POL Price Prediction: Can Polygon’s On-Chain Activity Support a Price Recovery for POL?

Polygon’s POL token is still far from its 2024 highs, and traders are unsure about where it heads next.

According to CoinGecko, POL, which replaced MATIC as Polygon’s main asset, traded near $0.1448 on Thursday.It gained about +2.6% over the past day but is still down almost -15% for the week.

The price moved between $0.1389 and $0.1506 in the last 24 hours, showing a narrow range and light momentum. CoinGecko data puts the token’s market cap around $1.53Bn, with roughly $80 million in daily trading volume. The circulating supply is nearing 10.54Bn POL. Since nearly the entire supply is already on the market, the fully diluted valuation matches the current market cap.

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Is POL Showing Any Signs of a Short-Term Trend Reversal?

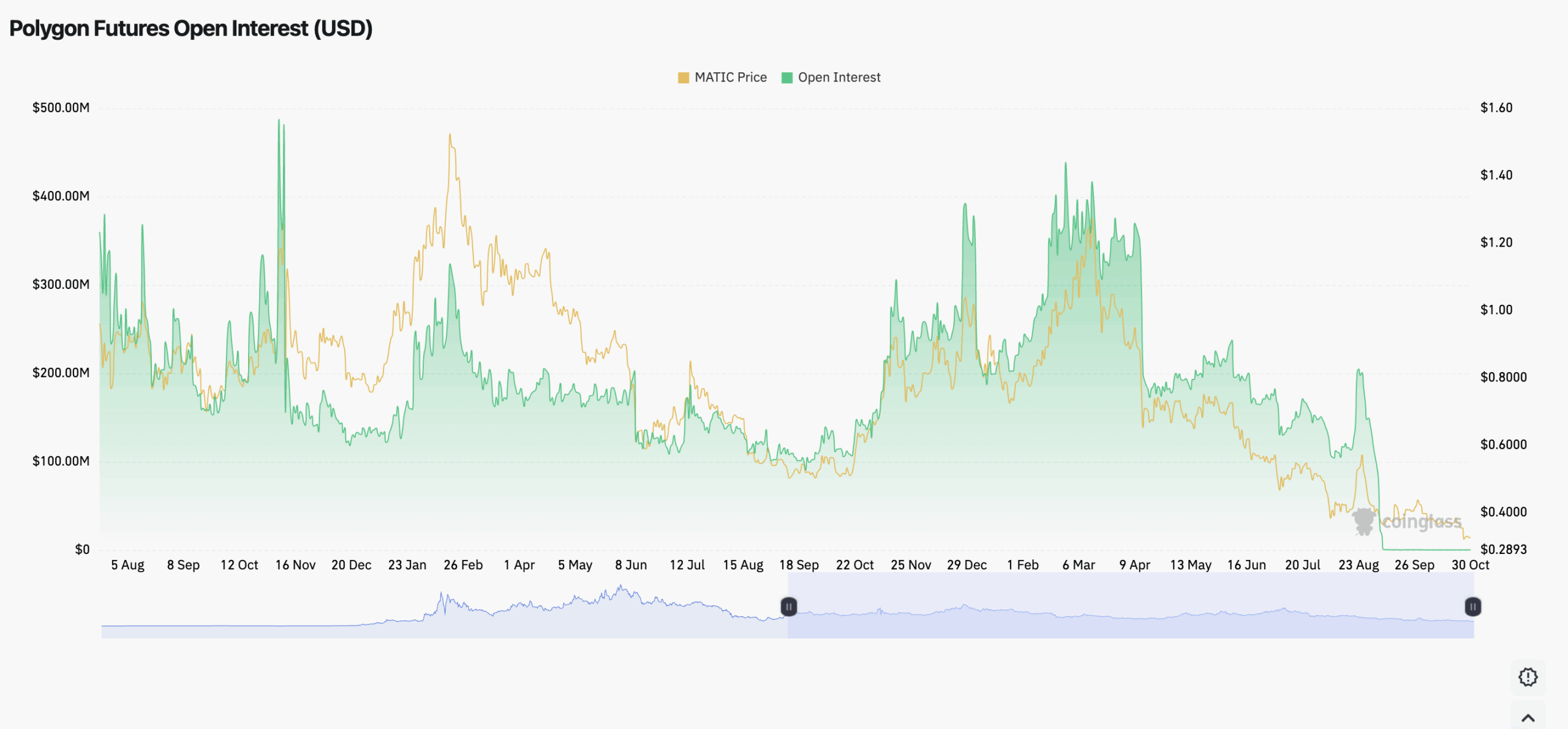

For now, POL’s short-term trend remains uncertain, and traders are watching whether demand can return after a week of steady pressure. The token is still down about 88.8% from its all-time high of $1.29 in March 2024. It sits only 12% above its record low from October 2025. That gap shows how much value it has given up during the market’s broader risk reset.

