world in crypto.”

Trump doubles down on digital dominance:

“I only care about one thing — will the U.S. be number one in $crypto? China is getting into it very big.” pic.twitter.com/M5cG5KsqYk

— COACHTY (@TheRealTRTalks) November 3, 2025

Technically, BTC is struggling to stay above its 200-day moving average. If the price drops further, the next support level is around $96,000. On the flip side, climbing back to $111,000 could help BTC regain its strength.

(Source: TradingView)

Market sitting at a crucial level — as long as EQL holds, we’re safe.

98K–100K is a strong zone and should hold.

A relief rally looks likely from here.

If this level breaks, eyes on the marked OB/Demand zone.

#BTC $ETH $SOL $mmt $giggle $xno $resolv pic.twitter.com/l0H69gtbuP

— BullSniper (@Bull_Sniper7) November 5, 2025

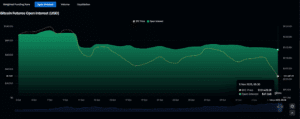

Right now, the market is shaky. The Fear and Greed Index has swung into extreme fear, a big shift from its neutral readings a week before. Open interest in BTC perpetual futures has dropped about 30% since October, as an indicator that leveraged investors are stepping away from the digital gold.

(Source: CoinGlass)

While retail is crying, institutions are taking up this opportunity to scoop up more BTC. Michael Saylor, Strategy’s CEO, bought 397 BTC between October 27 and November 2, paying an average of $114,771 per coin.

Strategy has acquired 397 BTC for ~$45.6 million at ~$114,771 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/2/2025, we hodl 641,205 $BTC acquired for ~$47.49 billion at ~$74,057 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/yJfoyeNzCm

— Strategy (@Strategy) November 3, 2025

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Crypto News Today: ETH Continues To Disappoint, Dips Below $3,100

6.30%

Ethereum

ETH

Price

$3,300.08

6.30% /24h

Volume in 24h

$62.36B

Price 7d

continues to disappoint. The FUD is overwhelming, with the market losing $54 million within 30 minutes yesterday.

ETH is struggling to stay above key technical levels. Its price action breaking through support zones at $3,500 and $3,450 signals market weakness. Its price action reached a low of $3,058 before bouncing slightly to its current trading price at

.

It’s facing resistance, with $3,500 being the big hurdle it needs to cross. If ETH manages to decisively break through $3,500, it could target $3,750 or $3,800.

However, if it fails to move past $3,500, it can drop towards support at $3,250 and $3,200. Also, if the selling pressure continues, it can fall lower to $3,120, $3,050, $3,020, or even $3,000.

Meanwhile, technical indicators are losing momentum. The RSI is at 35, nearing oversold levels, with some headroom left for further downslides.

(Source: TradingView)

For now, $3,200 is the key support to watch, while $3,500 remains the resistance to beat.

The SEC (US Securities and Exchange Commission) delaying its decision on ETH staking and ETFs till 13 November is adding bearish pressure as well. Because of the delay, institutional investors are holding off, waiting for some clarity before making any major moves.

In just the last 24 hours, more than $576 million in ETH has been liquidated, falling by more than 5% on the daily chart and by 17% on the weekly.

(Source: CoinGlass)

EXPLORE: Top 20 Crypto to Buy in 2025

Long-Time Holders Dump BTC Worth $45 Bn

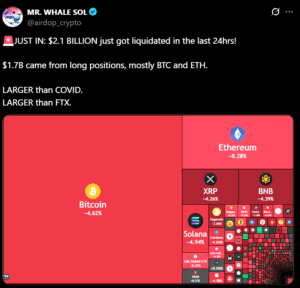

BTC fell as much as 7.4% on Tuesday, dipping below $100,000 for the first time since June. Unlike the liquidation event from last month, Bloomberg argues that this crash is a result of trust eroding in the digital gold.

Per Bloomberg’s report, BTC whales dumped more than 400,000 over the past month, roughly worth $45 billion. Many of the coins sold had been held for 6-12 months, indicating profit-taking rather than forced exits.

Unlike the October 10 liquidations that wiped out $19 billion, this crash involved only about $2 billion, highlighting a more deliberate approach.

(Source: @airdop_crypto)

Meanwhile, Markus Thielen of 10x Research and Vetle Lunde of K33 Research both noted that mega whales, i.e., wallets holding between 1,000 and 10,000 BTC, have been reducing their positions since mid-year.

At the same time, BTC accumulation by smaller whales has slowed down, leaving few buyers to absorb the excess.

Thielen has warned that this offloading could continue for months. He doesn’t expect a full crash, but he believes that prices could fall further, possibly bottoming around $85,000.

BTC Reserve Is The Only Way To Tackle National Debt: Sen. Cynthia Lummis

US Senator Cynthia Lummis, a long-time advocate for crypto, has argued that a Bitcoin National Reserve is the only solution to tackle national debt, now exceeding $33 trillion.

In an interview with Bloomberg, Lummins emphasized that regulators are looking at ways and means to create a reserve system that doesn’t depend entirely on gold.

(Source: @Sen. Cynthia Lummis)

She explains that BTC’s decentralized nature and limited supply make it a strong hedge against inflation and fiscal instability. Furthermore, Lummis argues that integrating BTC into the national reserve could help diversify and strengthen the country’s financial outlook as traditional fiat systems face mounting pressures.

She has in the past voiced her opinion against excessive government spending and called for more responsible fiscal policies, with BTC at the linchpin since its transparent and accountable nature offers a better alternative.

EXPLORE: 20+ Next Crypto to Explode in 2025

The post [LIVE] Crypto News Today, November 5: The Market Sees Red, BTC Barely Manages To Hold Above $100k And ETH Slides Down Further To $3.1k appeared first on 99Bitcoins.