El Salvador Buys the Dip: Why a $100 Million Bitcoin Purchase Matters in a Fragile Market

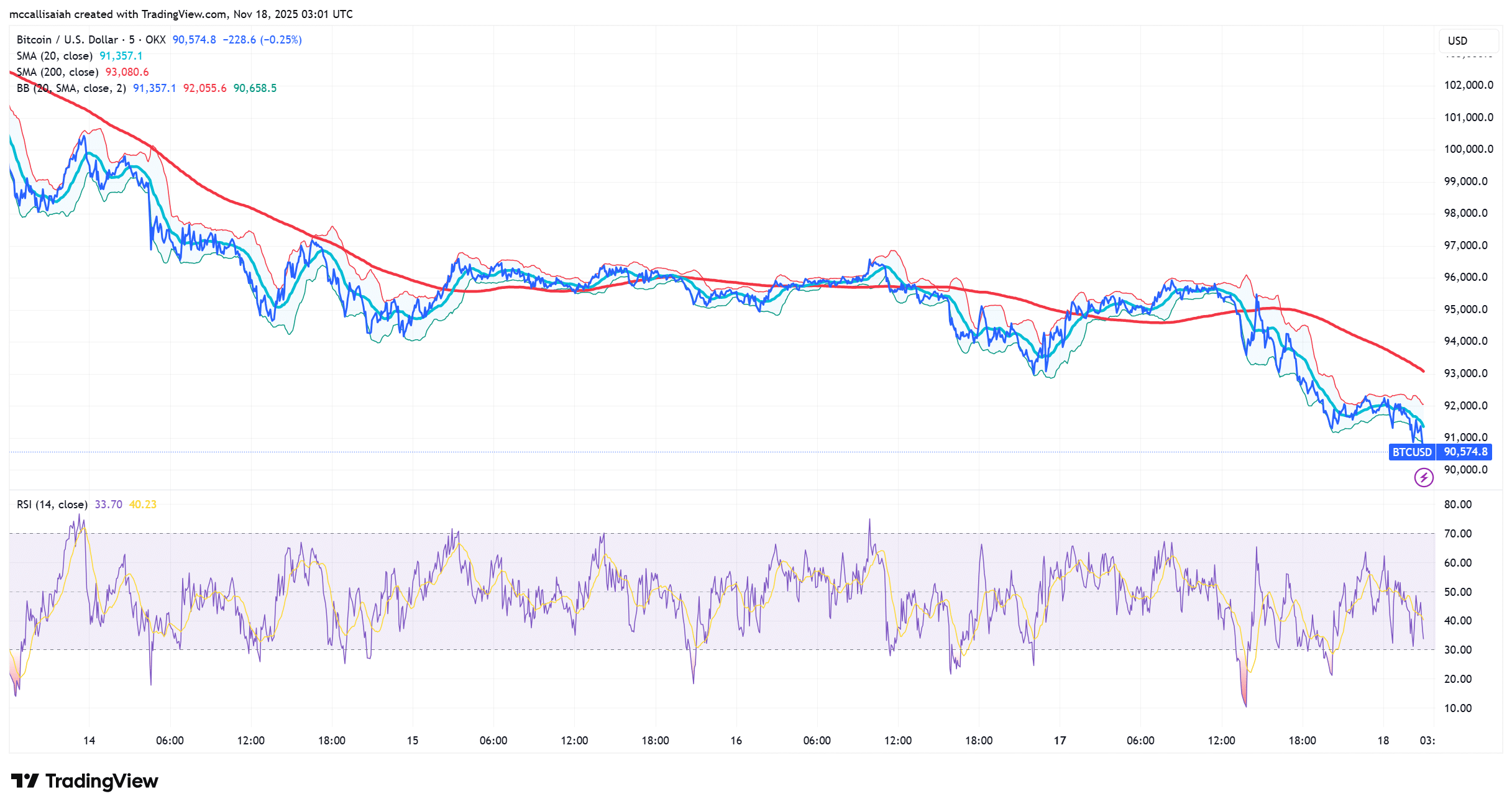

The market unraveled fast over the weekend. Bitcoin broke under $90,000, taking the year’s progress with it, and retail sellers flooded out in panic, with the exception of El Salvador. Mr Saylor … I don’t feel so good

El Salvador loaded up on approximately 1,100 BTC, a $100M purchase made right as the floor was giving way, making it the lone country to double down during the drawdown.

Think about it, we have all of this going for Bitcoin this year, and it is still crashing:

- M2 money supply pumping

- Debasement trade

- Rate cuts

- Quantitative easing

- Saylor

- El Salvador

What’s next for El Salvador in Bitcoin during this Black Swan-like crash?

DISCOVER: 20+ Next Crypto to Explode in 2025

Is This the Start of a Multi-Year Crash? Analysts Disagree

Bitcoin spent early Tuesday in free fall, slipping below $90,000 and erasing its year-to-date gains. Yet in the middle of the panic, one buyer showed up with nine-figure conviction: El Salvador of course!

The move follows government disclosures showing that El Salvador has continued to accumulate 1 BTC per day, bringing its total holdings to 6,380.18 BTC, worth roughly $630 million, according to Ministry of Finance data cited by Jinse Finance.

Despite Bitcoin’s volatility, the country sits on a floating profit of $317 Mn, returning to levels last seen in the spring.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

JUST IN: El Salvador just bought $100M dollars in Bitcoin, nearly 1100 BTC

pic.twitter.com/jiXhvmgGaL

— The ₿itcoin Therapist (@TheBTCTherapist) November 18, 2025

Despite the country buying the dip, Bitcoin’s decline is not small. The asset has fallen more than 26 percent since its October all-time high of $126,000, according to CoinGecko.