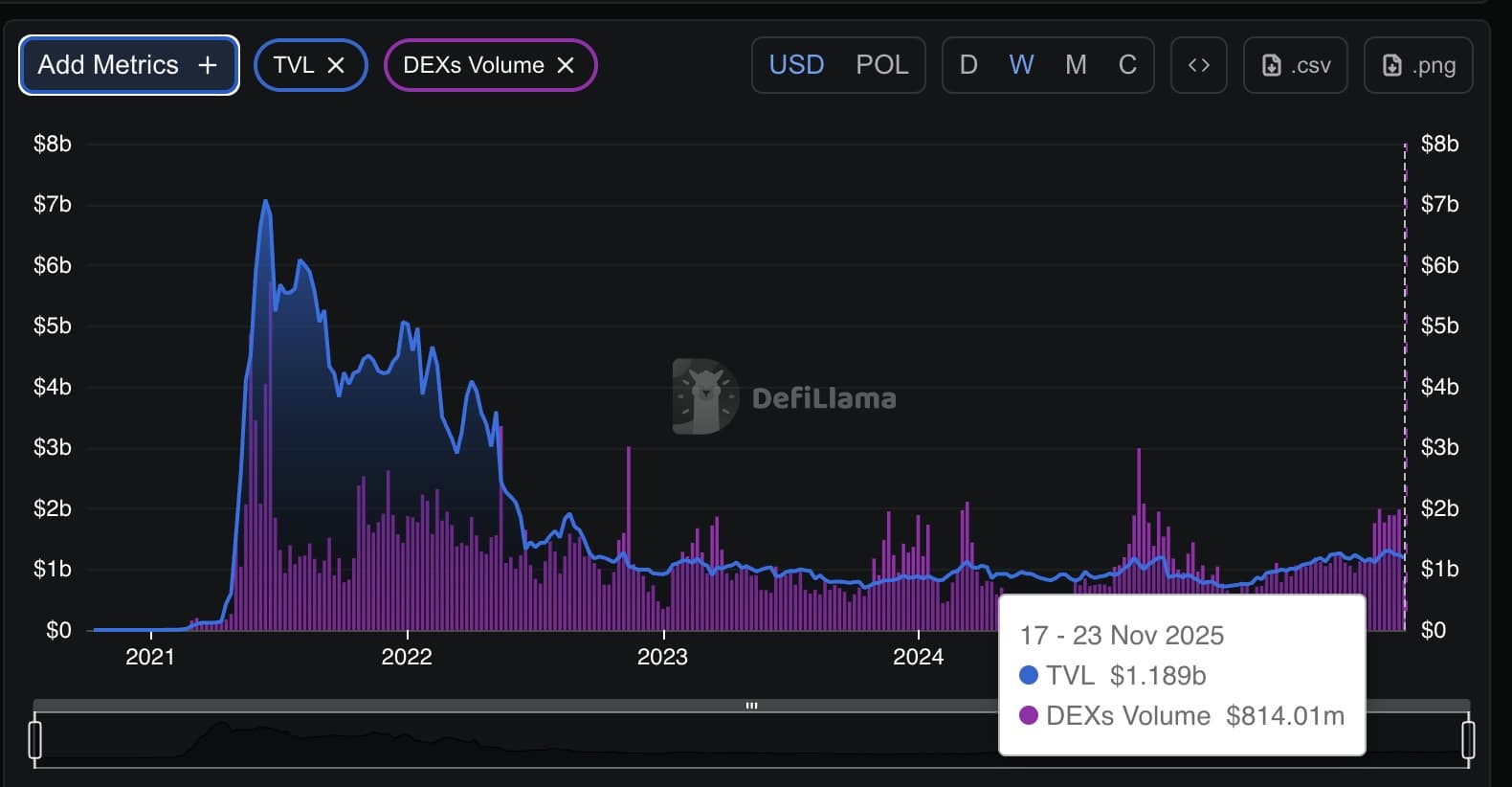

DeFiLlama data show about $1.18Bn locked across Polygon’s DeFi protocols. Daily DEX volume stands near $261M, while stablecoin supply on the network is roughly $3.22Bn.

The chain processed about 5M transactions in the past 24 hours, keeping activity steady even as prices remain under pressure.

Perpetuals trading on Polygon is limited and appears mainly at the chain level. DeFiLlama’s data shows around $534,000 in 24-hour perp volume and about $6.16M over the past week. It’s a small share of the chain’s overall trading flow, but it confirms that leverage-driven activity is present. POL’s derivatives market is active, though still smaller than spot. puts futures open interest at about $56.8M.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

POL Price Prediction: Can Polygon Reclaim the $0.16–$0.17 Zone to Shift Sentiment?

