After Uniswap Fee Switch, Will Wash Trading And Scam Pools Disappear Overnight?

Undoubtedly, Uniswap is the OG of DeFi. Without their AMM innovation of late 2018, DeFi would have taken a few more months or years to find a low-fee, easy solution for the decentralized swapping of the now thousands, if not millions, of tokens.

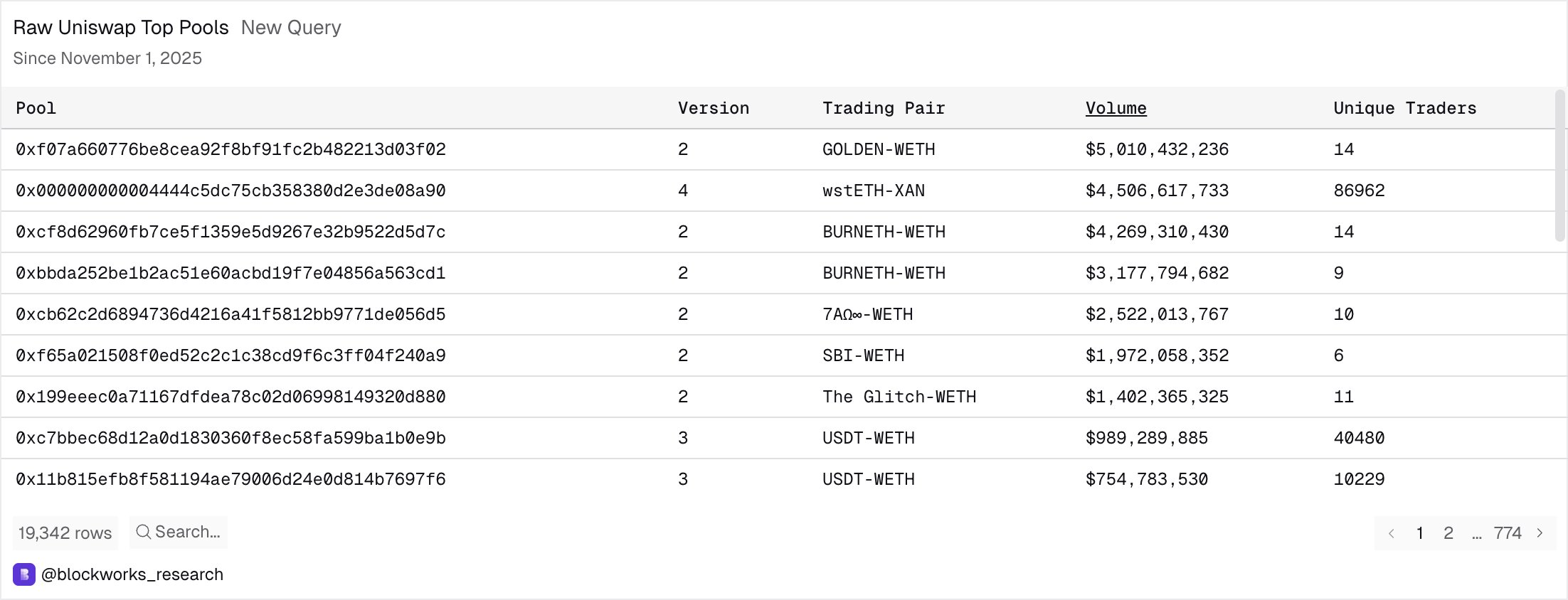

After their AMM miracle of Q4 2028, Uniswap has grown to be one of the top DeFi protocols. As of November 12, it is the top DEX by total value locked (TVL). A big chunk of the $4.9 billion under management is in Ethereum and its layer-2s.

(Source: DefiLlama)

The $4.9 billion is owned by diverse users, including projects and retailers, supplying liquidity for a share of the +0.30% fee. However, there is a proposal to change how this fee is distributed, allocating a tiny portion to UNI token buying and burning.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Uniswap Fee-Switch: Everything You Need To Know

On November 10, Hayden Adams, the founder of Uniswap, posted on X. He proposed a Uniswap fee switch that will redirect a portion of the pool’s trading fee to Uniswap, benefiting UNI token holders.

As it stands, all fees, +0.3% on v2 pools or tiered rates on v3, which supply concentrated liquidity, are entirely allocated to liquidity providers.

Today, I’m incredibly excited to make my first proposal to Uniswap governance on behalf of @Uniswap alongside @devinawalsh and @nkennethk

This proposal turns on protocol fees and aligns incentives across the Uniswap ecosystem

Uniswap has been my passion and singular focus for… pic.twitter.com/Ee9bKDric5

— Hayden Adams

(@haydenzadams) November 10, 2025

If the proposal is approved, the switch would allocate fees as follows.

0.25% to liquidity providers and 0.05% to the protocol on Uniswap v2 pools. On Uniswap v3, protocol fees will be set at a quarter or a sixth of the liquidity provider fee, depending on the tier.

This change effectively creates a UNIification. The protocol will use the funds received to purchase UNI from the market and burn them.

Additionally, the proposal seeks to eliminate the Uniswap Lab’s front-end fees and burn roughly 100 million UNI from the treasury, while also redirecting Unichain’s sequencer fees to the burn mechanism.

