POL Price Prediction: Can Polygon Recover After Blockchain Payments Consortium (BPC) News Hits Market Sentiment?

Polygon Price Prediction: Polygon’s native POL price has slumped as news about the payments consortium puts fundamentals back in focus.

Polygon’s native token POL slipped over the past day as traders assessed new activity in the payments sector that could influence on-chain use in the coming months.

On November 7, POL traded near $0.164, showing a decline of -4% and moving between $0.161 and $0.170 during the session.

Trading volume sat around $60–$110M, while the token’s market value held close to $1.7Bn.

What Does the New Payments Consortium Mean for Polygon’s Network Growth?

The move followed the formation of the Blockchain Payments Consortium (BPC) by seven blockchain groups, including Polygon Labs.

The new effort will work on shared technical and compliance standards for cross-network stablecoin transactions.

With over $15T settled onchain in 2024, stablecoins now move more than Visa and Mastercard combined.

We're proud to join the Blockchain Payments Consortium to help define a common framework and shape the future foundation for frictionless blockchain payments. https://t.co/rp9sRfbnQW

— Polygon (@0xPolygon) November 6, 2025

Backers say the group wants to make payments smoother across chains and borders.

They argue this could help cut through the fragmented systems that have slowed institutional interest in digital settlement.

If the consortium’s plan turns into working standards and shared tools, payment traffic across supported networks may pick up.

That would likely feed into fee revenue and day-to-day activity on chains such as Polygon.

DeFiLlama data shows about 4.9M transactions and 1.09M active addresses over the past day, with roughly $306M in DEX volume.

POL has traded in a tight band in recent weeks. The market is still adjusting to the network’s long move from MATIC to POL and its focus on ZK development, including zkEVM, AggLayer, and CDK-based chains.

Polygon says the token migration is essentially done. It adds that prior upgrades have helped reduce finality times on the PoS chain, which it argues should support payments and consumer-facing apps.

Members say the consortium is laying core plumbing for wider payments use.

The Stellar Development Foundation, one of the founding groups, described BPC as “a critical step” toward shared standards that let institutions move value across networks while meeting the data rules used in traditional payments.

If BPC teams meet their early goals and merchants or fintech firms test cross-chain payouts, Polygon could see increased activity, which may support throughput and demand for fees.

DISCOVER: Bank of England Rates Decision Looms as Fed Heads For Meeting: Next 1000X Crypto to Buy?

POL Price Prediction: What Does POL’s Downtrend Near $0.163 Signal for Traders?

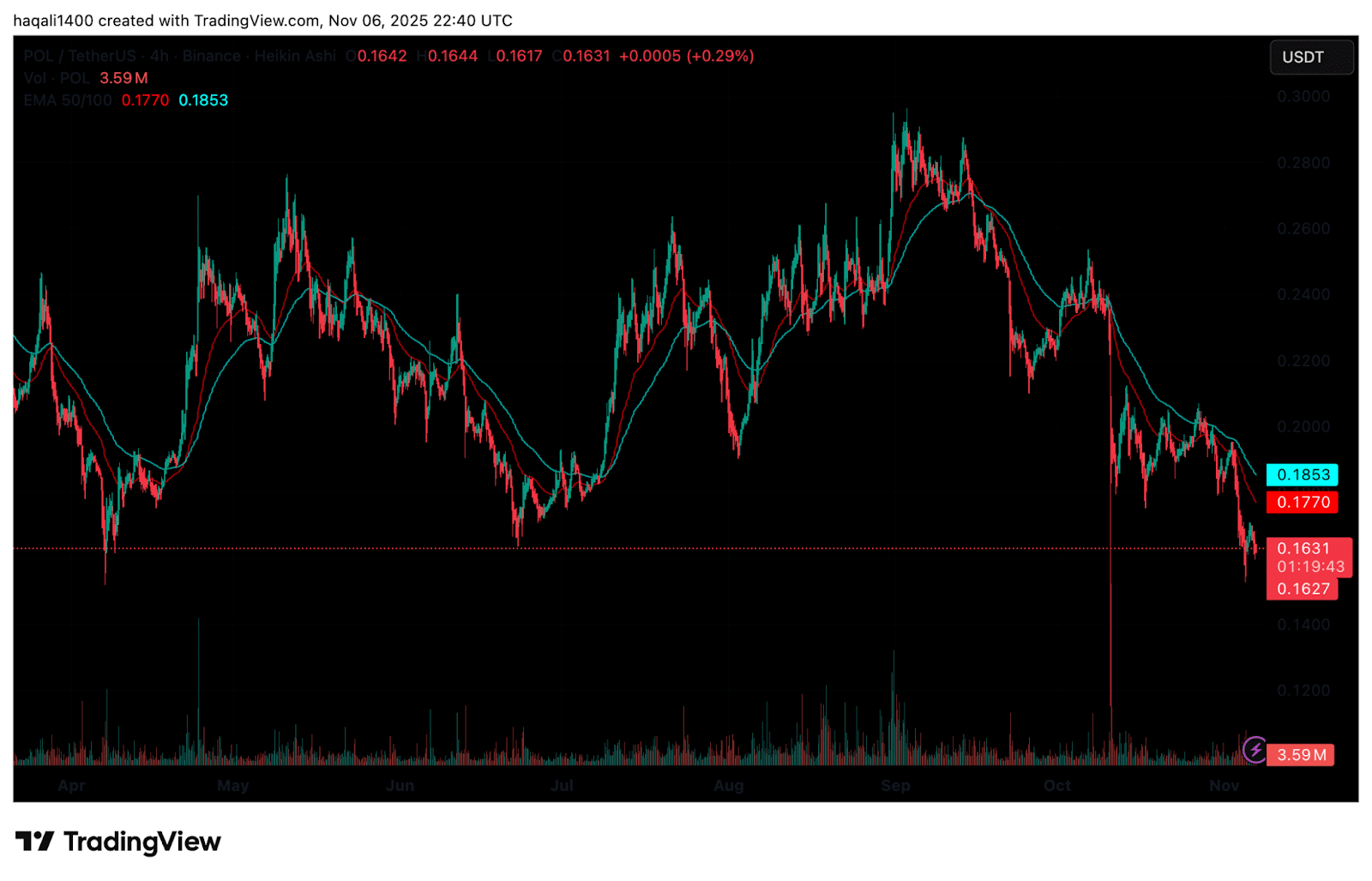

POL is trading near $0.163, sitting close to multi-month lows after a steady slide through late October and early November.

The chart indicates a steady downward trend. Since mid-September, the price has been making lower highs and lower lows, showing sellers remain in charge.

The token has tried several times to move back above its short-term averages, but each attempt failed. Both the 50- and 100-period EMAs now sit above the spot price, adding to the bearish bias.

(Source: POL USDT, TradingView)

Price slipped sharply after losing the $0.18–$0.19 support area. Small rebounds were pushed back near the moving averages, showing weak demand.

Volume has also picked up on the way down, which suggests active selling rather than a calm pullback.

There’s no strong reversal setup yet. The chart still shows exhaustion on the bid side, with little sign of momentum shifting. If today’s range breaks lower, the next key area many traders will watch sits near $0.15.

A move back over $0.18 would be an early sign of relief. Until then, the pressure stays to the downside.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

The post POL Price Prediction: Can Polygon Recover After Blockchain Payments Consortium (BPC) News Hits Market Sentiment? appeared first on 99Bitcoins.