Binance Accused of Coordinated POPCAT Market Attack on Hyperliquid

Early yesterday (November 12), a coordinated attack on Hyperliquid resulted in nearly $5M being wiped out from the protocol’s Hyperliquidity Provider (HLP) vault. An anonymous trader used $3M in capital to manipulate the POPCAT market, triggering cascading liquidations.

Binance and its founder, CZ, were quickly accused of being behind the attack, with CZ quickly moving to distance himself from the situation, stating, “I have not used any other CEX for 8 years.”

HYPE

0.48%

Hyperliquid

HYPE8

Price

$38.67

0.48% /24h

Volume in 24h

$298.66M

Price 7d

is down -4% today as fear surrounding the situation ramps up, with analysts saying the attack shows that those with deep enough pockets can financially disrupt the Hyperliquid platform.

Someone just manipulated $POPCAT to attack #Hyperliquid, burning through $3M of their own funds — and causing $4.9M in losses for the Hyperliquidity Provider (HLP).

The attacker withdrew 3M $USDC from #OKX yesterday, split it across 19 wallets, and deposited it into #Hyperliquid… pic.twitter.com/lnwsRSspFv

— Lookonchain (@lookonchain) November 13, 2025

Analytics Firm Lookonchain Were the First to Report the Attack

Blockchain analytics company @Lookonchain reported that the incident began at around 4:30am UTC on November 12, when the attacker withdrew $3M in USDC from the OKX crypto exchange and split the funds into 19 different wallets.

The trader then deposited these assets into Hyperliquid to open over $26 million in leveraged long positions tied to HYPE, the platform’s POPCAT-denominated perpetual contract.

Next, the trader created a $20M buy wall near the $0.21 price point. This wall sent an artificial signal of strength to the market, pushing prices upward, only for the orders to be canceled afterward. When this buy wall collapsed, liquidity thinned, and the support for prices vanished.

As a result, numerous highly leveraged positions were forced into liquidation, leading to significant losses absorbed by the HLP. In the aftermath, Hyperliquid’s vault revealed a loss of $4.9M, marking one of the largest single-event losses the platform has experienced since its launch.

Interestingly, while the attack caused substantial damage to Hyperliquid, the trader’s initial $3M investment was entirely wiped out. This suggests that the attacker has deep pockets and their motive was to inflict damage to the Hyperliquid platform, rather than to turn a profit.

This event was different from typical market manipulation incidents in that the attacker did not emerge with any profits. Instead, the structure of the trade indicated a goal of creating artificial liquidity only to collapse it, drawing Hyperliquid’s vault into a liquidation cascade.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Varied Community Reaction to the Hyperliquid Attack

hyperliquid is going to go insolvent longing popcat

cz on watch

— jintao.rivn (

,

) (@hellojintao) November 12, 2025

Reactions from the community varied. One member speculated that the $3 million was hedged, implying that the attacker had open positions locked in elsewhere. Another user described the event as “the costliest research ever.” Some suggested that it was not an attack but rather a $3M performative art piece, saying, “Only in crypto do villains burn millions for the plot.”

There were also multiple comments from people accusing Binance and CZ of being behind the attack, due to the longstanding competition between the two platforms, which has often resulted in subtle jibes being traded between oneanother.

On Thursday, community member @jconorgrogan reported that the Hyperliquid bridge had stopped processing withdrawals. The developer indicated that the contract was paused using the “vote emergency lock” function, only to announce an hour later that withdrawals had been re-enabled.

Throughout the entire drama, Hyperliquid did not make any official announcements regarding the POPCAT incident, the attacker who caused $4.9M in losses, or the temporary freeze on withdrawals.

