CME Group’s New Plan to Dominate Prediction Markets

CME Group is bringing prediction markets closer to everyday users in one of its most direct shifts from Wall Street to Main Street.

FanDuel, the US sports-betting leader, and CME Group, the world’s largest derivatives exchange, said late Wednesday that they will roll out a new prediction-markets app in December. The app, called FanDuel Predicts, will let people trade on outcomes tied to sports, major stock indexes, energy prices, and US economic data.

It will be available only in states where online sports betting is still prohibited. The two companies announced the partnership on November 12 in New York and Chicago.

The plan is straightforward: meet rising interest in prediction markets and use CME’s regulatory framework to stay within federal rules.

Will FanDuel Predict Offer Crypto, Commodity, and Index Contracts?

A joint statement on PR Newswire said FanDuel Predicts will launch as a separate mobile app. It will let users buy and sell event contracts priced between $0.01 and $0.99.

Each contract is a simple yes-or-no question. Users get a fixed payout at settlement if the outcome hits.

The product will focus on two groups of markets. On the sports side, FanDuel will list contracts tied to baseball, basketball, football, and hockey.

These will only appear in states where online sports betting is still illegal, and none will run on tribal lands. FanDuel says it will pull sports contracts as soon as any state approves online sports wagering.

The second group covers financial and economic outcomes. Users in eligible states will be able to trade contracts linked to the S&P 500, the Nasdaq-100, and major commodities such as oil, gas, and gold.

The app will also include cryptocurrency markets and economic indicators like US GDP and CPI.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Why Are CME’s $20 Daily Event Contracts Popular With Retail Traders?

New customers will have to clear FanDuel’s full identity checks before they can take part.

They must provide their date of birth, Social Security number, home address, bank details, and a valid ID. These are the same requirements FanDuel uses for its sportsbook.

CME opened the door to event contracts in 2022 with products tied to its major futures benchmarks, including WTI crude, natural gas, the E-mini S&P 500, the Nasdaq-100, the Dow, the Russell 2000, euro/dollar FX, and several metals.

Each contract costs $20 and settles on a simple outcome, whether the underlying future closes above or below a set level by the end of the day.

It gives retail traders a clear and limited-risk way to take a view on major markets.

CME now plans to expand the format in the fourth quarter of 2025. The exchange will offer 24/7 trading in new swap-based event contracts, with yes/no positions that start at $1.

The first group will cover cryptocurrencies and key economic indicators such as US GDP and CPI. These contracts will be available worldwide through any futures commission merchant that chooses to support them.

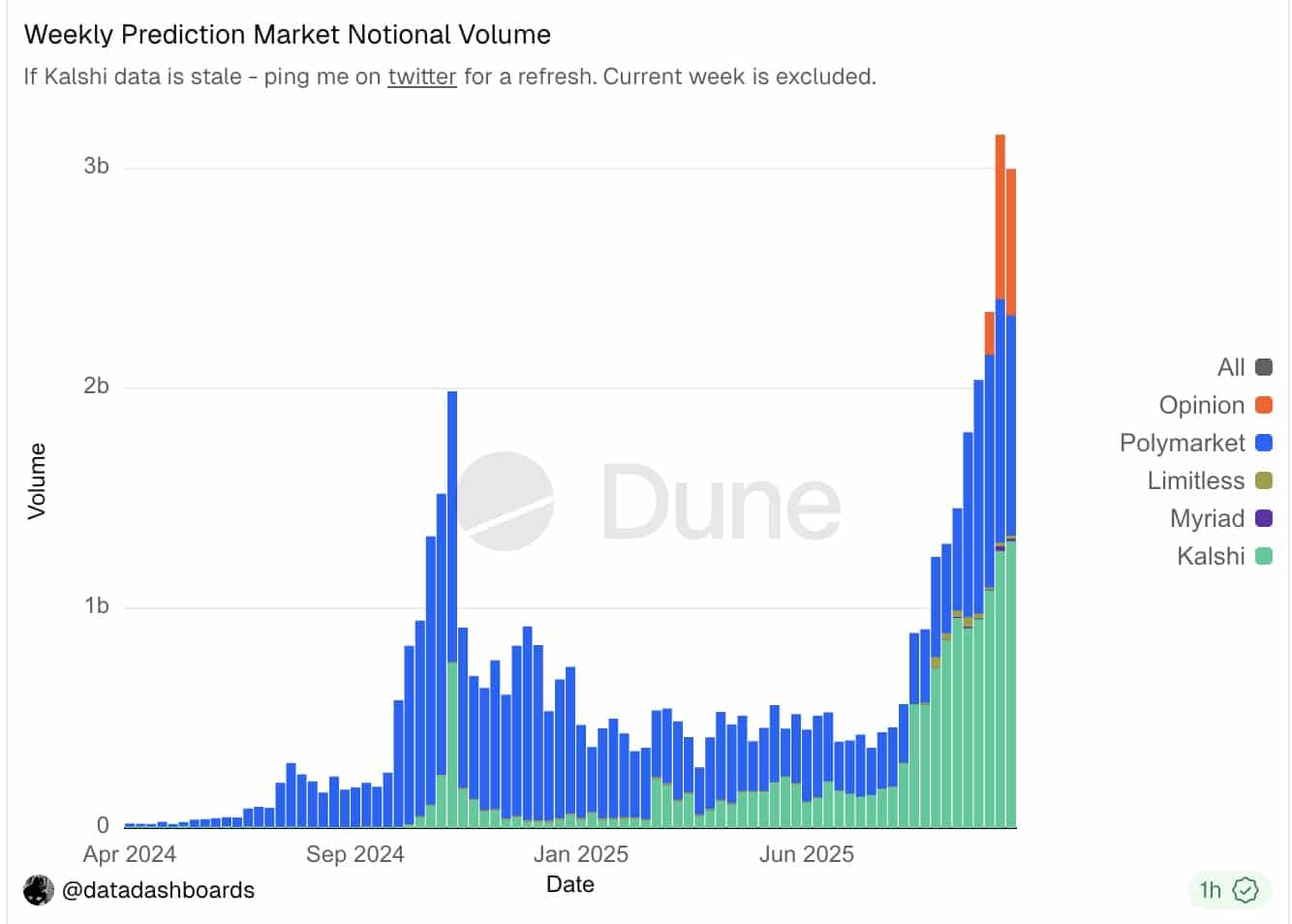

Dune Analytics shows that weekly notional volumes on major prediction platforms climbed to about $2Bn in November.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

One recent week even reached $3Bn, with most of the activity coming from sports markets.

CTOL Digital Solutions estimates that prediction markets processed nearly $28Bn in trades from January to October 2025.

Two years ago, the sector was barely visible. Now it’s moving real money at a fast pace.

EXPLORE: Best Non KYC Crypto Exchanges in 2025 – Anonymous Non KYC Exchanges

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post CME Group’s New Plan to Dominate Prediction Markets appeared first on 99Bitcoins.