What Does G20 South Africa Mean For Crypto This Week?

This coming weekend, on November 22 and 23, South Africa will be hosting world leaders and thousands of delegates at the G20 Summit in Johannesburg. Many investors are wondering what the G20 meeting will mean for the cryptocurrency market as Bitcoin

0.69%

Bitcoin

BTC

Price

$95,315.61

0.69% /24h

Volume in 24h

$66.35B

Price 7d

continues to struggle in its attempt to reclaim $100,000.

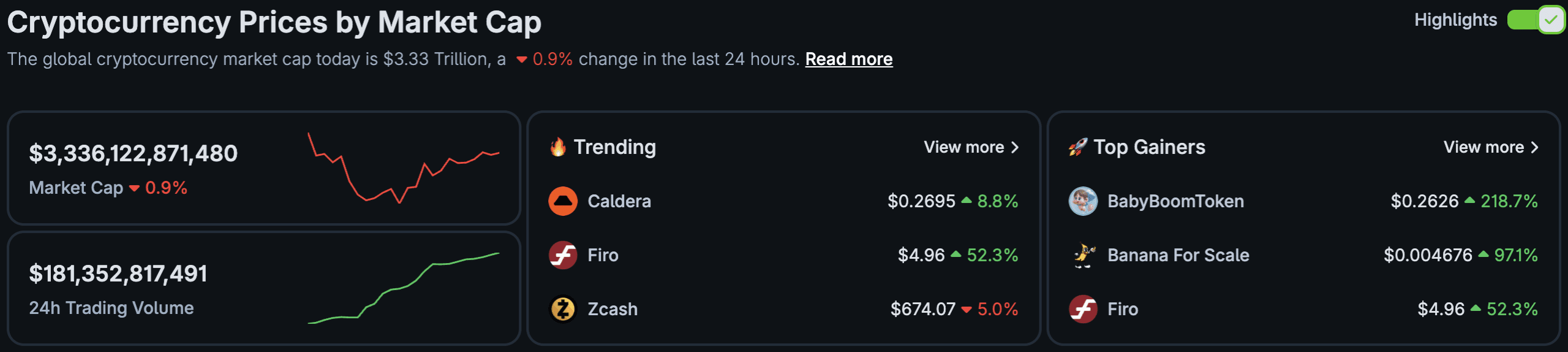

As world leaders from across the globe begin packing their suitcases for the trip to Johannesburg later this week, the crypto market has fallen a further -1%, down to $3.3 trillion, with hopes that any bullish mention of crypto at the G20 Summit could spark a rally across the market.

Drama Surrounding the US and Whether Trump Will Send a Delegate to the G20 Summit

Even before the summit, there were signs that the new US administration was preparing to exert its disruptive influence on the event. President Donald Trump will not be attending personally.

His Secretary of State, Marco Rubio, boycotted a G20 foreign ministers’ meeting in Johannesburg in February 2025, taking to X to accuse South Africa of promoting a G20 agenda focused on the Trump administration’s biggest gripes: diversity, equity, and inclusion (DEI) and climate change.

While the summit presents a challenging diplomatic situation for South Africa, it also offers a unique opportunity to highlight the country’s interests, as well as those of Africa and the Global South, on the global stage. Additionally, it allows South Africa to promote itself as a key destination for investment.

Crypto investors will be hoping that President Trump at least sends a delegate to the G20 summit, as the US is likely to defend any anti-crypto talk due to its pro-crypto stance, following the recent passing of its GENIUS Stablecoin Act, coupled with Trump’s memecoin endeavors and the World Liberty Financial DeFi project.

As of November 7, President Trump took to his Truth Social platform to say that the US would not be attending the G20 in South Africa due to Afrikaners being killed and slaughtered, with their lands allegedly being confiscated by the South African Government.

BREAKING

President Trump just put the world on notice saying America will not join G20 held in South Africa since they are k*lling Christians

Save Christians at all costs

pic.twitter.com/PDzwz6d4wt

— MAGA Voice (@MAGAVoice) November 7, 2025

Financial Stability Board Crypto Review Calls for ‘Close Monitoring’

In a recent review, the Financial Stability Board (FSB) stated that while some progress had been made, the international implementation and coordination of rules related to digital assets remained too “fragmented, inconsistent, and insufficient to address the global nature of crypto-asset markets.”

This year’s surge in the value of the crypto market has come against a backdrop of US President Donald Trump’s pro-crypto stance. FSB Secretary General John Schindler stated that there is a need for close monitoring as cryptocurrency becomes increasingly integrated with the traditional financial system and stablecoins become more widely used.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

One of the key concerns flagged by the FSB’s report was that hardly any countries have complete regulatory frameworks for stablecoins yet. The market for stablecoins has grown by more than 75% over the last year to just over $ 310Bn, a trajectory expected to continue with US rules on them now in place following the passage of the GENIUS Act.

The FSB’s report reviewed the implementation of crypto and stablecoin recommendations in 29 jurisdictions, including the US, EU, Hong Kong, and the UK. Interestingly, El Salvador, where the world’s largest stablecoin, Tether, is based, did not take part.

FSB Issues G20 Finance Ministers with Stark Crypto Warning

Global finance alert: the G20’s financial watchdog (FSB) warns of “significant gaps” in crypto regulation — cross-border risks are growing as markets scale. Meanwhile, weak macro signals are rattling risk assets, putting pressure on crypto.

— Cryptalix (@Doublure34) November 17, 2025

Now, today (November 17), with the G20 Summit right around the corner, the FSB has delivered its interim report to the G20 group of nations, taking place in Johannesburg, South Africa, later this week.

In a brief letter to G20 Finance Ministers and central banks, FSB Chair Andrew Bailey focused on four key topics: cross-border payments, crypto-assets and stablecoins, implementation monitoring, and AI, with a particular emphasis on cross-border payments and crypto.

Last week, the FSB indicated that although the majority of work on cross-border payments has been completed, the targets set for 2027 will not be met. In fact, progress has been limited.

The letter and accompanying report emphasize the rapid growth of the cryptocurrency sector and its increasing integration with traditional finance. This trend raises the potential for disruptions in the crypto industry that could affect financial stability.

While many jurisdictions are either planning (93%) or have already developed (88%) regulatory frameworks for crypto assets and stablecoins, these frameworks often focus on anti-money laundering and sanctions compliance rather than addressing issues that would specifically protect financial stability.

As of now, the rhetoric surrounding crypto heading into the G20 Summit is centered on caution due to the regulatory framework seemingly struggling to keep pace with the widespread adoption of digital assets, especially stablecoins, on a global level.

If any discussion of crypto emerging from the G20 meeting is bearish and full of warnings and cautions, this could cause further market distress, as Bitcoin struggles to hold onto its key $90,000 level.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post What Does G20 South Africa Mean For Crypto This Week? appeared first on 99Bitcoins.