Crypto News Today: BTC, ETH Rebound Modestly As US Shutdown End Comes Into Focus

In crypto news today, the market has rebounded based on the news of the US Government shutdown ending soon.

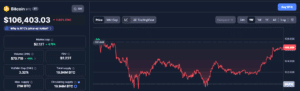

Bitcoin (BTC) has rebounded from its consolidation zone at $100k and $103.5k, where it has been since last week.

3.92%

Bitcoin

BTC

Price

$105,948.42

3.92% /24h

Volume in 24h

$54.73B

Price 7d

breached the $105k key support line and has been holding steady above it, currently trading at

.

In the last 24 hours, it has risen by 4.3% $106,330. This gain extended its weekend recovery, driven by bargain hunters after BTC’s steep drop in October.

(Source: CoinMarketCap)

Earlier in October, BTC fell into a bear trap and shed more than 20% of its value from its ATH, struggling to break past $110k and then eventually losing steam and testing the $99k-$100k support zone.

There was some optimism regarding a possible reversal based on the US-China trade deal in late October, but it was not to be. Crypto investments saw major outflows with BTC ETFs losing more than $2Bn in just eight trading sessions.

Stocks related to crypto also declined, with Coinbase and Strategy both falling more than 8% last week.

US spot $BTC ETFs are running dry on institutional ammo. Last 2 weeks: steady outflows of $150M–$700M daily- a sharp reversal from Sept/early Oct inflows that buoyed prices.Buy-side conviction cooling fast: profit-taking ramps up, fresh capital dries up, easing ETF pressure. pic.twitter.com/qpUwBVcTaO

— Crypto Whale (@CryptoWhale) November 8, 2025

Technically, BTC has broken through its consolidation phase and is trying to hold above $106k, between $106.3k and $106.7k. It will retest the $110k level soon.

The Relative Strength Index (RSI) has turned positive, currently at 57, indicating a lot more headroom before it reaches overbought territory.

(Source: TradingView)

BTC has historically rallied when interest rates have dropped. It happened in 2020 and 2023, with BTC jumping more than 30% after the Fed eased financial conditions.

EXPLORE: Top 20 Crypto to Buy in 2025

Crypto News Today: ETH Reclaims $3.5k, $3.7k Next?

6.26%

Ethereum

ETH

Price

$3,593.42

6.26% /24h

Volume in 24h

$33.65B

Price 7d

has bounced back after its sharp decline earlier this week. It has surged by more than 5% in the last 24 hours and is currently trading at

.

It is trying to hold steady above the $3.5k level after buyers stepped in when the price briefly fell near $3,058. Meanwhile, its support around $3.2k helped ETH gain momentum, especially since BTC also started to recover.

Technical indicators now suggest a growing bullish interest in the altcoin king as its price action has moved above a key trend line and has cleared half of its recent losses, pointing to a stronger short-term outlook.

BULLISH MACD CROSS!

$ETH held that $3,200 support line perfectly and now the momentum signal has flipped to green. pic.twitter.com/qYMKNqELlg

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s) November 10, 2025

Its next big resistance is at $3.7k. If ETH can close decisively above this level, it could further climb towards $3,820, a level where it has faced heavy selling pressure before.

(Source: TradingView)

However, if ETH fails to break above $3.7k, it could pull back again to its first support at around $3.580, followed by a more critical level at $3.5k.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

CoinShares: Global ETPs Face $1.2Bn Weekly Outflows

Global ETPs saw massive outflows, driven by post-liquidity volatility and investor profit-taking after recent price surges. Most of the withdrawals came from BTC-related products, which accounted for over $1Bn of the total.

Per the report, ETH ETPs also saw outflows, but to a lesser extent.

Crypto flow check

• $1.17B in total outflows from digital asset funds

• $BTC and $ETH led with $932M and $438M pulled

• $SOL stood out with $118M in fresh inflows

• Rate cut jitters still weighing on risk appetite

• Post-liquidity chop keeping traders cautiousFlows… pic.twitter.com/bW0f8F4CGc

— Kyledoops (@kyledoops) November 10, 2025

Although institutional interest in crypto is strong, short-term market turbulence and uncertainty around macroeconomic conditions have led to somewhat of a repositioning.

Meanwhile, trading volumes are still high despite the sell-off.

DeFi In Corporate Cash Flow? Execs Park Excess Cash In DeFi Vaults

David Pakman, managing partner at CoinFund, a crypto investment fund, highlighted the slow emergence of DeFi as a viable option for corporates looking to earn yield on idle cash.

Pakman explained that traditional corporate treasuries typically park funds in low-yield instruments like money market funds or short-term bonds. DeFi, on the other hand, can offer higher returns, sometimes in the 5-10% range, by lending stablecoins or participating in liquidity pools.

He emphasized that the infrastructure and compliance landscape around DeFi has matured, making it accessible and less risky for institutional players.

He believes that as more companies explore blockchain-based finance, DeFi could become a mainstream tool for treasury management.

Robert Kiyosaki: Bitcoin Will Reach $250K

Rich Dad Poor Dad author Robert Kiyosaki says he’s buying more gold, silver, Bitcoin, and Ethereum as he prepares for what he believes could be a sharp economic downturn.

In a post on X on Sunday, Kiyosaki warned that markets may be heading toward trouble. He said he’s shifting more of his money into what he calls “real money,” suggesting he sees these assets as safer than cash.

Kiyosaki said his view on gold is influenced by economist Jim Rickards.

CRASH COMING: Why I am buying not selling.

My target price for Gold is $27k. I got this price from friend Jim Rickards….and I own two goldmines.

I began buying gold in 1971….the year Nixon took gold from the US Dollar.

Nixon violated Greshams Law, which states “When fake…

— Robert Kiyosaki (@theRealKiyosaki) November 9, 2025

He also repeated his long-held call that Bitcoin could reach $250,000, arguing that BTC acts as protection against what he describes as the Federal Reserve’s “fake money.”

He pointed to growing interest in Ethereum, citing analyst Tom Lee from Fundstrat, and said he views ETH as the main network supporting stablecoins, a role he believes gives it weight in global finance.

Kiyosaki said his views are shaped by two key ideas: Gresham’s Law, which holds that weaker money replaces stronger money in daily use, and Metcalfe’s Law, which links a network’s value to the size of its user base.

Japan Plans to Tighten Crypto Custody Rules

Japan’s Financial Services Agency (FSA) is planning to chart a new framework that would require crypto custody and trading management service providers to register with the authority before working with exchanges.

With this framework, the FSA hopes to close security gaps exposed by prior accidents, most notably the 2024 DMM Bitcoin hack, where $312 million was stolen through a third-party software provider.

Japan’s Financial Services Agency (FSA) is considering introducing a new framework that would require crypto asset custody and trading management service providers to register with the regulator before offering services to cryptocurrency exchanges. The proposed rules would also…

— Wu Blockchain (@WuBlockchain) November 10, 2025

Currently, crypto exchanges in Japan follow strict asset management rules. But third-party software companies are not held up to the same standards.

The proposed rule will mandate that only registered custodians be used by the exchanges in Japan going forward.

EXPLORE: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

The post Crypto News Today: BTC, ETH Rebound Modestly As US Shutdown End Comes Into Focus appeared first on 99Bitcoins.