Crypto News Today: No BTC Moonvember This Year, Price Consolidates Above $104k

In crypto news today,

1.95%

Bitcoin

BTC

Price

$104,714.54

1.95% /24h

Volume in 24h

$48.32B

Price 7d

is currently holding steady above $104,000 after briefly breaching $106,000 earlier this week. On Monday, its price action climbed to $106,453, but could not break past that level and dropped nearly 3% the next day.

Currently trading at

, it is down by 0.35% in the last 24 hours. However, on the weekly chart, it is still up by 3.35%, recovering slightly.

The price action suggests that BTC is in a consolidation phase. However, the upcoming US economic updates and the end of the US government shutdown could shake things up and bring more price swings.

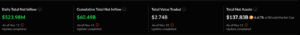

So far, that bit of news hasn’t done anything to BTC’s price action, but you never know. At the same time, institutional interest in the crypto gold is growing. US-listed BTC ETFs saw over $520M in new investments on 11 November 2025.

(Source: SoSoValue)

From a technical perspective, if BTC can close above $106,453, it can continue to climb towards the next key level at $109,755. The Relative Strength Index (RSI) is at 53, indicating a neutral state in that the market is currently uncertain and waiting for a catalyst for the next leg up or down, depending on the news.

(Source: TradingView)

The sideways crawling of BTC has dashed any hopes for a Moonvember pump. However, all is not lost yet. Historically, November has been a strong month for BTC, averaging around 41.78% of gain since 2013, as per CoinGlass’s data.

Crypto traders believed that BTC’s fundamentals are strong and that BTC is still undervalued compared to other investments.

As promised, here is my 11 minute Bull Case For Bitcoin at todays price:

TLDR – Fundamentals are strong, Context is VERY constructive relative to previous “cycles” and we are at the BOTTOM, not the top of the range, relative to other financial assets. pic.twitter.com/pizZ8oOmoy

— Dave W (@daveweisberger1) November 11, 2025

EXPLORE: Top 20 Crypto to Buy in 2025

Crypto News Today: BTC Likely Bottomed Out At $98K

It appears that BTC might have found its bottom for the short term at $98,000. Crypto trader Mayne pointed out that this level matches past cycle lows seen at $25,000, $50,000, and $75,000. Moreover, it lines up with BTC’s 50-week moving average.

The rebound to $106,000 earlier this week, before consolidating, suggests that the market has not given up on BTC altogether.

In his podcast, Mayne said that if BTC can manage to climb back above $110,000, it could pave the way for new all-time highs. In the short term, however, resistance is expected around $105,000 to $107,000.

Important level. https://t.co/ifTgsnqvNF pic.twitter.com/oQDT82u9Bb

— Mayne (@Tradermayne) November 11, 2025

He predicts a possible 50%-60% rally from the $98,000 low, which can potentially push BTC to $140,000- $160,000 level or even to 200,000 in what he calls a “giga blowoff rally” by late December or early 2026.

Mayne said that he is optimistic as long as the price remains above $98,000. If at all the price slides below $98,000, or fails to reclaim the $110,000 level, it will mean the end of the current cycle.

Everyone claiming $BTC won’t have massive corrections anymore, no more 4 year cycle

But what if it’s really this simple pic.twitter.com/JpllxpAouD

— Guy (@Credib1eGuy) October 30, 2025

He continues to follow BTC’s 4-year cycle pattern and is expecting the next peak in late 2025 or early 2026, followed by a downturn.

He also noted the market’s current fear and negative sentiment could actually be a sign of a coming surge. “Either way, I think the end is soon,” he said. “The vast majority of 2026 is going to be bearish.”

EXPLORE: 20+ Next Crypto to Explode in 2025

JPM Coin Launches On Base

According to a Bloomberg article published on 12 November 2025, JPM Coin’s launch on Base marks the first major instance where traditional banks have begun to use public blockchains in earnest for real-world money transfers.

With this launch, institutional clients can send and receive USD payments instantly, any time of the day, and without having to wait for regular banking hours to start.

BREAKING:

JPMORGAN just launched its on-chain deposit token ( $JPM Coin) for institutional clients, marking a major shift from trad-fi to real blockchain rails.

When the biggest bank goes on-chain… you know what’s next!

pic.twitter.com/TATajVhgpe

— Wise Advice (@wiseadvicesumit) November 12, 2025

The coin itself is backed by actual deposits at JPMorgan, making it a secure and regulated way to settle transactions on-chain.

Right now, only verified institutions can use JPM Coin on Base. But the banking giant hopes to eventually offer access to its clients, depending on regulatory approval. The token can also be used as collateral on Coinbase.

This launch builds on JPMorgan’s earlier pilot programs with Mastercard, Coinbase, and B2C2 and follows a roadmap it shared earlier in June 2025.

Chainlink ETF Debuts On DTCC

Bitwise’s Chainlink ETD has officially appeared on the Depository Trust & Clearing Corporation (DTCC) website. It has been categorized as both active and pre-launch.

It is a positive step, but it does not guarantee approval from the U.S. Securities and Exchange Commission (SEC). The decision is currently delayed due to the US Government shutdown.

Bitwise Chainlink ETF $CLNK listed on DTCC pre-launch funds list

$LINK pic.twitter.com/4sgYnxGkE5

— Zach Rynes | CLG (@ChainLinkGod) November 12, 2025

The ETF aims to give institutional and retail investors direct exposure to Chainlink’s token,

5.12%

Chainlink

LINK

Price

$16.07

5.12% /24h

Volume in 24h

$811.55M

Price 7d

. There was a lot of bullish sentiment regarding the listing, but its price fell by 5% to $15.52, following a failed attempt to break the $17.40 resistance.

Kraken CEO Slams UK Crypto Rules For Stifling Innovation

Kraken CEO Arjun Sethi has criticized the UK’s strict crypto promotion rules. He has argued that they create unnecessary friction for users and discourage broader adoption, stifling growth.

He compared the required risk warnings to cigarette labels, saying they make crypto platforms feel hostile to new users. Sethi believes that these rules, introduced by the FCA (Financial Conduct Authority), are overly restrictive and block UK users from accessing around 75% of crypto products, including staking and lending services.

Kraken’s co-CEO warns that new UK regulations intended to protect crypto users are actually harming them. It’s crucial to find a balance that safeguards users without stifling innovation!

#CryptoNews #UKRegulations pic.twitter.com/ana95qCUXn

— The Lebowski (@TheLeebowski) November 12, 2025

FCA has, in the meantime, defended its position as a way for consumers to make informed choices. Sethi further said that excessive disclosures and multi-step processes could drive users away from crypto entirely.

The post Crypto News Today: No BTC Moonvember This Year, Price Consolidates Above $104k appeared first on 99Bitcoins.