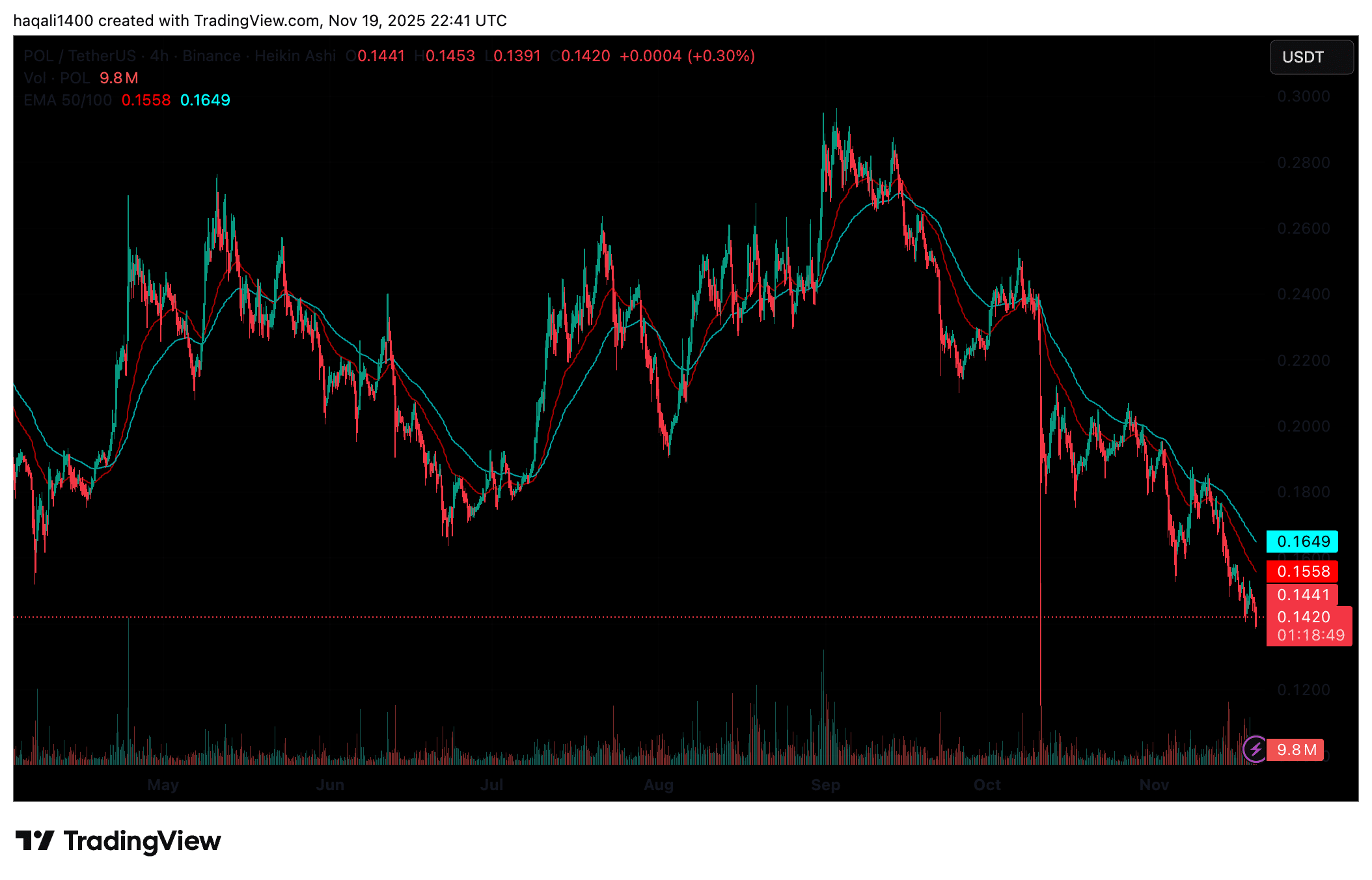

Pol’s latest 4-hour chart points to steady selling pressure, with the downtrend that began in early October still in place.

The token has slipped toward the $0.14 area, one of its weakest levels in months. The 50- and 100-period EMAs continue to point lower, and the price is trading well under both lines. That setup shows that momentum is still against buyers.

The chart also shows a clean pattern of lower highs and lower lows since the early-October peak near $0.29. Each small bounce has failed at the falling EMA levels, which signals that sellers are still in control.

Volume is calm for the most part, but the sharp spikes that appear during sell-offs suggest that forced selling is still active.

Buyers haven’t shown any real strength yet, and the trend remains pointed down.

Pol spent the summer moving inside a wide range between $0.18 and $0.28. That floor didn’t hold. The breakdown in late September pushed the token into a steady downward channel, and the chart hasn’t shown any real pause since then.

Recent candles still lean weak, with no clear sign of a base forming.

For now, the trend stays bearish. Pol needs to move back above the $0.16–$0.17 zone and close over the key EMAs to shift sentiment.

Traders are watching the next support area near $0.13–$0.14 to see if the decline slows there or continues to fall.

EXPLORE: What is Liquid Staking & How Does it Work?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post POL Price Prediction: Can Polygon’s On-Chain Activity Support a Price Recovery for POL? appeared first on 99Bitcoins.