With buybacks and token burning, UNI holders will benefit from direct value accrual, unlike the current architecture.

DISCOVER: Top 20 Crypto to Buy in 2025

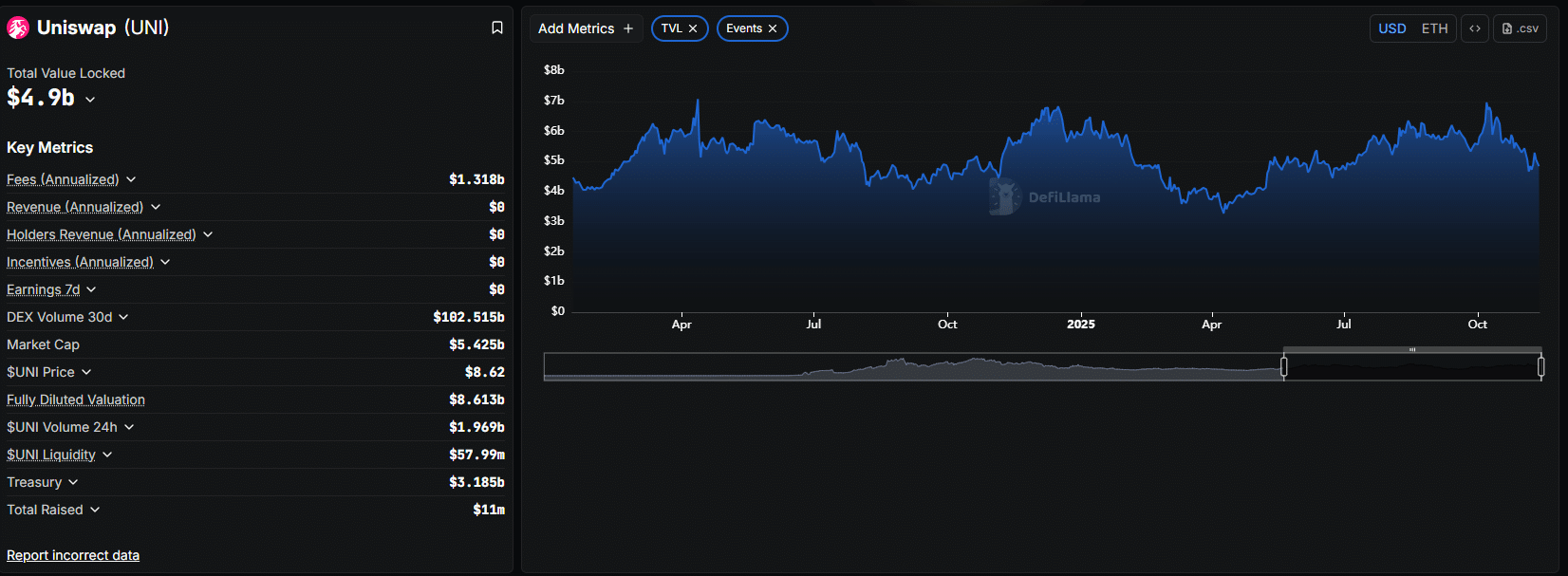

Will This Fee Switch Kill Wash Trading And Scam Pools On Uniswap?

In response to this proposal, the UNI USD price surged. It continues to trend on multiple crypto trackers, including Coingecko.

UNI crypto is up +65% in the last week alone. And if buyers push on, the DeFi coin might break above $10.

Besides the sharp price spike, analysts on X believe that, with a portion of fees from liquidity providers redirected to UNI token burning, wash trading will “vanish” overnight.

(Source: OXSharples, X)

In a post on X, one observer said scammy liquidity pools, some of them engaged in automated rug pulling, rely on zero protocol fees to thrive.

So, one thing a fee switch will do is make scammy pools (honeypots, automated rugs, etc.) vanish overnight. These rely on the protocol take rate being exactly 0.

By my rough estimation, half of recent Uniswap volume on Base falls into this camp.

Uniswap’s official Dune tracker… https://t.co/M0Wg4eVJEX pic.twitter.com/Jmh2A9Z3h5

— jpn memelord

(@jpn_memelord) November 11, 2025

On Base, he estimated that over $130 billion of volume generated on Uniswap so far in 2025, are linked to scam pools and wash trading.

Once the fee switch is activated, likely in December after community approval, most of them won’t be incentivized to operate since they have nothing to lose.

Wash trading will also be costly since the +0.05% protocol fee directly siphons revenue from fake trades. This, in turn, erodes profitability for manipulators.

Without scam pools and wash trading, Uniswap metrics will reveal the true state of its ecosystem, while drastically boosting volume quality.

On the downside, trading volume on Uniswap may decrease. This will lead to fewer UNI being bought and burned than initially projected based on the current volume.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

After Uniswap Fee Switch, Will Wash Trading And Scam Pools Disappear Overnight?

- Uniswap is the top DEX in crypto.

- Over $4.9 billion locked in Uniswap.

- Founder proposes fee-switch.

- Will this eliminate scam pools and wash trading on Uniswap?

The post After Uniswap Fee Switch, Will Wash Trading And Scam Pools Disappear Overnight? appeared first on 99Bitcoins.