After Blocking Tron’s Founder, World Liberty Financial Strikes Again

World Liberty Financial brings together crypto and the Donald Trump family. The president may not be directly involved in the day-to-day operation of the DeFi platform, but he certainly has an interest in crypto as a whole. His son, Eric Trump, is the face of World Liberty Financial, and how the WLFI token performs is something they track.

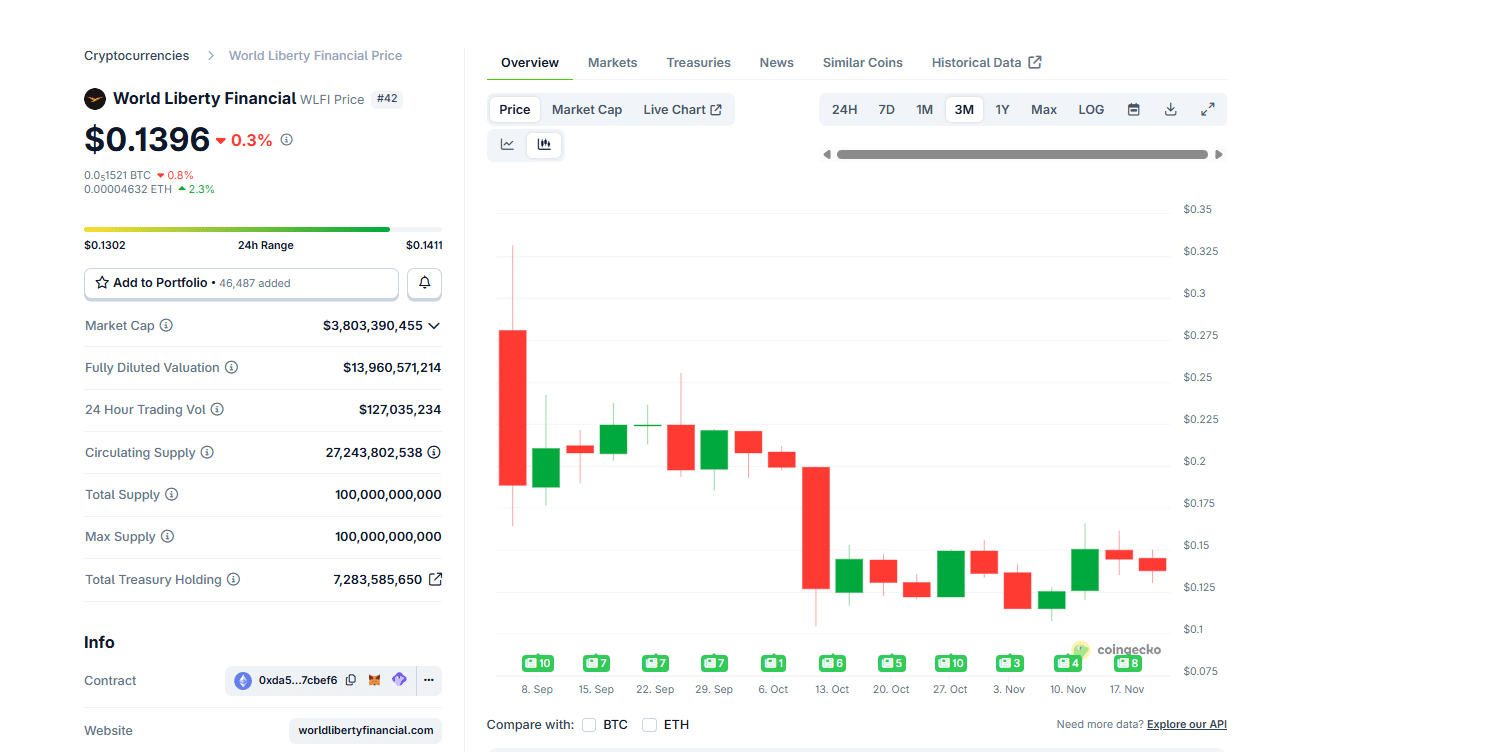

As of November 20, WLFI crypto had a market cap of over $3.8Bn, securing a spot in the top 50. On September 1, when it launched, the token initially rose to $0.33, then peaked and crashed nearly 60% to spot rates.

(Source: Coingecko)

In the last three months of trading, there is nothing much that can be written about World Liberty Financial as a project. Price-wise, the WLFI token is also proving to be a disappointment to early investors.

DISCOVER: Best Meme Coin ICOs to Invest in 2025

World Liberty Financial Burns and Mints $22.1M of WLFI Tokens

Amid this, yesterday, the DeFi project had to burn $22.1M worth of WLFI. These tokens, analysts say, had been distributed to compromised addresses.

Burnt tokens were removed from circulation, and a similar amount was minted and reallocated to verified recovery addresses controlled by legitimate owners.

World Liberty Fi executed an emergency function burning 166.667M $WLFI ($22.14M) from compromised address, reallocating to a recovery address.

Function designed for two scenarios:

An investor loses wallet access before vesting OR malicious account acquires WLFI via exploit pic.twitter.com/VSUDWhDPCR— Emmett Gallic (@emmettgallic) November 19, 2025

World Liberty Financial had to act fast. The move was designed primarily to prevent unauthorized parties from accessing or, worse, liquidating WLFI tokens, and secondly, to protect WLFI investors.

It should be noted that this burn was not a result of a hack, directly affecting World Liberty Financial as a platform. Instead, it was a direct intervention by the team to protect users who lost access to their tokens after falling prey to malicious activities, including phishing attacks and the loss of seed phrases.

During the pre-launch in September, several user wallets intended for WLFI token allocations were compromised.

Specifically, attackers exploited third-party lapses, including scam clones that mimicked WLFI to steal private keys.

Overall, 272 user wallets were impacted. These wallets were frozen to prevent immediate drains. Before they were made them whole, World Liberty Financial thoroughly verified the identity of these users.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

Is This Good or Bad for Crypto? Justin Sun of Tron Blacklisted

In a month that has seen DeFi protocols attacked, some losing tens of millions of dollars of user funds, the intervention by World Liberty Financial can be applauded.

If anything, the “kill-switch” approach is rare.

Still, crypto transactions are supposed to be irreversible, and once an address receives funds, all power rests with the private key controller. In this case, World Liberty Financial froze the address, preventing transfer.

If the Ethereum Foundation or any other entity were to resort to freezing an address, it would be controversial, even triggering a collapse in the ETH price due to concerns about censorship.

Still, this is not the first time World Liberty Financial has blocked addresses.

Earlier, Justin Sun, the founder of Tron and the early WLFI backer holding 600M WLFI tokens worth over $200M at launch, had his primary WLFI address on Ethereum blacklisted on September 4.

Blacklist of the Decade

Justin Sun bought around 3B $WLFI tokens at the presale for $0.015 each, investing about $45M USD. He became one of the advisors of the WLFI team.

At launch, he received an unlock of 600M tokens (20%).

He publicly promised on his X account that he… pic.twitter.com/bkvGwWNF8d

— Peak (@CryptoPeakX) September 5, 2025

Sun was banned following suspicions that he was dumping WLFI, contributing to the sharp fall on launch day.

DISCOVER: 10+ Next Crypto to 100X In 2025

- World Liberty Financial is linked to the Trump family

- WLFI token began trading on September 1

- WLFI USDT had been falling

- World Liberty Financial burns and mints $22M of WLFI tokens

The post After Blocking Tron’s Founder, World Liberty Financial Strikes Again appeared first on 99Bitcoins.