Arca Executive: MicroStrategy Not A Risk To Bitcoin, Chances Of Selling Next To Nil

When MicroStrategy changed tack, adding

0.69%

Bitcoin

BTC

Price

$95,315.61

0.69% /24h

Volume in 24h

$66.35B

Price 7d

to its balance sheet, no one thought this move would be a game-changer, let alone an inspiration to other public firms.

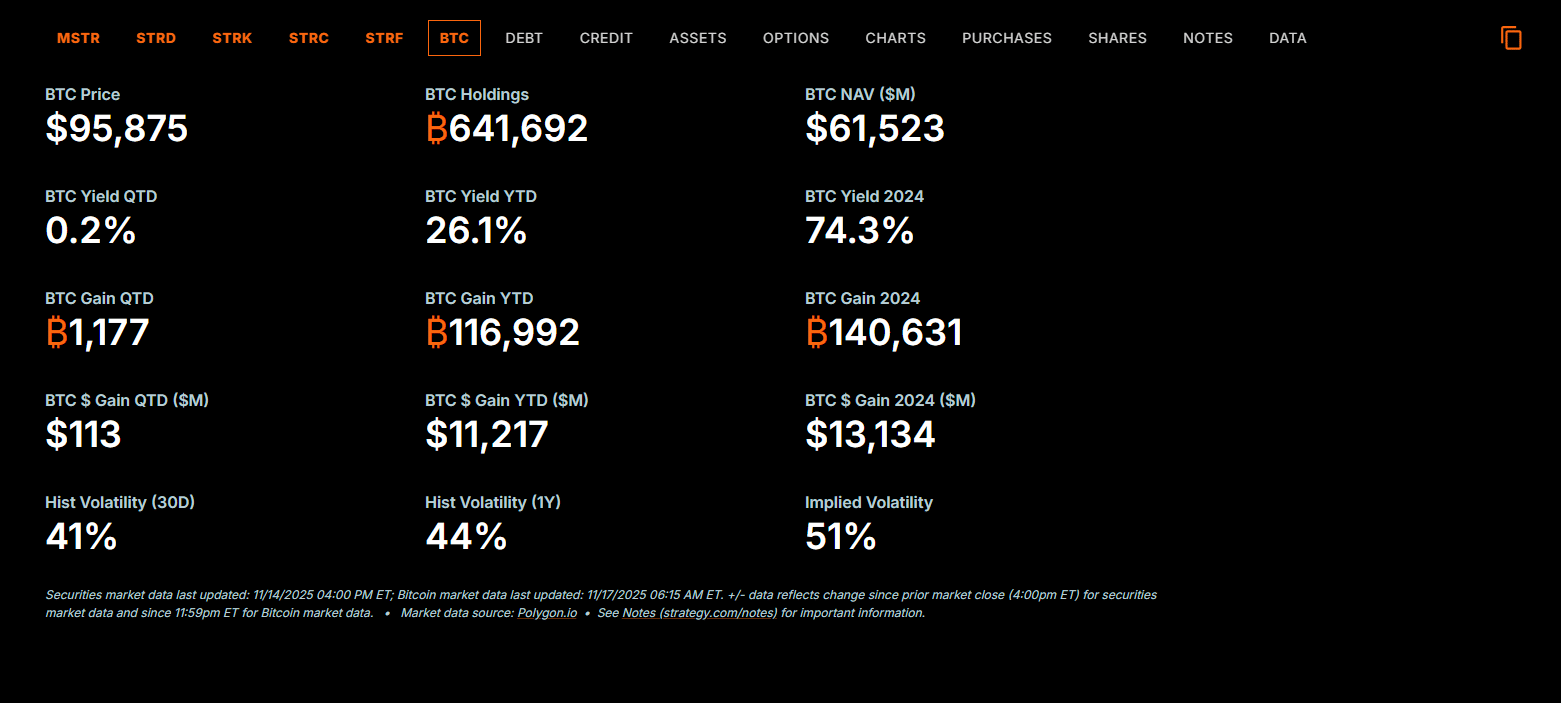

Since they first acquired Bitcoin in November 2020, the Nasdaq-listed tech company is now among the largest holders of BTC. They now control 641,692 BTC at a Bitcoin net asset value (NAV) of over $61,500 at press time.

(Source: Strategy)

Michael Saylor, the co-founder of MicroStrategy and majority shareholder, believes Bitcoin is the perfect hedge against fiat debasement. As a result, the Bitcoin price will continue rallying, raking in big money for investors down the line.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

MicroStrategy Bitcoin Buying Plan

As such, since late 20220, the business intelligence firm, whose revenue from software sales, is, after all, positive, has been accumulating Bitcoin as a primary reserve.

Their model is simple: raise low-interest convertible debt, sell equity shares, and use the proceeds to buy more Bitcoin. This strategy means they no longer have to rely on their otherwise stagnant software revenue.

To encourage more investors, Saylor and MicroStrategy promise a Bitcoin Yield, which measures the percentage increase in their BTC holdings per share over time. As of mid-November, this yield stood at over 26%, year-to-date.

Investors buying into the MicroStrategy plan always chase the yield, which is promoted as a way for MSTR shareholders to gain leveraged exposure to the Bitcoin’s upside without having to buy or manage Bitcoin directly.

Over the years, this approach has not only delivered substantial returns for MSR investors but has also drawn increased scrutiny from analysts and critics.

While the MSTR stock traded at a premium, often 2-3X to its net asset value (NAV) tied directly to their mega Bitcoin stash, others believe MicroStrategy is a ponzi and a big risk to Bitcoin and crypto as a whole.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

No, MicroStrategy Is Not a Risk To Bitcoin and is not Selling BTC Anytime Soon

The main concern is that MicroStrategy issues debt and equity to buy Bitcoin, which not only pumps BTC USD prices but also its market cap, allowing them to issue even more debt.

Therefore, if inflows cease, such as during a crypto bear market, the cycle will break, and MicroStrategy will be forced to sell its Bitcoin holdings.

While this may happen, Jeff Dorman of Arca thinks the possibility of MicroStrategy having to liquidate, causing a Bitcoin and meme coin death spiral, is next to nil.

I will never understand the fascination with Michael Saylor / $MSTR nor will I understand how people can confidently spout such stupid, inaccurate takes that are so easily disprovable.

It takes <5 minutes talking to any debt/equity expert to understand that he will never have to…

— Jeff Dorman (@jdorman81) November 16, 2025

He argues that the only time the business intelligence firm would have to sell is if Bitcoin has “already fallen so far that his selling is an irrelevant afterthought.”

What’s more? With the approval of spot Bitcoin ETFs in the United States, MicroStrategy is not the only entity creating demand for the digital gold.

Spot Bitcoin ETF issuers have already bought way more BTC for their investors than MicroStrategy holds since the product was approved in early 2024. For this reason, Dorman thinks MicroStrategy is not a “relevant marginal buyer.”

He further added that as part of its debt-raising plan to buy Bitcoin, no section obligates MicroStrategy to sell BTC forcefully.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

MicroStrategy Not A Risk to Bitcoin, Chances Of Selling Next To Nil

- Bitcoin crypto under pressure

- MicroStrategy in the crosshairs

- MicroStrategy holds over 641,000 BTC

- Arca executive says MicroStrategy unlikely to sell BTC

The post Arca Executive: MicroStrategy Not A Risk To Bitcoin, Chances Of Selling Next To Nil appeared first on 99Bitcoins.