To Please a King: Trump Heads To Saudi Royal Court – Crypto On Cards After F35 Deal?

The Trump Saudi relationship got a new coat of paint this week as the US closed in on a sweeping defense and security agreement that includes Riyadh gaining access to F-35 fighter jets.

Meanwhile, with Saudi Prince Mohammad Bin Salman coming to Washington D.C. this week, maybe they’ll also announce an insane amount of investment in fully halal AI datacenters and crypto-centered trades? Who knows!

BREAKING: ELON MUSK is now expected to attend President Trump’s dinner with Saudi Crown Prince Mohammed bin Salman Al Saud – Punchbowl

The boys are BACK.

I can’t WAIT! We last saw them reunite at Charlie’s memorial.

pic.twitter.com/rNbJBcQj5m

— Eric Daugherty (@EricLDaugh) November 17, 2025

All of this is happening against the backdrop of

3.70%

Bitcoin

BTC

Price

$91,379.93

3.70% /24h

Volume in 24h

$96.82B

Price 7d

dropping below $92,000 this week for the first time in months, sealing a 25 percent slide from October’s peak and putting the market firmly in bear-market territory.

What’s next for the Trump Saudi deal, and where does it leave BTC?

DISCOVER: 20+ Next Crypto to Explode in 2025

The Saudi Trump F-35 Deal Signals a Geopolitical Reset, and Crypto Is Part of It

Besides, El Salvador “buying the dip” on Bitcoin again, this week’s biggest geopolitical flashpoint came from outside the crypto markets. The United States and Saudi Arabia closed in on a sweeping defense and security agreement that includes Riyadh gaining access to F-35 fighter jets, adding to their growing defense powerhouse.

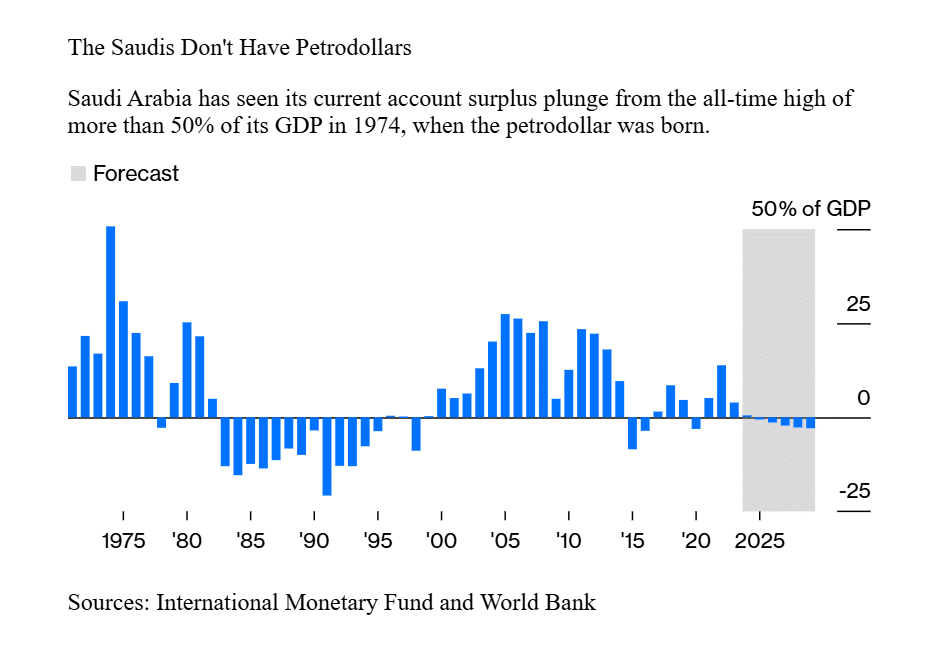

This matters for crypto for one reason: the ever-weakening petrodollar realignment.

Saudi Arabia has already signaled interest in diversifying beyond traditional USD-denominated oil settlement structures, exploring tokenized commodities (bullish?), digital settlement rails, and Bitcoin-adjacent asset strategies through sovereign funds.

The F-35 deal only cements US-Saudi priorities, yet both sides are clearly preparing for a new financial system that could involve Bitcoin and blockchain but certainly will involve different lanes of wealth creation.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Tokenization Goes Mainstream as the Trump Organization Turns to Blockchain

What many expected to be crypto’s easiest year in a decade, thanks to a pro-crypto White House, a cooperative SEC, and new stablecoin laws, has instead devolved into a churn of liquidations and fear. More than $19Bn in leveraged long positions evaporated in October alone, kicking off a selloff that flipped Bitcoin negative on the year.

Against this backdrop, the Trump Organization announced it will tokenize its new Trump International Hotel Maldives, allowing investors worldwide to buy fractional stakes in the project via blockchain.

“This development will set a new benchmark for innovation in real-estate investment through tokenization,”* Eric Trump said.

JUST IN:

President Trump’s son Eric says he’s “all in” on #Bitcoin

“The biggest families want it. The biggest private wealth funds want it. Fortune 500 companies are treasuring it”

pic.twitter.com/DkjlMdF14U

— Bitcoin Magazine (@BitcoinMagazine) November 7, 2025

Bitcoin may be in a correction, possibly a deep one, but we’ll see how long it lasts with institutions, countries, and even the Trumps – who have often been predators in this industry – continuing to adopt.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Key Takeaways

- The Trump-Saudi relationship got a new coat of paint this week as the US closed in on a sweeping defense that gives them F-35s.

- Against this backdrop, the Trump Organization announced it will tokenize its new Trump International Hotel Maldives,

The post To Please a King: Trump Heads To Saudi Royal Court – Crypto On Cards After F35 Deal? appeared first on 99Bitcoins.