Stand Aside Shuttered High Streets: Is Coinbase the UK’s Next Big Bank?

Coinbase is taking a clear step toward mainstream finance in the UK. The company is introducing a savings account that resembles those typically found at traditional banks, offering a 3.75% AER on cash deposits.

The new account was announced on November 11 and is being offered first to selected users. It pays daily interest, doesn’t require a minimum balance, and allows instant access to funds.

Is Coinbase Now Competing Directly With UK Banks?

It also comes with FSCS protection, providing customers with the same level of safety they would expect from a high-street bank.

The product runs through ClearBank, but it sits inside Coinbase’s ecosystem. It provides users with a way to hold and earn interest on pounds without transferring money to another app or bank.

For Coinbase, it’s a strategic shift. It places the company in direct competition with UK banks and finance apps that market easy-access savings.

Funds are held with ClearBank and fall under FSCS protection, covering up to £85,000 per eligible person. Coinbase says this is the first UK savings account offered by a crypto-native exchange.

The launch follows Coinbase’s securing of VASP registration from the Financial Conduct Authority in February. Since then, the company has described the UK as its biggest market outside the United States.

The Bank of England kept the Bank Rate at 4.0% last week. This rate often helps guide variable savings products. FSCS protection remains £85,000, though the Prudential Regulation Authority has suggested raising the cap to £110,000.

DISCOVER: Top Solana Meme Coins to Buy in 2025

How Does Coinbase’s FSCS-Protected Savings Account Work?

Coinbase’s help pages say the savings rate can change, including after Bank of England decisions. Interest accrues daily and is paid once it reaches at least one penny.

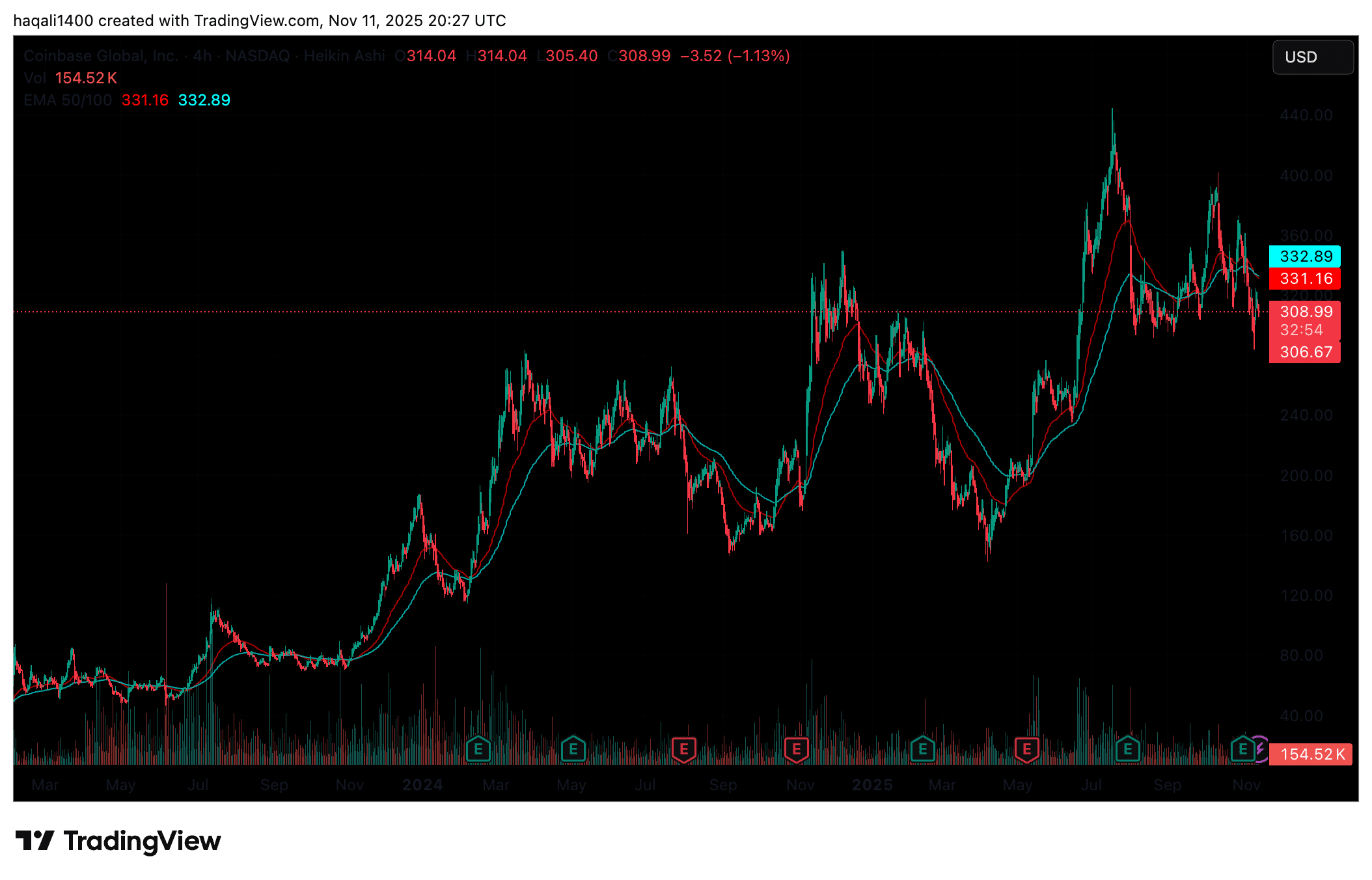

FSCS coverage applies across all funds held with ClearBank. Coinbase shares slipped to about $310.78 on Tuesday as the wider crypto market cooled.

Chief executive Brian Armstrong said offering “a high-interest and instant-access savings account” inside the Coinbase app is part of its effort to modernize financial services for users in the UK

ClearBank UK’s chief, Emma Hagan, described the partnership as a means to link traditional money and digital assets, according to comments shared with Finextra and ClearBank.

The move places a bank-style, FSCS-protected savings feature inside a crypto platform, narrowing the gap between exchanges and conventional banks.

It could help Coinbase keep customer deposits on its platform for longer and increase cash balances.

The rollout also tests how far regulated banking services can be built into digital-asset firms.

Industry watchers say Coinbase has tightened its compliance in Britain over the past year, while European supervisors continue to examine anti-money laundering practices across the sector.

EXPLORE: How to Buy Bitcoin Anonymously in 2025

The post Stand Aside Shuttered High Streets: Is Coinbase the UK’s Next Big Bank? appeared first on 99Bitcoins.