Why is Crypto Crashing Now? Bitwise CIO Shocks Market With Massive Prediction

Thursday puuuump. Some get gains and others fear the dump. Dumping paaaaain. You should stop buying the top agaaaaaain. *Ahem* Chocolate Rain references aside, why is crypto crashing now?

Well, Bitwise CIO Matt Hougan says the real bull run isn’t coming this year but lining up for 2026. Speaking at The Bridge Conference in New York, he argued that the missing late-2025 rally, usually the last gasp before a cycle top, may have rewired the script. Instead of another blow-off peak, he sees the market coiling for a deeper, longer surge.

“I’m actually more confident in that quote,” Hougan told Cointelegraph. “The biggest risk was if we ripped into the end of 2025 and then we got a pullback.”

DISCOVER: 20+ Next Crypto to Explode in 2025

Why is Crypto Crashing Now? Bitwise CIO Predicts 2026 Crypto Boom

1.28%

Bitcoin

BTC

Price

$102,565.94

1.28% /24h

Volume in 24h

$57.67B

Price 7d

According to Santiment, social sentiment for the big three – Bitcoin, Ethereum, and XRP -has slipped into full bearish mode. While sentiment for Bitcoin is holding steady, XRP is drowning in negativity not seen since early 2025, a classic setup for exhausted sellers.

The Fear & Greed Index agrees, collapsing to 15/100. It hasn’t been this bleak since February, which is exactly why smart money thinks 2026 is where the real move begins.

“The underlying fundamentals are just so sound,” Hougan said. “Institutional investment, regulatory progress, stablecoins, tokenization—those forces are too big to keep down.”

Crypto Fear and Greed Chart

1y

1m

1w

24h

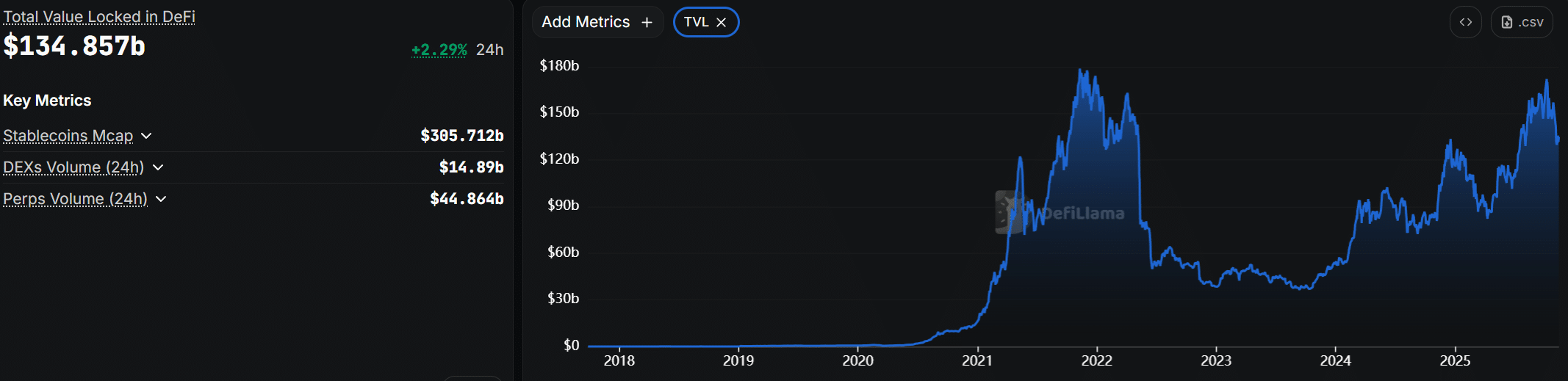

According to DeFi Llama, the total value locked (TVL) in DeFi protocols has stabilized around $135 Bn, up 38% since January.

Meanwhile, CoinGecko data shows Bitcoin trading at $101,762 and Ethereum at $3,416 which is well, well below the $250,000 and $15,000 targets floated by Arthur Hayes and Tom Lee.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

The Smart Money Is Betting on 2026, Here’s Why

99Bitcoin analysts note that such extreme fear has historically coincided with accumulation phases, with Glassnode data confirming that long-term holders are increasing their positions while short-term traders exit. This is with the exception of a few ancient Bitcoin whales that have cashed out entirely.

“Crypto-native retail is depressed,” Hougan said. “They got burned by FTX, memecoins, and the 10/10 liquidation. But traditional retail, [like] people buying through ETFs, are still coming in.”

I see stories about “old whales dumping bitcoin”, but the data does not support those stories.

Almost 7 million BTC transacted onchain in 2025. Most BTC came from 2024 transactions. One big 84k BTC 2011 whale. And some 2017-2023 sellers. But that’s it, business as usual. pic.twitter.com/w2aHjJ3XmD

— PlanB (@100trillionUSD) November 12, 2025

ETF inflows back up what Hougan is saying. Glassnode data shows net inflows into spot Bitcoin ETFs exceeding $18 Bn year-to-date, underscoring steady institutional appetite. Hougan says this structural shift of institutions leading the charge in crypto will continue to define the next cycle.

If history rhymes, 2026 could mirror 2020’s explosive recovery after a year of capitulation and disbelief.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Key Takeaways

- Bitwise CIO Matt Hougan says the real bull run isn’t coming this year but lining up for 2026.

- ETF inflows back this up. FRED data shows net inflows into spot Bitcoin ETFs exceeding $18 Bn year-to-date.

The post Why is Crypto Crashing Now? Bitwise CIO Shocks Market With Massive Prediction appeared first on 99Bitcoins.