Linea Exponent Goes Live: LINEA Price Prediction For November 2025

The crypto market has cooled this week, with

2.23%

Bitcoin

BTC

Price

$103,879.90

2.23% /24h

Volume in 24h

$99.31B

Price 7d

slipping after briefly retesting $99,000 and triggering broad weakness across altcoins. Ethereum fell more than 10%, while

6.24%

Linea

LINEA

Price

$0.0127

6.24% /24h

Volume in 24h

$92.79M

Price 7d

extended its decline.

Yet, while the near-term picture looks uncertain, long-term investors are paying close attention to what’s happening under the surface. The recent Linea Exponent upgrade marks a significant step in reshaping how value flows through the Linea ecosystem — and could play a defining role in the Linea price prediction for November 2025 and beyond.

This upgrade introduces a dual burn system that directly connects network activity with token scarcity, a move that could influence both market perception and long-term sustainability. The Ignition program has been extended, allowing liquidity providers to earn rewards through a vesting mechanism on the Brevis platform, supporting steady participation.

Linea Introduces a Deflationary Mechanism: a Dual Burn System

Linea, a Layer-2 network built on Ethereum, has officially launched its dual burn system. Beginning November 4, 2025, every transaction on the network burns both ETH and LINEA: 20% in ETH and 80% in LINEA. This mechanism effectively makes Linea a continuous buyer of its own token while simultaneously contributing to Ethereum’s deflationary supply model.

$LINEA Burn mechanism is live

Important points to note

:

– 20% burned in ETH

– 80% converted to LINEA and burned

– Linea will burn all the Fee collected from Sep 11

– Already burned 20,294,430 $LINEA ($236k)Fee collection wallet:https://t.co/3jmOCaORUm pic.twitter.com/joTMCVZ6eh

— Madbro.eth (@SadlifeTv_) November 5, 2025

The update applies retroactively to all transactions since September 11, 2025, shortly after Linea’s token generation event. Gas fees paid in ETH flow to a collector contract, which covers infrastructure costs first, then allocates the remaining funds for burns.

This approach replaces traditional token incentives with a sustainable structure that directly ties network activity to scarcity and long-term value creation.

Linea is pairing its burn model with new ecosystem developments aimed at improving liquidity and institutional adoption.

DISCOVER: 20+ Next Crypto to Explode in 2025

Realignment With Ethereum’s Economic Core

In parallel, SharpLink has launched on Linea to enable institutional-grade capital markets functionality. This integration enables more advanced yield opportunities connected to Ethereum staking and restaking, thereby deepening the network’s connection to the broader DeFi landscape. Together, these upgrades reinforce Linea’s goal of balancing deflationary supply mechanics with active ecosystem utility.

Linea’s design channels value directly back into Ethereum’s monetary structure. Each transaction not only fuels the Linea network but also strengthens Ethereum’s long-term economic health. By burning both ETH and LINEA, the network reduces total supply, embeds sustainable yield into its operations, and positions itself as a model for future Layer-2s seeking real deflationary tokenomics.

This model creates an alignment between network usage, ETH demand, and LINEA scarcity, a loop that could make the project more resilient during market downturns and more attractive to developers and investors as activity returns.

EXPLORE: Metaplanet Secures $100 Million In New Funding: Is It Going To Buy The Dip?

