Did Bank of England Stablecoin Blunder Just Spook $2Bn Coinbase Deal?

Acquisition talks between Coinbase and the UK-based stablecoin infrastructure startup BVNK have fallen through, according to a report from Fortune yesterday (November 11). Although not mentioned, there is a strong possibility that the recent Bank of England stablecoin framework proposal contributed to Coinbase’s decision to walk away from the deal.

The proposed deal would have seen Coinbase acquire BVNK for an estimated $2Bn, and would’ve been a huge move for the UK/GBP stablecoin industry. However, the messy and restrictive proposal by the Bank of England has likely spooked many Web3 firms from entering the UK market.

coinbase has reportedly pulled out of its planned

$2 billion acquisition of BVNK ( uk based stablecoin startup)the two companies described the breakup as mutual but insiders suggest regulatory uncertainty, valuation disagreements and compliance exposure were the real deal… pic.twitter.com/MPWJjgZCkP

— Iptisha | Circulox.org (@iptishax) November 12, 2025

Coinbase Speaks: “Both Parties Agreed to Not Move Forward”

Speaking to Fortune, a Coinbase representative said, “We’re continuously seeking opportunities to expand on our mission and product offerings, after discussing a potential acquisition of BVNK, both parties mutually agreed to not move forward.”

Before collapsing, the talks between the parties appeared to be progressing well, and it seemed they were close to reaching a deal, potentially by the end of the fourth quarter of this year.

In late October, it was announced that BVNK had entered into an exclusivity arrangement with Coinbase, which meant the startup could not negotiate with any other parties. This signaled that the deal was nearly finalized, pending due diligence.

The reasons for the sudden breakdown of the deal have not been disclosed. Still, it is entirely possible that the fallout from the Bank of England’s stablecoin framework proposal contributed to the issue.

In the proposal, it stated the UK investors would have a holding limit of £20,000 per UK-based stablecoin, which was lambasted as anti-innovation by retail investors and institutional players within the crypto space.

Had the deal gone through, it would have been one of the largest acquisitions ever for a stablecoin startup, nearly double the size of Stripe’s $1.1Bn acquisition of the stablecoin startup Bridge in February 2025.

DISCOVER: Top Solana Meme Coins to Buy in November 2025

Coinbase Partners With Citi for Fiat and Blockchain Institutional Settlements

We’re collaborating with @Citi to build the future of payments.

→Exploring making it easier for Citi clients to use digital assets

→Unlocking the power of stablecoins for payments

→Improving on and off-rampsTime to make digital assets an integral part of the global economy. pic.twitter.com/jGaTZ8wPRf

— Coinbase

(@coinbase) October 27, 2025

Although Coinbase has walked away from its move into the UK stablecoin market, the firm is still ploughing ahead with other growth initiatives in the region. The US-based exchange announced a new partnership with Citi in October to offer 24/7 digital asset payments to institutions.

Coinbase claims the collaboration will enhance existing settlement arrangements partly through the use of blockchain technology. The joint project will initially focus on streamlining Coinbase’s own on and off-ramp systems, as well as improving payment coherence for Citi’s institutional clients.

Eventually, the new payment system will also incorporate stablecoins to bridge the gap between fiat and blockchain settlements, with updates expected on this front in the coming months. It is possible that Coinbase would have incorporated the BVNK stablecoin bank into its Citi settlement project if the acquisition had been completed.

“Citi’s global network and expertise in payments make them an ideal partner as we work to advance digital asset capabilities,” said Brian Foster, Global Head of Crypto as a Service at Coinbase. “By combining their reach with Coinbase’s leadership in digital assets, we’re creating solutions that can simplify and expand access to digital asset payments.”

Q3 Earnings Report Bullish for Coinbase as Director Sells $3M COIN Shares

In other Coinbase-related news, Coinbase, the digital asset exchange, reported strong third-quarter results for 2025, with transaction revenues more than doubling compared to the same quarter in the previous year.

Additionally, subscription and services revenue surpassed the high end of management’s guidance, resulting in better-than-expected performance in both revenue and earnings.