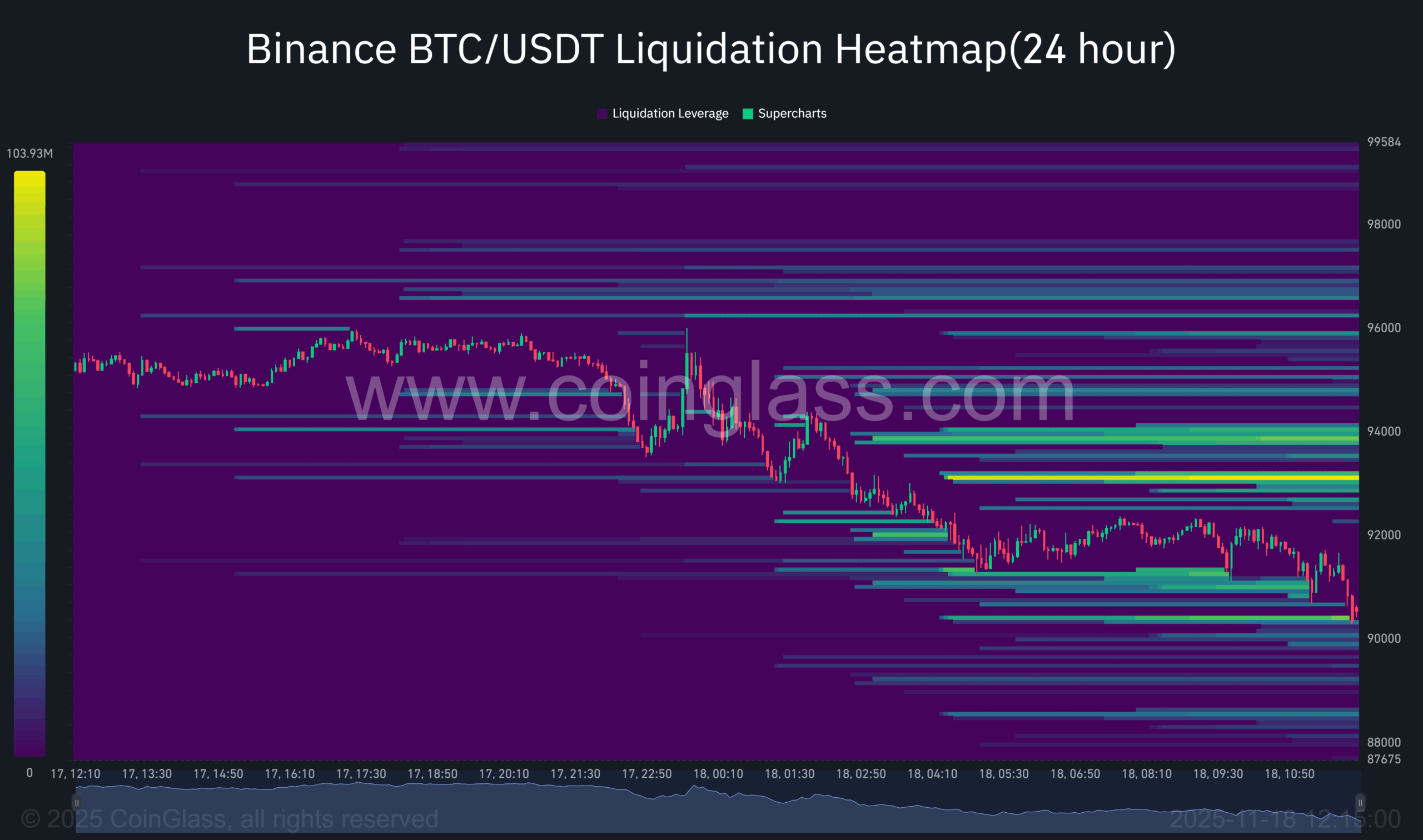

The sell-off began when $19 Bn in leveraged long positions were wiped out, a chain reaction worsened by long-term holders taking profits into strength.

Bernstein analysts say Bitcoin’s pullback aligns with its historical peak window, 400 to 600 days after the halving, which occurred in April 2024. But they reject the idea that a 60–70 percent drawdown is coming.

However, key institutional and policy tailwinds suggest otherwise:

- Growing ETF ownership by traditional investors

- Trump administration support for Bitcoin and the Clarity Act

- Continued corporate treasury adoption, led by Strategy (formerly MicroStrategy)

“The current market environment does not feel like a cycle-peak to us,” wrote analyst Gautam Chhugani.

DISCOVER: Top 20 Crypto to Buy in 2025

Does The Data Signal a Potential Local Bottom? What You Need to Know

10X Research analysts warned that demand stalled around Oct. 10 and that the Fed’s hawkish tone has made conditions more fragile. Still, they argue the four-year cycle cannot be ignored and that 2026 now looks to be the fabled – but could also be considered COPE – bull run of Q4. We’ll see. Panic selling continues.

If Bitcoin does bottom in the $80,000–$90,000 zone, as several analysts expect, El Salvador’s dip-buy may end up being one of the smartest macro calls of the year

EXPLORE: Now That Bitcoin is Facing a Real Test, What’s The Next Big Thing?

Key Takeaways

- The market unraveled fast over the weekend. Bitcoin broke under $90,000, taking the year’s progress with it.

- If Bitcoin does bottom in the $80,000–$90,000 zone, as several analysts expect, El Salvador’s dip-buy may end up being one of the smartest macro calls of the year

The post El Salvador Buys the Dip: Why a $100 Million Bitcoin Purchase Matters in a Fragile Market appeared first on 99Bitcoins.