LINEA Price Prediction: November 2025 Outlook

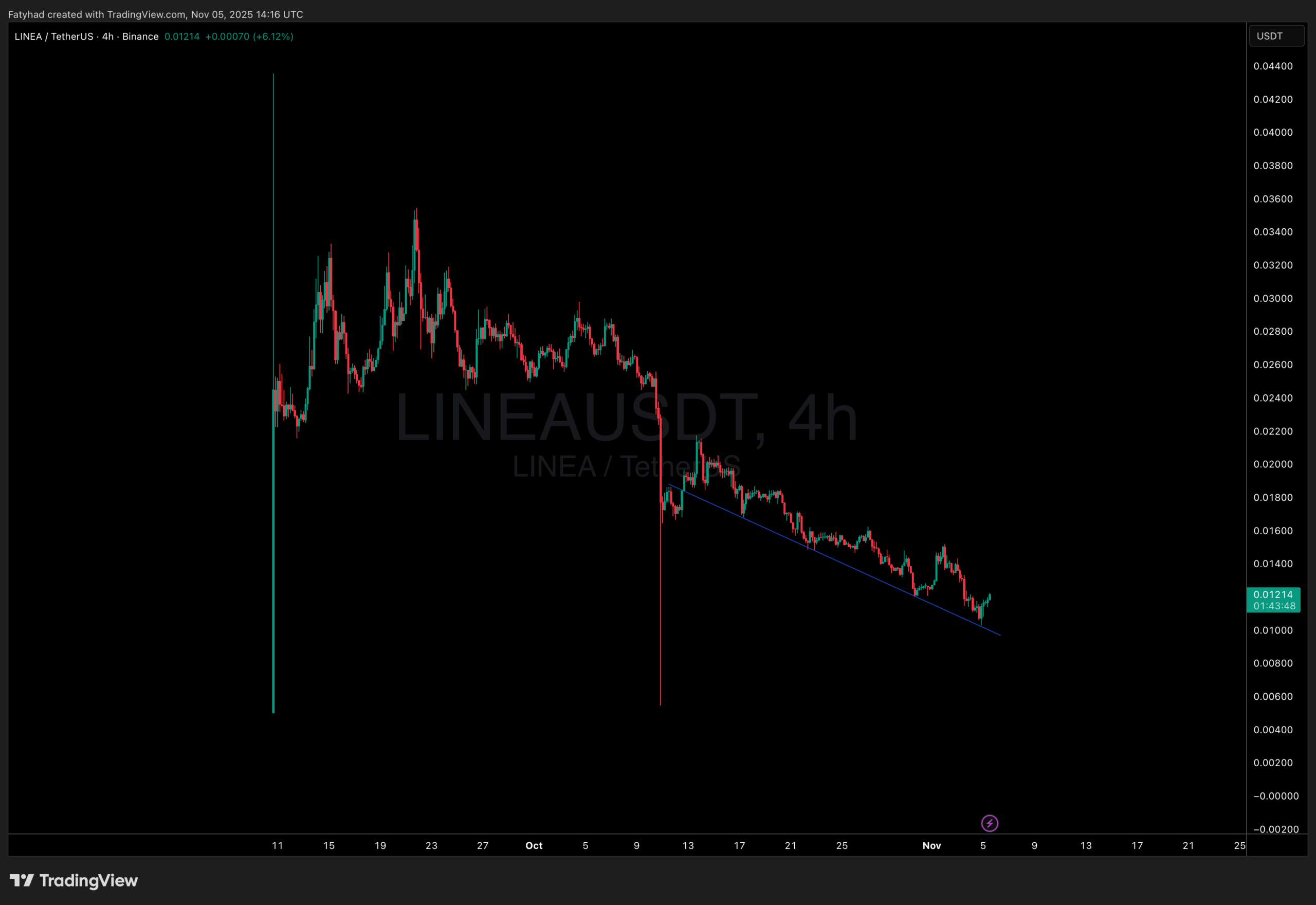

From a technical perspective, LINEA is now trying to consolidate after several months of decline, currently trading near $0.012. The token remains below a descending trendline formed in mid-October, but a clean breakout above $0.012 could signal a short-term reversal. If confirmed, traders may look for a move toward the $0.018–$0.022 range, especially if Bitcoin recovers above $100K level and market liquidity improves.

(Source: Coingecko)

However, in a sustained risk-off environment, LINEA may retest its lower support around $0.009 before forming a longer-term base. Given the network’s new deflationary model and ecosystem expansion, LINEA could emerge as one of the more fundamentally aligned Layer-2 tokens once broader sentiment stabilizes.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Key Takeaways

- Linea introduces Exponent: Linea’s new dual burn mechanism permanently removes both ETH and LINEA from circulation, creating a sustainable deflationary model aligned with Ethereum.

- Despite current market pressure, the Linea price prediction suggests potential recovery toward $0.02 in November 2025 if Bitcoin stabilizes above $100K.

The post Linea Exponent Goes Live: LINEA Price Prediction For November 2025 appeared first on 99Bitcoins.