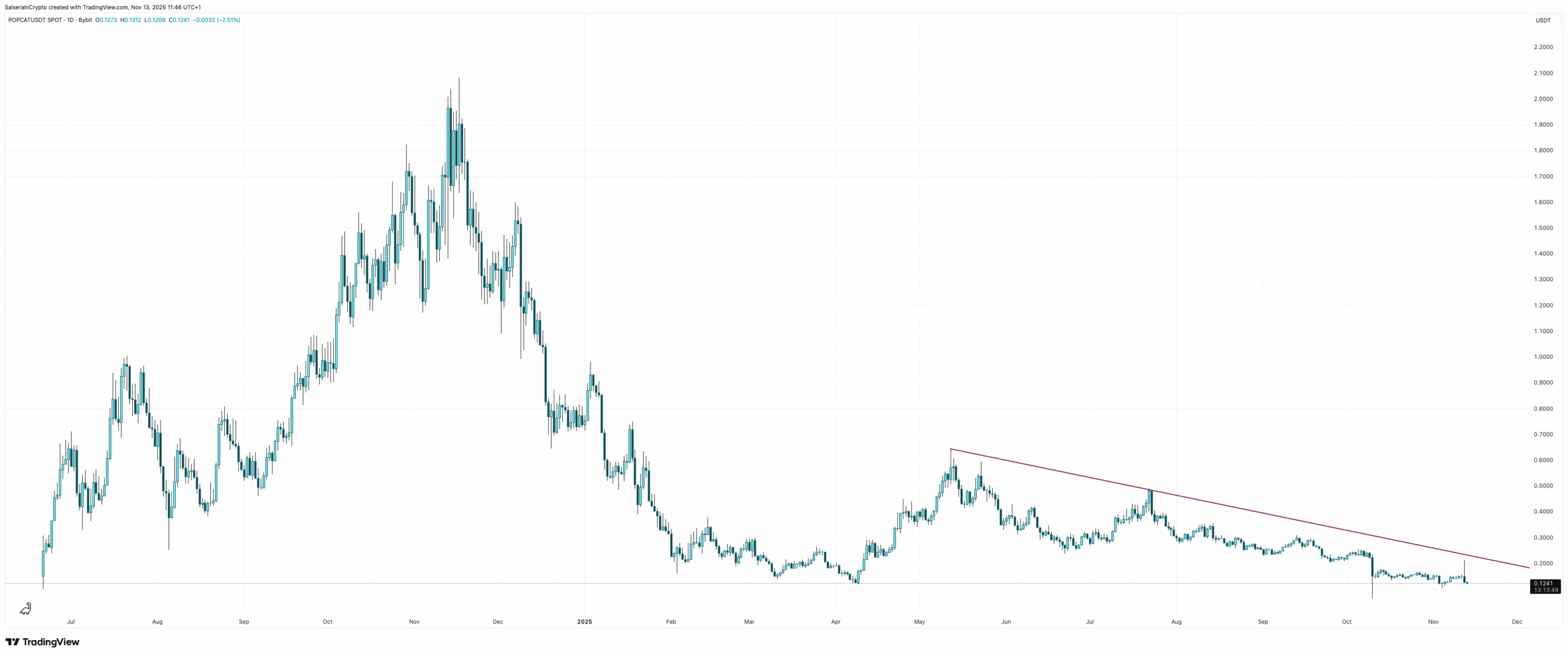

POPCAT Down -25% Today Following Hyperliquid Shenanigans

POPCAT crypto was an unfortunate casualty of yesterday’s attack, resulting in a nearly $5M loss to the platform. The Solana memecoin is down 25% in the past 24 hours, as the fallout from its use in an attack on Hyperliquid continues to affect the price.

There was a brutal flush on POPCAT that resulted in $25M in liquidations, giving it a hard reset at a time when memecoins are already struggling to keep their heads above water.

It is now sitting in a key support and accumulation zone at $0.12, but is worryingly down -94% from its all-time high of $2.05, which was reached exactly one year ago during the peak POPCAT mania.

HYPE has been less affected by yesterday’s attack and is currently down only -3.5% today, trading at $39, which represents a -34% decrease from its all-time high of $59.30, according to CoinGecko data.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Binance Accused of Coordinated POPCAT Market Attack on Hyperliquid appeared first on 99Bitcoins.