The strong financial results for Coinbase have led to its Director, Frederick R. Wilson, selling 9,180 shares of Class A Common Stock on November 6, 2025, for approximately $3,014,586. The sales were executed at prices ranging from $295.43 to $312.13.

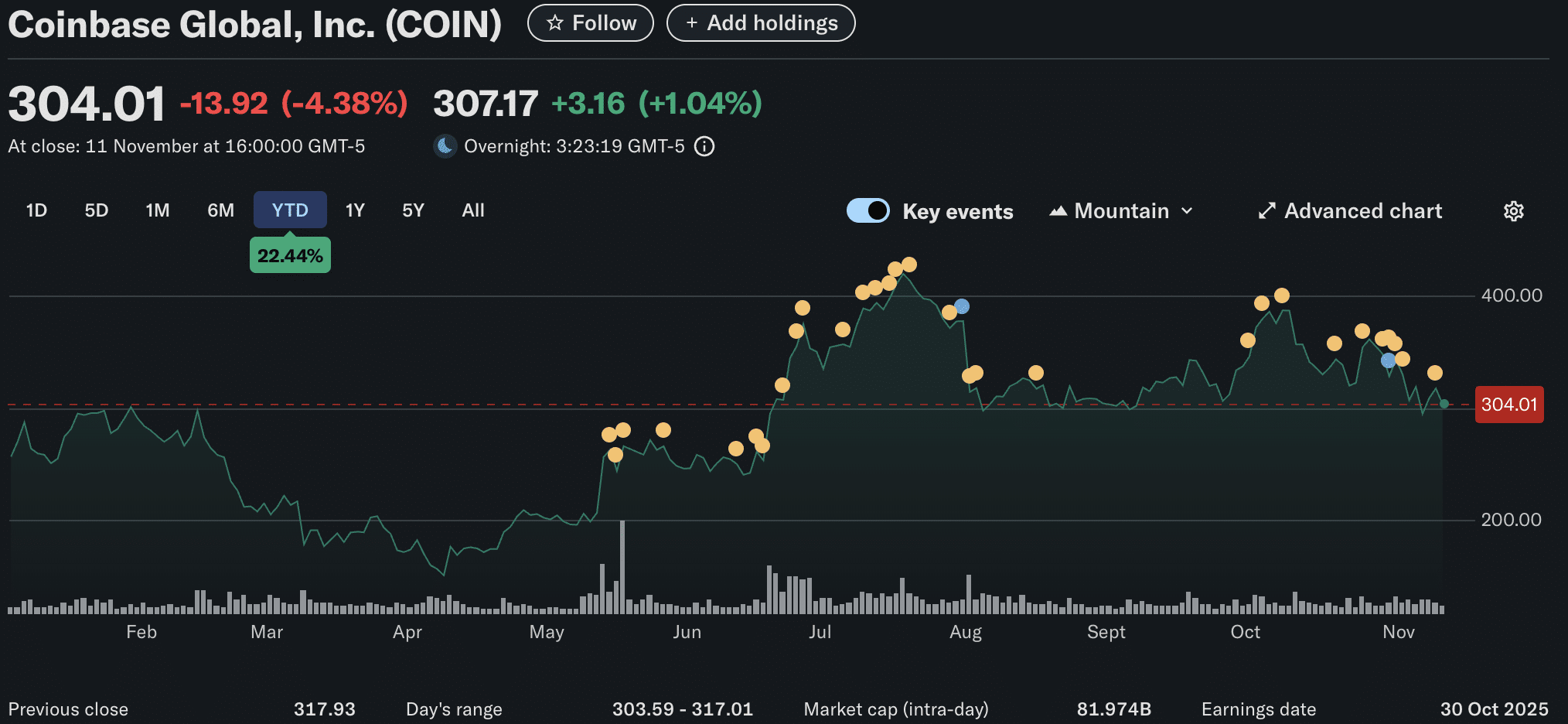

Coinbase stock, COIN, closed yesterday’s trading session at $304.01, dropping -4.3% in the past 24 hours. However, it is up +22% year-to-date, with the company now valued at $81.9Bn by market cap.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Did Bank of England Stablecoin Blunder Just Spook $2Bn Coinbase Deal? appeared first on 99Bitcoins.